Printable Small Estate Affidavit Form for South Dakota

In the legal framework of estate management, navigating the distribution of assets for deceased individuals with relatively small estates is facilitated by the South Dakota Small Estate Affidavit form. This legal document serves as a streamlined tool for transferring property without the lengthy process of probate court proceedings, offering an efficient alternative for eligible estates. By outlining specific criteria regarding the value of the estate and the types of assets involved, the form simplifies the legal responsibilities of successors, enabling a quicker distribution of assets to rightful heirs. It embodies a critical intersection of law and practical necessity, providing a clear pathway for individuals to claim property under state law guidelines. Importantly, the use of this affidavit underscores the commitment to minimizing bureaucratic hurdles in the face of grieving, promoting a more compassionate approach to the challenges of estate resolution. Hence, understanding the nuances, eligibility requirements, and legal implications encapsulated within the South Dakota Small Estate Affidavit form is paramount for heirs, legal practitioners, and anyone involved in the estate planning and settlement process.

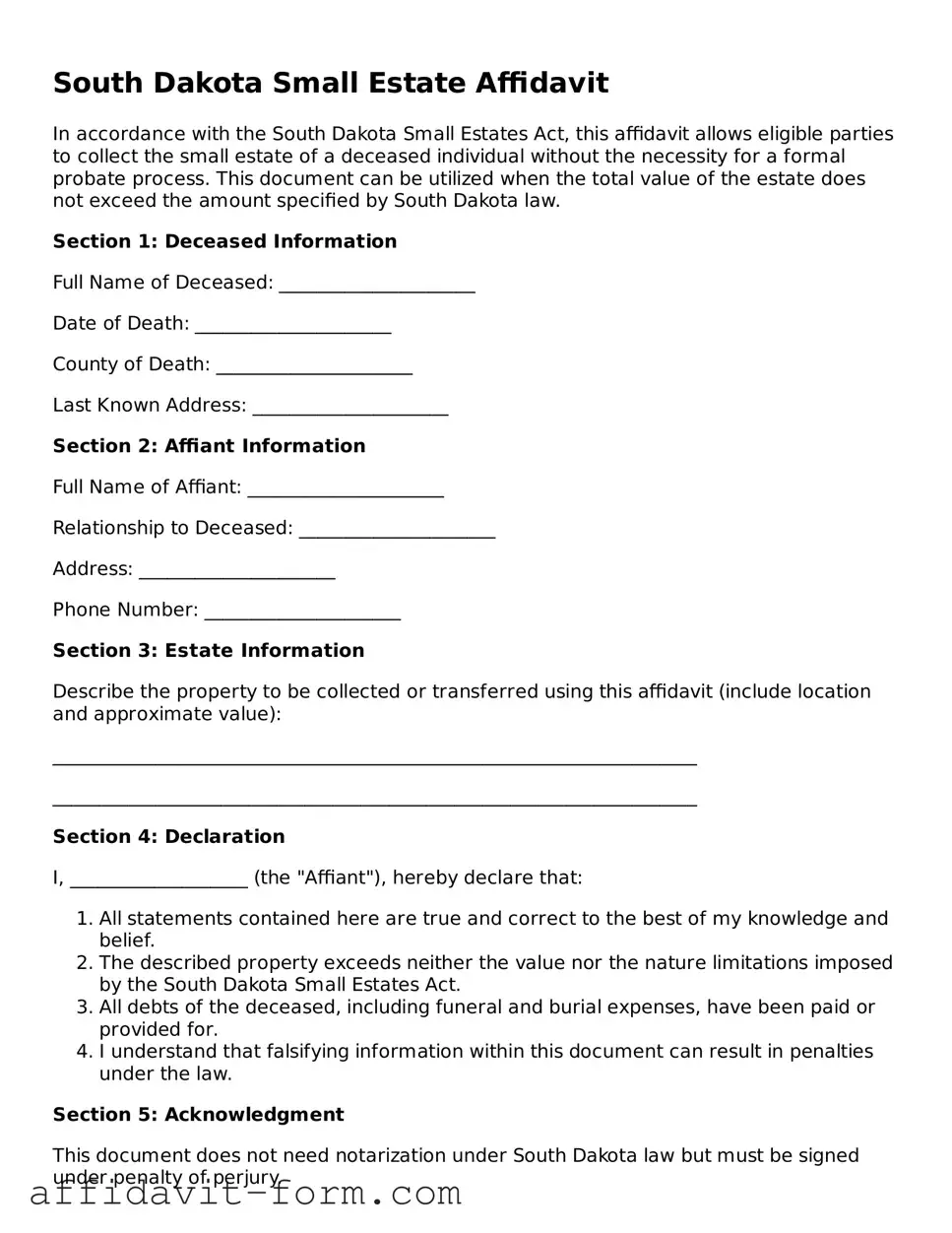

Form Example

South Dakota Small Estate Affidavit

In accordance with the South Dakota Small Estates Act, this affidavit allows eligible parties to collect the small estate of a deceased individual without the necessity for a formal probate process. This document can be utilized when the total value of the estate does not exceed the amount specified by South Dakota law.

Section 1: Deceased Information

Full Name of Deceased: _____________________

Date of Death: _____________________

County of Death: _____________________

Last Known Address: _____________________

Section 2: Affiant Information

Full Name of Affiant: _____________________

Relationship to Deceased: _____________________

Address: _____________________

Phone Number: _____________________

Section 3: Estate Information

Describe the property to be collected or transferred using this affidavit (include location and approximate value):

_____________________________________________________________________

_____________________________________________________________________

Section 4: Declaration

I, ___________________ (the "Affiant"), hereby declare that:

- All statements contained here are true and correct to the best of my knowledge and belief.

- The described property exceeds neither the value nor the nature limitations imposed by the South Dakota Small Estates Act.

- All debts of the deceased, including funeral and burial expenses, have been paid or provided for.

- I understand that falsifying information within this document can result in penalties under the law.

Section 5: Acknowledgment

This document does not need notarization under South Dakota law but must be signed under penalty of perjury.

Signature of Affiant: _____________________

Date: _____________________

Printed Name of Affiant: _____________________

Document Details

| Fact | Detail |

|---|---|

| Purpose | Used to handle small estates without formal probate in South Dakota |

| Governing Law | South Dakota Codified Laws (SDCL) 29A-3-1201 |

| Eligibility Criteria | Estate value must not exceed $50,000 |

| Waiting Period | Must wait 30 days after death to file |

| Required Documents | Death certificate and a detailed list of estate assets |

| Filing Location | Filed with the probate court in the county where the decedent lived |

| Intended Recipients | Beneficiaries or heirs of the estate |

| Affidavit Must Include | Affirmation of no pending probate proceedings and all debts are paid, or arrangement for payment has been made |

| Legal Effect | Transfers property without probate |

| Additional Requirement | May require a bond from the affiant to protect the estate |

How to Use South Dakota Small Estate Affidavit

After the loss of a loved one, managing their estate can be a complex and emotionally taxing process. For those handling smaller estates in South Dakota, the Small Estate Affidacy form offers a simpler alternative. This document enables you to collect assets, settle debts, and distribute property to rightful heirs without the lengthy process of probate. Below are the steps to fill out the Small Estate Affidavit form accurately.

- Start by entering the full legal name of the deceased, also known as the decedent, at the top of the form.

- Fill in the date of the decedent's death. Ensure this information is accurate, as it has legal implications.

- Provide the decedent's last known address, including the city, state, and zip code. This information helps in identifying the correct estate.

- List all known assets of the decedent. Be specific and include any bank accounts, stocks, vehicles, and real estate properties.

- State the estimated value of each listed asset. It's crucial to be honest and accurate, as this may be verified against other records.

- Identify and list all debts owed by the decedent, including but not limited to, credit card debts, loans, and utility bills. The total amount of debts must be accurately calculated.

- Include the names and addresses of all heirs or beneficiaries. This section ensures that assets are distributed to the correct individuals.

- Describe the relationship of each heir or beneficiary to the decedent, which is essential for legal verification.

- Sign and date the affidavit in front of a notary public. The signature must be notarized to validate the document legally.

This form, once completed, serves as a legally binding document that aids in the efficient resolution of the decedent's estate. It allows assets to be transferred to the rightful heirs without the need for a prolonged probate process. Consider seeking assistance from a legal professional if you encounter any difficulties or require further guidance while completing the Small Estate Affidavit form.

Listed Questions and Answers

What is a South Dakota Small Estate Affidavit?

In South Dakota, a Small Estate Affidavit is a legal document used to facilitate the transfer of property from a deceased individual's estate to their heirs without the need for a formal probate process. It's particularly useful for estates that fall below a certain value threshold, making the estate settlement process quicker and less complicated.

Who can use a South Dakota Small Estate Affidavit?

A South Dakota Small Estate Affidavit can be used by the successors in interest, such as the deceased's spouse, children, or other relatives, or by individuals designated in the deceased’s will, provided the total value of the estate meets the state-defined threshold and does not include real estate.

What is the value limit for using a South Dakota Small Estate Affidavit?

The value limit for using a Small Estate Affidavit in South Dakota is subject to change based on legislative updates. It typically involves a threshold where the value of the entire estate subject to probate does not exceed a certain dollar amount, excluding specific assets. For the most current threshold, it's recommended to consult the latest legal resources or a legal advisor.

What documents are needed to fill out a South Dakota Small Estate Affidavit?

When preparing a Small Estate Affidavit in South Dakota, several documents are necessary, including:

- A certified copy of the death certificate of the deceased.

- A detailed list of the estate's assets, including bank accounts, securities, and personal property, among others.

- Proof of the heir's relationship to the deceased or a copy of the will if applicable.

- Any other documents that might be required by a specific financial institution or entity holding the assets.

How is a South Dakota Small Estate Affidavit filed?

To file a South Dakota Small Estate Affidavit, the completed affidavit along with the necessary accompanying documents should be presented to the entity or institution holding the assets of the deceased. For example, if the estate includes funds in a bank account, the affidavit would be submitted to the bank. It is not typically filed with a court, but specific situations may vary, so it's advisable to consult with a legal professional.

How long does it take to process a Small Estate Affidavit in South Dakota?

The processing time for a Small Estate Affidavit in South Dakota can vary based on the complexity of the estate and the responsiveness of the asset holders. However, using a Small Estate Affidavit usually results in a quicker distribution of assets compared to going through the probate process, often within a few weeks to a couple of months.

Are there any special considerations when using a Small Estate Affidavit in South Dakota?

Yes, several special considerations should be kept in mind, including:

- The Small Estate Affidavit cannot be used if the estate includes real property, such as land or buildings.

- There may be specific waiting periods required by law before the affidavit can be used following the death of the estate owner.

- Accuracy in the affidavit is crucial, as errors can lead to delays or legal complications.

- Consulting a legal professional is advisable to ensure compliance with all South Dakota laws and regulations concerning small estates.

Common mistakes

Filling out the South Dakota Small Estate Affidavit form requires attention to detail. However, it's not uncommon for people to make mistakes. This document is crucial for those handling a small estate insofar as it simplifies the process of asset distribution without the need for a lengthy probate proceeding. Here are ten mistakes frequently made during this process:

- Not meeting eligibility requirements: Individuals often begin the process without verifying whether the estate qualifies as 'small' under South Dakota’s legal definition. This prerequisite is fundamental to proceeding correctly.

- Incorrectly listing assets: It's vital to accurately list and describe all assets belonging to the estate. Misidentifications or omissions can lead to delays or complications.

- Failing to properly value the estate: The estate's total value must be assessed accurately. Under or over-estimating this value can have significant repercussions, including legal challenges.

- Overlooking debts and liabilities: All outstanding debts and liabilities must be accounted for. Neglecting to list these can misrepresent the estate’s actual value.

- Not obtaining required documentation: The form requires supporting documents, such as death certificates and proof of ownership. Failing to attach these can invalidate the affidavit.

- Inaccurate beneficiary information: Providing wrong or incomplete information about the heirs or beneficiaries can lead to disputes and delays in asset distribution.

- Signature issues: Either not signing the form in the presence of a notary public or forgetting to sign it altogether is a common oversight that renders the document non-binding.

- Ignoring the waiting period: South Dakota law mandates a waiting period before the affidavit can be filed. Initiating the process too soon can lead to rejection.

- Improper filing: The affidavit must be filed in the appropriate local court. Mistakes regarding where to file can lead to procedural delays.

- Lack of coordination with financial institutions: Not communicating with banks or other institutions holding the assets can cause confusion and slow down the transfer process.

In summary, the successful completion of the South Dakota Small Estate Affaffidavit hinges on meticulous attention to detail and a clear understanding of the procedure's requirements. Avoiding the above mistakes can streamline the process, ensuring a swift and smooth transfer of the deceased's assets to the rightful heirs or beneficiaries.

Documents used along the form

When dealing with the resolution of a small estate in South Dakota, a Small Estate Affidavit is a beneficial document for simplifying the probate process in situations that meet certain qualifications. However, to effectively manage and distribute the assets of a deceased individual in accordance with legal requirements and the decedent's wishes, several other documents are often utilized alongside the Small Estate Affidavit. These documents help to ensure that the process is executed smoothly, providing clarity and legal authority to the actions taken by the surviving family members or representatives. Here is a list of some of these important documents.

- Death Certificate: This government-issued document serves as an official record of death and is necessary for legally proving the death of the individual. It is often required when transferring ownership or claiming assets.

- Will: If the decedent left a will, it specifies the distribution of assets and names an executor to manage the estate. It’s essential for guiding the distribution of assets not covered under the Small Estate Affidavit.

- Letters of Administration or Letters Testamentary: Issued by a court, these documents grant authority to an individual (usually the executor or administrator named in the will or appointed by the court) to act on behalf of the deceased’s estate.

- Trust Documents: If the decedent had established any trusts, these documents would be necessary to understand the directions given for the management and distribution of the assets held in trust.

- Bank Statements and Financial Records: These are crucial for identifying the assets of the estate, understanding its financial situation, and managing debts and obligations.

- Property Deeds: For real estate owned by the decedent, deeds are necessary to confirm ownership and to facilitate the transfer of property according to the decedent’s wishes or state law.

- Vehicle Titles: Similar to property deeds, titles for vehicles owned by the decedent are required for transferring ownership.

- Investment and Retirement Account Statements: These documents are needed to ascertain the value and beneficiary designations of investment accounts, including IRAs, 401(k)s, and other retirement accounts, which may not go through the probate process.

Collectively, these documents play a pivotal role in the administration of a small estate in South Dakota. Each serves a unique function, from validating the death and providing the legal framework for estate management, to identifying assets and stipulating their distribution. By utilizing the South Dakota Small Estate Affidavit in conjunction with these documents, the representatives of the decedent can navigate the legal landscape with greater ease and efficiency, ensuring that the estate is settled in a manner that honors the decedent’s intentions and complies with state law.

Similar forms

The South Dakota Small Estate Affidavit form is similar to other legal documents that simplify estate management and asset distribution. These documents are crafted to ease the process during emotionally taxing times, making it straightforward for survivors to claim their inheritance without getting entangled in the complexities of probate court. Each document serves a unique purpose but shares the goal of streamlined legal processes.

Transfer on Death Deed (TODD): The South Dakota Small Estate Affidavit form and a Transfer on Death Deed share the common aim of bypassing the traditional probate procedure. While the Small Estate Affidavit allows for the direct transfer of property from the estate to the beneficiaries under a certain threshold value, a Transfer on Death Deed enables an individual to name beneficiaries to receive real estate upon their death. Both mechanisms act as tools to simplify the transfer of assets, but the key difference lies in the type of asset and the timing of the transfer. The TODD is prepared and executed by the property owner while they are alive, specifying the future transfer upon death, whereas the Small Estate Affidavit is utilized after the individual’s passing to manage the distribution of their assets.

Joint Tenancy with Right of Survivorship Agreement: Another document similar to the South Dakota Small Estate Affidavit form is the Joint Tenancy with Right of Survivorship Agreement. This agreement allows individuals to co-own property in such a way that upon the death of one co-owner, the property automatically passes to the surviving co-owner(s) without the need for probate. Both the Small Estate Affidavit and joint tenancy agreements help avoid probate, but they apply to different situations. The Small Estate Affidavit is used after someone’s death to transfer their assets, including personal property, money, and real estate, while a joint tenancy agreement is used for co-owned property and takes effect upon the death of a co-owner.

Payable on Death (POD) Account Agreements: Similar in purpose to the South Dakota Small Estate Affidavit, Payable on Death Account Agreements allow account holders to name beneficiaries who will receive the account's assets upon the account holder's death. Both forms aim to simplify and expedite the process of transferring assets to beneficiaries without going through probate court. The main difference lies in their application; the Small Estate Affidavit can encompass various types of assets within an estate, whereas POD agreements are specifically designed for financial accounts, such as bank savings or investment accounts. Like the Small Estate Affidavit, POD agreements offer a straightforward path for asset transfer directly to the named beneficiaries at the account holder’s death.

Dos and Don'ts

When dealing with the aftermath of a loved one's passing, the Small Estate Affidavit form in South Dakota can simplify the process of asset distribution. However, it's crucial to approach this document with care to avoid complications. Here are five dos and five don'ts to keep in mind:

What You Should Do:

- Ensure eligibility: Verify that the estate qualifies under South Dakota's small estate threshold, which can change over time.

- Complete the form accurately: Provide precise and thorough information about the deceased, their assets, and any debts or obligations.

- Check for required attachments: Certain assets may need documentation such as titles or account statements to be attached with the form.

- Obtain necessary signatures: Make sure all required parties sign the form, which could include heirs or beneficiaries.

- File the form with the appropriate court: Depending on the county, the filing location may vary, so it's important to submit the affidavit to the right office.

What You Shouldn't Do:

- Avoid guessing on details: If unsure about specific assets or legal questions, it's better to seek guidance than to make assumptions.

- Don't skip notifying potential heirs: All possible heirs or beneficiaries should be informed about the affidavit to prevent future disputes.

- Don't disregard debts and taxes: Ensure all outstanding debts, including taxes, are acknowledged and addressed in the form.

- Do not use the form for real estate without proper advice: In South Dakota, real estate may require a different process, so consult with a professional if the estate includes property.

- Don't rush the process: Filling out the form requires careful consideration and attention to detail to ensure it's completed correctly.

Approaching the South Dakota Small Estate Affidavit with diligence and awareness of these dos and don'ts can facilitate a smoother legal process, allowing for a more efficient transfer of assets to the rightful heirs or beneficiaries.

Misconceptions

When navigating the probate process, particularly in South Dakota, the Small Estate Affidavit form is often misunderstood. Several misconceptions cloud its purpose and process, leading to confusion and potential missteps. Below are ten common misunderstandacies about this document, each unpacked to clarify their inaccuracies:

It Can Be Used Immediately After Death: Many believe that the Small Estate Affidavit can be utilized right after a person's death. However, there is a mandatory waiting period in South Dakota. The law requires a specific period to elapse — usually 30 days after the death — before the affidavit can be filed. This waiting period allows for all claims against the estate to be identified.

Any Estate Qualifies, Regardless of Size: The term "small estate" misleads some into thinking any estate can pass through this process. In reality, South Dakota has a threshold that defines a "small estate." This cap includes both real and personal property, and only estates valued below this limit qualify for the simpler process afforded by the affidavit.

It Eliminates the Need for a Lawyer: While the Small Estate Affidavit simplifies the process of settling an estate, it doesn’t remove the potential for legal complexities. In situations where the will is contested, or the estate involves complicated assets, professional legal advice may still be necessary.

It Transfers Property Immediately: Some people think that filing a Small Estate Affidifferentlyspeeds up the property transfer process. In reality, while it does streamline the process considerably, it doesn’t guarantee immediate transfer. The affidavit serves as a sworn statement that allows the transfer of property without formal probate, but the actual transfer might still take time, depending on the institutions involved.

Only Family Members Can File It: Although close relatives are the most common filers of Small Estate Affidavits, they are not the only ones eligible. Any person indebted to or possessing personal property of the deceased can file, provided they meet the state’s criteria for doing so.

It’s Complicated to File: The perception exists that the filing process is fraught with legal complexities. However, the form is designed to be straightforward and user-friendly, aiming to minimize the burden on grieving families. Still, accuracy in completing the form is crucial to avoid delays.

All Assets Can Be Transferred Using It: Not all assets can be transferred through a Small Estate Affidavit. Typically, it’s limited to personal property and sometimes vehicles or small bank accounts. Real estate and certain other types of assets may require a different process.

There's No Cost Involved: While filing a Small Estate Affidavit is certainly less expensive than undergoing formal probate, there may still be filing fees or other minor costs associated with the process, depending on the county where the affidavit is filed.

A Notary Public Can Provide All Necessary Legal Advice: While a notary can notarize the document, making it a legally binding affidavit, they cannot offer legal advice about the estate or the implications of signing the affidavit. For such advice, consulting with an attorney is recommended.

It Supersedes a Will: Some think that a Small Estate Affidavit can override the directives of a will. This is not the case. If a valid will exists, it dictates the distribution of assets. The affidavit simplifies the process for eligible estates but does not supersede the decedent’s final wishes as expressed in their will.

Understanding these misconceptions about the South Dakota Small Estate Affidavit can help individuals navigate the process more effectively and with realistic expectations. When in doubt, seeking professional legal advice is always a prudent step to ensure compliance with the law and the accurate distribution of the deceased's estate.

Key takeaways

When you're managing the assets of a loved one who has passed away in South Dakota, and the estate falls under the state-specific threshold for a "small estate," you might consider using the Small Estate Affidiation form. This legal document simplifies the process, making it possible to transfer assets without going through the full probate process. Here are 10 key takeaways to keep in mind:

- The Small Estate Affidavit form is designed for scenarios where the deceased's estate doesn't exceed certain values set by South Dakota law.

- To use this form, you must wait at least 30 days after the death of the estate's owner. This waiting period is crucial before any action can be initiated.

- Eligibility hinges on the total value of the estate. It's important to accurately assess and confirm the estate falls under the small estate threshold.

- The form requires a detailed list of the deceased's assets. This includes bank accounts, vehicles, and any other personal property, but not real estate, as it has different rules.

- Debts and liabilities of the estate need to be well-documented. This ensures that any claims against the estate can be properly addressed.

- Affidavit signers must swear, under oath, that the information provided is accurate and truthful. This promotes honesty and reduces the risk of fraudulent claims.

- Legal identification and documentation verifying the death of the property owner are necessary to accompany the affidavit.

- Once completed, the affidavit needs to be filed with the appropriate local court or used directly with institutions holding the assets (like banks) to transfer ownership.

- Signing the affidavit may legally obligate the signer to use the assets for paying the deceased's debts and distributing the remainder according to their will or state law.

- Consultation with a legal expert is advised to navigate through the process accurately and ensure that all legal requirements are met.

Properly completing and using the South Dakota Small Estate Affidavit form can significantly simplify the process of settling an estate. However, attention to detail and careful adherence to legal requirements and deadlines is crucial for a smooth transfer of assets to the rightful heirs or beneficiaries.

Fill out Popular Small Estate Affidavit Forms for Different States

Pa Small Estate Procedure - Despite its benefits, it is crucial to consult with an estate lawyer to ensure it is the appropriate action for your specific circumstances.

Affidavit for Collection of Small Estate - It’s a practical solution for asset distribution in situations where probate might be deemed unnecessary.

How Much Does a Small Estate Affidavit Cost - Acts as a legal shortcut for the distribution of assets under the small estate threshold, facilitating a quicker resolution for grieving families.

Small Estate Affidavit Delaware - It serves as an important tool for those seeking to legally claim their inheritance without undue burden.