Printable Small Estate Affidavit Form for South Carolina

When managing the assets of a deceased individual in South Carolina, especially if the estate in question is relatively small, understanding the South Carolina Small Estate Affidavit form is crucial. This particular form, designed for use when the total value of the estate does not exceed certain thresholds, serves as an expedited alternative to the often lengthy probate process. It allows individuals, typically heirs or beneficiaries, to claim assets without the need for formal court proceedings. Essential for simplifying the legal framework surrounding the distribution of a decedent's estate, this affidavit is subject to specific requirements, including limitations on the estate's value and the types of assets eligible for transfer. Utilizing this form not only facilitates a smoother transition of assets but also underscores the importance of adhering to state-specific legal standards and procedures. For those navigating the aftermath of a loved one’s passing, understanding the nuances and proper execution of the South Carolina Small Estate Affidavit form is a significant step towards resolving estate matters swiftly and efficiently.

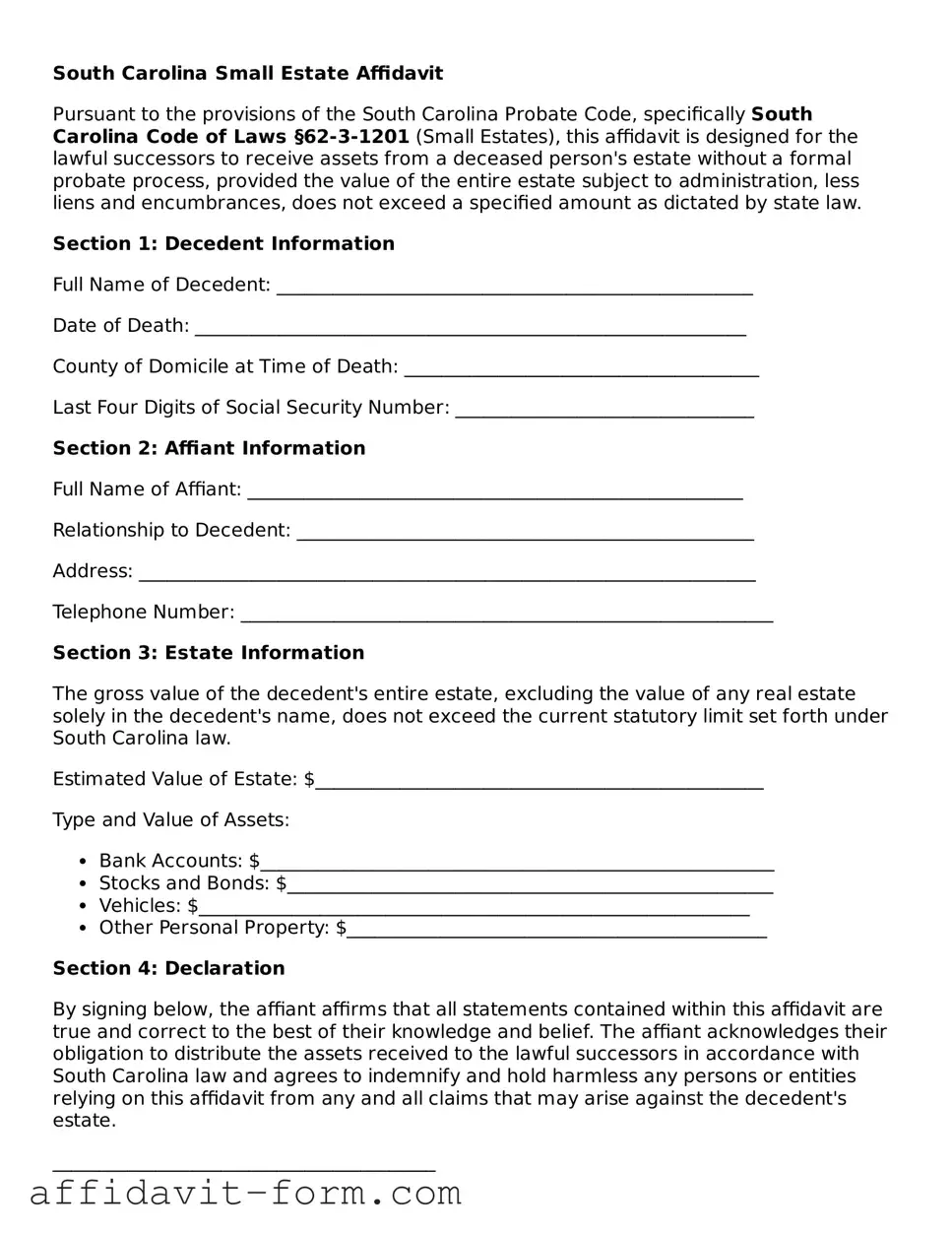

Form Example

South Carolina Small Estate Affidavit

Pursuant to the provisions of the South Carolina Probate Code, specifically South Carolina Code of Laws §62-3-1201 (Small Estates), this affidavit is designed for the lawful successors to receive assets from a deceased person's estate without a formal probate process, provided the value of the entire estate subject to administration, less liens and encumbrances, does not exceed a specified amount as dictated by state law.

Section 1: Decedent Information

Full Name of Decedent: ___________________________________________________

Date of Death: ___________________________________________________________

County of Domicile at Time of Death: ______________________________________

Last Four Digits of Social Security Number: ________________________________

Section 2: Affiant Information

Full Name of Affiant: _____________________________________________________

Relationship to Decedent: _________________________________________________

Address: __________________________________________________________________

Telephone Number: _________________________________________________________

Section 3: Estate Information

The gross value of the decedent's entire estate, excluding the value of any real estate solely in the decedent's name, does not exceed the current statutory limit set forth under South Carolina law.

Estimated Value of Estate: $________________________________________________

Type and Value of Assets:

- Bank Accounts: $_______________________________________________________

- Stocks and Bonds: $____________________________________________________

- Vehicles: $___________________________________________________________

- Other Personal Property: $_____________________________________________

Section 4: Declaration

By signing below, the affiant affirms that all statements contained within this affidavit are true and correct to the best of their knowledge and belief. The affiant acknowledges their obligation to distribute the assets received to the lawful successors in accordance with South Carolina law and agrees to indemnify and hold harmless any persons or entities relying on this affidavit from any and all claims that may arise against the decedent's estate.

_________________________________________

Affiant's Signature

_________________________________________

Date

Section 5: Notarization

This section to be completed by a Notary Public.

State of South Carolina

County of ___________________________

Subscribed and sworn to (or affirmed) before me this ______ day of _______________, 20____, by ________________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________________________

(Notary Public Signature)

(Seal)

My Commission Expires: ___________________

Document Details

| Fact | Detail |

|---|---|

| Purpose | Used to streamline the probate process for estates considered small under South Carolina law. |

| Governing Law | South Carolina Code of Laws, Title 62 - Article 3, Section 62-3-1201 |

| Eligibility Criteria | Estate value must not exceed $25,000 (as of the last knowledge update). |

| Waiting Period | Affidavit can be filed 30 days after the decedent's death. |

| Who Can File | Primarily for successors or legally recognized representatives of the decedent. |

| Required Documentation | Death certificate of the decedent and proof of the estate's value. |

| Filing Location | Filed with the Probate Court in the county where the decedent resided. |

How to Use South Carolina Small Estate Affidavit

Filling out the South Carolina Small Estate Affidavit form is a necessary step for individuals seeking to manage the assets of a deceased person's estate that falls under the state's small estate threshold. This document allows for a simpler, more expedited process than going through probate court. It's important to provide accurate and complete information to ensure the process goes smoothly. Follow the steps below to correctly fill out the form.

- Begin by collecting all necessary information about the deceased, including their full legal name, date of death, and a list of their assets and their estimated values.

- Next, confirm that 30 days have passed since the death of the estate owner. This is a requirement before the affidavit can be submitted.

- Ensure the total value of the estate's assets does not exceed the small estate threshold set by South Carolina law.

- Complete the top section of the form with the full legal name and last address of the decedent, as well as the date of their death.

- Identify yourself in the form's section designated for the affiant's information. Provide your relationship to the decedent and your contact details.

- List all known assets of the estate, including bank accounts, real estate, vehicles, and personal property, along with their estimated values in the designated sections on the form.

- Include information about any known debts the estate owes, such as mortgage balances, personal loans, and credit card debts.

- Read the affidavit statements closely, ensuring you understand each point, as these are legal declarations confirming your knowledge and accuracy of the information provided.

- Sign and date the form in the presence of a Notary Public. The form will need to be notarized to be valid.

- If required, attach any additional documentation that supports the affidavit, such as a copy of the death certificate, titles or deeds for property, and statements for bank accounts.

- Finally, submit the completed and notarized affidavit to the appropriate local or state office as directed by South Carolina law. This could be the clerk of court or another designated official.

Once submitted, the form will be reviewed by the designated authority. If everything is in order, it will facilitate the transfer of the deceased's assets to their rightful heirs or beneficiaries without the need for a formal probate process. Remember, this form is a legal document, and it's important to take the process seriously to ensure the estate is managed and distributed according to the law.

Listed Questions and Answers

What is a South Carolina Small Estate Affidavit?

In South Carolina, a Small Estate Affidavit is a legal document used when a deceased person's estate is valued at $25,000 or less (after funeral expenses and debts are paid). This document allows the transfer of the decedent's assets to their rightful heirs or beneficiaries without the need for a formal probate process. It simplifies the procedure, making it quicker and less expensive.

Who can file a South Carolina Small Estate Affidavit?

The right to file a South Carolina Small Estate Affidavit typically falls to the surviving spouse or, if there is no spouse, to the adult children of the deceased. If neither a spouse nor adult children are available, other close relatives may be considered eligible. An affidavit can also be filed by a creditor if there are outstanding debts owed by the estate, and no other family member has stepped forward to handle the estate within a certain timeframe.

What documents are needed to file a South Carolina Small Estate Affidavit?

To file a Small Estate Affidavit in South Carolina, several documents are required, including but not limited to:

- The completed Small Estate Affidavit form.

- A certified copy of the death certificate of the deceased.

- Documentation verifying the value of the estate's assets.

- Proof of payment of the deceased's funeral expenses.

- Lists of the debts owed by the estate and the supposed heirs.

It's important to gather all necessary documents before filing to ensure the process goes smoothly.

How long does it take to process a South Carolina Small Estate Affididavit?

The processing time for a Small Estate Affidavit in South Carolina can vary depending on the complexity of the estate and the specific court's caseload. Generally, once all required documents are submitted and in order, it typically takes between 30 to 45 days for the affidavit to be processed. However, if there are issues with the paperwork or further verification is needed, the process may take longer.

Are there any fees associated with filing a Small Estate Affidavit in South Carolina?

Yes, there are filing fees associated with a Small Estate Affidavit in South Carolina. The amount can vary by county, so it's essential to check with the local probate court where the affidavit will be filed. Besides the filing fees, there may be additional costs for obtaining certified copies of the death certificate and other necessary documentation. It's advisable to budget for these expenses in advance.

Common mistakes

Filling out the South Carolina Small Estate Affidavit form is a common procedure for those handling the estate of a deceased individual with assets below a certain threshold. However, individuals often encounter hurdles during this process due to common mistakes. It's essential to navigate these carefully to ensure the process goes smoothly and legally.

Not confirming eligibility: One critical error is failing to verify whether the estate qualifies as a "small estate" under South Carolina law. The affidavit is only applicable if the total value of the estate, minus any debts, does not surpass a specific monetary cap established by the state.

Incorrect asset valuation: Accurately assessing the value of the deceased's assets is essential. This includes everything from bank accounts to personal property. An incorrect valuation can result in the affidavit being rejected or, worse, legal challenges down the road.

Leaving sections blank: Skipping sections or leaving parts of the form blank can lead to processing delays or outright denial. Each section is designed to gather critical information; missing data can lead to incorrect assessments and complications.

Failing to attach necessary documents: The affidavit requires various documents to be attached for verification purposes, including death certificates and proof of asset ownership. Forgetting to attach these documents or attaching incomplete or incorrect documents can hinder the process.

Overlooking required signatures: The affidavit must be signed by all eligible heirs or beneficiaries. Missing signatures can invalidate the document or at least pause its processing until the oversight is corrected.

Not seeking legal advice when necessary: Sometimes, the estate’s circumstances are complex, and professional guidance is invaluable. Individuals often underestimate the need for legal advice, potentially missing out on expert insight that could navigate complexities or identify overlooked assets or debts.

By understanding and avoiding these six mistakes, individuals can better navigate the intricacies of the South Carolina Small Estate Affidavit process. This ensures a smoother transition of assets and reduces the potential for legal complications, benefiting all parties involved.

Documents used along the form

When an individual passes away, their loved ones are often tasked with the complex and emotional process of managing the deceased's estate. In South Carolina, for smaller estates that meet certain criteria, the use of a Small Estate Affidavit can greatly simplify this process. However, this affidavit often needs to be accompanied by various other forms and documents to ensure a smooth and compliant legal transition of assets. These supplementary documents vary depending on the specifics of the estate and the requirements of different institutions. Below, we outline several key documents that are commonly utilized alongside the South Carolina Small Estate Affidavit to provide a clearer understanding of this process.

- Certified Copy of the Death Certificate: A legal proof of death, often required by financial institutions, government agencies, and to transfer ownership of assets.

- Last Will and Testament: If the deceased left a will, it outlines their wishes regarding the distribution of their estate, which may impact the small estate process.

- Real Property Deeds: Documentation of any real estate owned by the deceased, vital for the proper transfer of real property titles.

- Vehicle Title and Registration Documents: Required for the transfer of ownership of any vehicles that the deceased owned.

- Bank Statements and Financial Account Records: Provide a detailed record of the deceased's financial assets that fall under the small estate threshold.

- Stocks and Bonds Certificates: If the deceased owned any stocks or bonds, these certificates are necessary for the transfer of ownership.

- Life Insurance Policies: Documents pertaining to any life insurance policies, which may need to be claimed and potentially affect the estate’s value.

- Proof of Funeral Expenses: Documentation showing any funeral expenses paid out of pocket, which might be reimbursable from the estate assets.

- Affidavit of Heirship: When applicable, this document officially identifies the heirs of the deceased, which is particularly useful in the absence of a will.

Navigating the aftermath of a loved one's passing is never easy, and the legal intricacies involved can often add to the emotional toll. By arming oneself with the appropriate knowledge and documents, such as the South Carolina Small Estate Affidavit and its complementary forms, the process can become more manageable and less burdensome. It is always recommended to seek legal advice to ensure compliance with all state laws and to streamline the estate management process in the most effective and compassionate way possible.

Similar forms

The South Carolina Small Estate Affidavit form is similar to other legal documents designed to expedite estate proceedings for small estates. This form allows for the assets of the deceased to be distributed without the need for a lengthy probate process. Two key documents share commonalities with the South Carolina Small Estate Affidavit: the Transfer on Death Deed (TODD) and the Joint Tenancy with Right of Survivorship agreement (JTWROS).

The Transfer on Death Deed (TODD) is a legal document allowing property owners to name a beneficiary to whom the property will transfer upon their death, bypassing the traditional probate process. Like the Small Estate Affidavit, the TODD is designed to simplify the transfer of assets. Both documents avoid probate and streamline the process of transferring assets to beneficiaries. However, while the Small Estate Affidavit can apply to various types of assets within the small estate threshold, the TODD specifically applies to real estate property.

The Joint Tenancy with Right of Survivorship (JTWROS) agreement is another legal arrangement that allows property to pass directly to the surviving co-owner(s) upon the death of one owner, without going through probate. Both the JTWROS and the Small Estate Affidavit serve to expedite the transfer of assets to beneficiaries. Unlike the Small Estate Affidavit, which is activated by the death of the estate holder and applies only to estates that fall under a specific value threshold, the JTWROS is effective immediately upon execution and pertains to co-owned property regardless of the estate's size.

Dos and Don'ts

When handling the South Carolina Small Estate Affidavit form, it's crucial to approach the process with care and attention to detail. Below, find key dos and don'ts that will guide you through accurately and efficiently completing the form.

Do:Ensure you meet the eligibility requirements. Before filling out the form, confirm that the total value of the estate falls under the threshold set by South Carolina law and that the appropriate time has passed since the deceased's passing.

Gather all necessary documents. Have a certified copy of the death certificate, a list of the estate's assets, and any debts owed ready before you start filling out the affidavit.

Accurately itemize the estate's assets. Be detailed in listing all assets, including bank accounts, securities, and personal property, with their current market value.

Provide complete and truthful information. Accuracy is crucial in legal documents; ensure all information provided on the affidavit is true and correct to the best of your knowledge.

Review the form before submission. Double-check for any errors or omissions, ensuring every question is answered and all information is current and accurate.

Rush through the form. Take your time to understand each section and input data carefully to avoid mistakes that could delay the process.

Estimate values. Make sure to use actual figures when detailing the assets and liabilities of the estate to prevent any inaccuracies or legal issues.

Omit any assets or liabilities. Failing to disclose all relevant information can lead to legal complications or delays in the affidavit's approval.

Forget to sign the form in the presence of a notary. Your signature must be notarized for the affidavit to be legally binding.

Submit the form without making copies. Keep a copy for your records and for other legal proceedings that may require proof of the affidavit’s filing.

Misconceptions

When navigating the process of dealing with an estate in South Carolina, it's easy to come across misconceptions, especially regarding the Small Estate Affidavit form. This document can be a useful tool under the right circumstances, but understanding what it is and isn't can save a lot of time and effort. Here are five common misconceptions explained:

All estates qualify for a Small Estate Affidavit. This is not the case. In South Carolina, an estate must meet specific criteria to qualify, such as the total value of the estate not exceeding a certain threshold, which is currently $25,000, after funeral expenses and debts have been paid.

A Small Estate Affidavit allows you to skip probate completely. While it's true that this form can simplify the process, it doesn't eliminate the need for all probate procedures. The form allows for a more streamlined process but still requires submission to the court, and certain assets may still require formal probate.

Real estate can be transferred using a Small Estate Affidavit. In South Carolina, this form cannot be used to transfer real estate. The affidavit is typically used for personal property, such as bank accounts, vehicles, or other tangible items not including real property.

Anyone can file a Small Estate Affidavit. Actually, South Carolina law specifies who can file this affidavit, usually giving priority to the surviving spouse, then to other heirs. There's a priority list that determines who is eligible to apply, and it's not a free-for-all process.

The process is immediate. While the process is quicker than traditional probate, it's not instant. Once the affidavit is filed, there's a waiting period of at least thirty days before the assets can be distributed. This allows time for creditors to make claims against the estate.

Understanding these truths about the Small Estate Affidavit can save a lot of frustration. It's a helpful process but it's important to know the requirements and limitations before beginning. When in doubt, consulting with a legal professional can provide clarity and direction tailored to an individual situation.

Key takeaways

When someone passes away with a relatively modest amount of assets, their estate can sometimes be settled without the need for a full probate process. In South Carolina, the Small Estate Affidavit is a tool designed for this purpose. It streamlines the legal procedures required for the transfer of assets to the rightful heirs or beneficiaries. Understanding how to effectively fill out and use this form is crucial for a smooth process. Here are some key takeaways to keep in mind:

- Eligibility criteria: To use the Small Estate Affidavit in South Carolina, the total value of the deceased's personal property must not exceed a specified amount, set by state law. This threshold does not include the value of the deceased's real estate, and certain other assets may also be exempt. It's essential to first determine if the estate qualifies under these rules.

- Waiting period: South Carolina law requires a waiting period after the death before the Small Estate Affidavit can be filed. This period allows for the identification of all potential creditors and claims against the estate. Understanding this timeline is vital for planning and appropriately timing the affidavit's submission.

- Accurate completion: It is critical to fill out the Small Estate Affidavit form accurately and completely. Incorrect or incomplete information can delay the process, potentially necessitate court intervention, or even lead to legal penalties for knowingly providing false statements on the affidavit.

- Documentation: Along with the completed affidavit, additional documents must be provided. These may include a certified copy of the death certificate, proof of the deceased's ownership of the assets in question, and any other documentation required by the specific financial institutions or entities holding the assets.

- Legal implications: Filing a Small Estate Affidavit transfers the responsibility of the assets to the person signing the affidavit. This individual is then obligated to distribute the assets according to the will (if one exists) or state intestacy laws if there is no will. It's crucial to be aware of these responsibilities and ensure compliance with the law.

- Seeking advice: Given the legal implications and potential complexities involved, consulting with a legal professional to ensure the process is handled correctly can be very beneficial. An attorney can provide guidance on the specifics of South Carolina law, assist with accurately completing the form, and help navigate any issues that may arise during the process.

Navigating the aftermath of a loved one's passing is challenging, and the legal aspects can often seem daunting. However, tools like the South Carolina Small Estate Affidavit can significantly simplify the process, provided it is used appropriately and with a clear understanding of its requirements and implications.

Fill out Popular Small Estate Affidavit Forms for Different States

How to Fill Out a Small Estate Affidavit Illinois - An effective solution for distributing a deceased person's lesser-valued assets directly to heirs.

Michigan Probate - Intended for estates that do not include real property, the Small Estate Affidavit helps expedite the distribution of assets to beneficiaries.