Printable Small Estate Affidavit Form for Tennessee

When a loved one passes away, the process of settling their estate can seem daunting, particularly for small estates that might not require the complexities of probate court. In Tennessee, the Small Estate Affidavit form provides a simplified method for the legal transfer of property from the deceased to their heirs or beneficiaries. This tool is especially useful for estates valued at $50,000 or less, as it offers a faster, less complicated route than traditional probate procedures. The form allows for the distribution of both personal property and real estate, under certain conditions, ensuring that assets are transferred according to the deceased's wishes or the state’s succession laws if there is no will. Additionally, the form necessitates a comprehensive list of the deceased’s assets, debts, and the proposed distribution plan, which must be agreed upon by all beneficiaries. Filing this affidavit requires a thorough understanding of its eligibility criteria, as well as adherence to Tennessee’s specific regulations and timelines, to effectively bypass the need for a prolonged probate process.

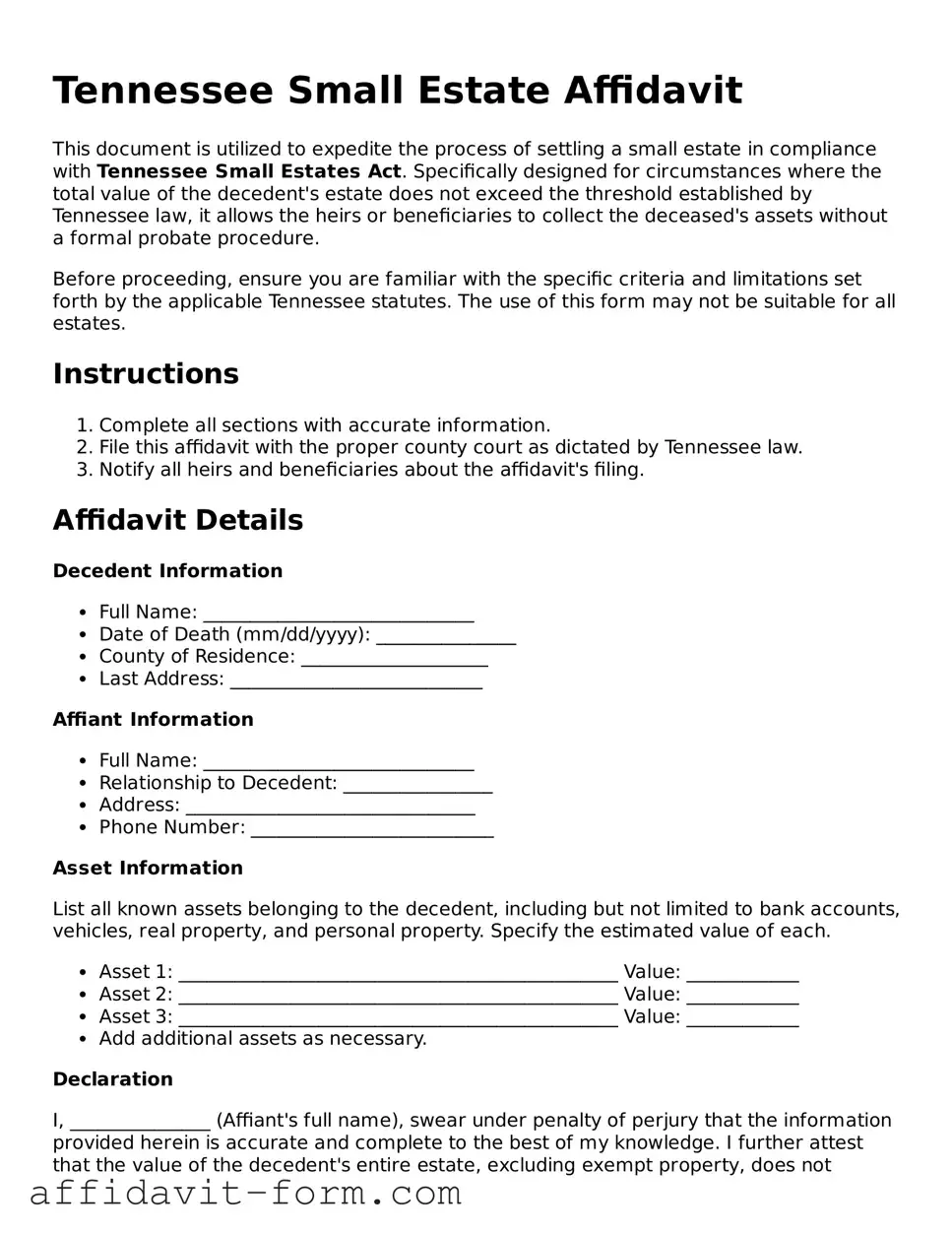

Form Example

Tennessee Small Estate Affidavit

This document is utilized to expedite the process of settling a small estate in compliance with Tennessee Small Estates Act. Specifically designed for circumstances where the total value of the decedent's estate does not exceed the threshold established by Tennessee law, it allows the heirs or beneficiaries to collect the deceased's assets without a formal probate procedure.

Before proceeding, ensure you are familiar with the specific criteria and limitations set forth by the applicable Tennessee statutes. The use of this form may not be suitable for all estates.

Instructions

- Complete all sections with accurate information.

- File this affidavit with the proper county court as dictated by Tennessee law.

- Notify all heirs and beneficiaries about the affidavit's filing.

Affidavit Details

Decedent Information

- Full Name: _____________________________

- Date of Death (mm/dd/yyyy): _______________

- County of Residence: ____________________

- Last Address: ___________________________

Affiant Information

- Full Name: _____________________________

- Relationship to Decedent: ________________

- Address: _______________________________

- Phone Number: __________________________

Asset Information

List all known assets belonging to the decedent, including but not limited to bank accounts, vehicles, real property, and personal property. Specify the estimated value of each.

- Asset 1: _______________________________________________ Value: ____________

- Asset 2: _______________________________________________ Value: ____________

- Asset 3: _______________________________________________ Value: ____________

- Add additional assets as necessary.

Declaration

I, _______________ (Affiant's full name), swear under penalty of perjury that the information provided herein is accurate and complete to the best of my knowledge. I further attest that the value of the decedent's entire estate, excluding exempt property, does not exceed the statutory limit as prescribed by Tennessee law. I acknowledge my obligation to utilize these assets to discharge the decedent's debts and distribute the remainder according to law.

Signature

- Affiant's Signature: _______________________ Date: ____________

- Notary Public: ____________________________ Date: ____________

This document and the information contained within is not a substitute for legal advice. Consider consulting with a legal professional to ensure compliance with all Tennessee state requirements and to adequately address your specific situation.

Document Details

| Fact Name | Description |

|---|---|

| Eligibility Criteria | The estate must be valued at $50,000 or less, not including certain exemptions, to qualify for the small estate process in Tennessee. |

| Required Waiting Period | There is a mandatory waiting period of 45 days after the death of the decedent before the affidavit can be filed with the court. |

| Governing Law | The process is governed by Tennessee Code Annotated § 30-4-101 through § 30-4-105. |

| Intended Use | The form is used to expedite the process of settling a small estate by bypassing the traditional and lengthier probate process. |

| Publication Requirement | There is no requirement to publish notice to creditors, unlike in a formal probate proceeding. |

| Personal Property Limit | Only personal property is included in the determination of the estate’s value for the purpose of using the small estate affidavit; real property is not considered. |

How to Use Tennessee Small Estate Affidavit

When someone dies without a will in Tennessee, handling their estate can seem intricate. However, for smaller estates, the process can be significantly simplified through a Small Estate Affiditat. This document allows the property of the deceased to be transferred without a formal probate process. To ensure a smooth process, it's essential to accurately complete the form. Below are step-by-step instructions to help you through.

- Begin by entering the full legal name of the deceased, also known as the decedent, at the top of the form where indicated.

- Under the section marked "Applicant," input your name and address, establishing your relationship to the estate.

- Fill in the decedent's date of death in the designated area. This information should exactly match the death certificate.

- Specify the legal residence of the decedent at the time of death, ensuring it aligns with Tennessee jurisdiction.

- List all known assets of the estate. Be thorough, including everything from bank accounts to personal property that didn’t require titles.

- Identify and document any debts the decedent owed, including final bills, credit cards, or personal loans.

- Provide information on the heirs, including their names, addresses, and relationships to the decedent. If minor children are involved, indicate their ages.

- Detail how the assets will be distributed among the heirs according to the law or as agreed by all parties.

- Review the affidavit to ensure all the information provided is accurate and complete. Mistakes could lead to delays or legal complications.

- Sign the form in front of a notary public. The notary will verify your identity and witness your signature, making the document legally binding.

- Submit the completed Small Estate Affidavit to the appropriate local court in Tennessee. The court will then process your application.

After submitting the Small Estate Affidavit, the court will review the documents. If everything is in order, it will issue an order that allows the transfer of the decedent's assets to the rightful heirs. This process typically takes less time than going through a full probate, enabling families to settle their loved one's affairs more promptly. Keep a copy of all submitted documents for your records.

Listed Questions and Answers

What is a Tennessee Small Estate Affidavit?

A Tennessee Small Estate Affidavit is a legal document used to handle the assets of a deceased person (known as the decedent) when those assets are under a certain value threshold. In Tennessee, this document allows for the distribution of the decedent's assets without the need for a formal probate process. It is a simplified process designed to make it easier for the heirs or beneficiaries to collect the property of the deceased when the total estate value does not exceed $50,000.

Who can file a Tennessee Small Estate Affidayit?

Under Tennessee law, the right to file a Small Estate Affidavit typically falls to the surviving spouse of the deceased or a next of kin. If neither is available or willing to file, a creditor of the deceased who has a claim against the estate may also file the affidavit. To use this process, the petitioner must wait at least 45 days following the death of the decedent and ensure that the total value of the estate is indeed less than $50,000, excluding the value of certain assets like real estate.

What are the steps to file a Tennessee Small Estate Affidavit?

- Confirm that the total estate value is $50,000 or less, excluding certain assets such as real property.

- Wait 45 days after the death of the decedent to file the affidavit.

- Fill out the Tennessee Small Estate Affidavit form completely, listing all assets and their values.

- Sign the form in front of a notary public.

- Submit the completed form and a certified copy of the death certificate to the probate court in the county where the decedent lived.

- Notify all interested parties, such as heirs and known creditors, about the affidavit petition.

What assets can be distributed using a Tennessee Small Estate Affidayit?

Assets that can be distributed with a Tennessee Small Estate Affidavit include tangible personal property, debts owed to the decedent, bank accounts, and stocks and bonds. It is important to note that real estate cannot be transferred using this affidavit. Additionally, certain assets that typically pass outside of the probate process, such as life insurance proceeds payable to a named beneficiary or retirement accounts, are also not covered by the Small Estate Affidavit.

Common mistakes

Filling out legal documents accurately is crucial for them to serve their intended purpose, especially for sensitive matters like the dispersion of a small estate in Tennessee. Here are some of the common mistakes that people make when completing the Tennessee Small Estate Affidavit form:

-

Not verifying eligibility requirements: Before proceeding, it’s essential that individuals first confirm the estate in question is eligible under Tennessee law for small estate treatment. This typically involves limitations on the value of the estate. Overlooking or misunderstanding eligibility can lead to filing the wrong forms or facing rejection.

-

Omitting required information or providing incomplete details: The form requires specific information regarding the deceased, their assets, debts, and heirs. Leaving sections incomplete or not providing detailed, accurate information can result in processing delays or outright denial of the affidavit.

-

Incorrectly listing assets and valuations: Assets must be listed accurately with current market values where applicable. Some individuals may underestimate or overestimate the value of certain assets, leading to complications or challenges during the affidavit’s execution.

-

Failing to obtain necessary signatures and notarization: The affidavit requires signatures from all heirs or legatees and, in some cases, notarization. Missing signatures or not properly notarizing the document can invalidate the form, requiring parties to correct and resubmit it for processing.

Attention to detail and careful adherence to instructions can greatly reduce the likelihood of these mistakes occurring. When in doubt, seeking assistance from a legal professional can help ensure that the process is handled correctly and efficiently.

Documents used along the form

When managing a small estate in Tennessee, several additional forms and documents commonly accompany the Small Estate Affidavit to ensure the process is smooth and compliant with state law. These documents collectively help in accurately transferring the decedent's assets to the rightful heirs or beneficiaries and fulfilling any remaining legal obligations.

- Certified Copy of the Death Certificate: This is a vital document required to authenticate the death. It is necessary for the validation of the Small Estate Affidavit and is often required by financial institutions and other entities to transfer assets.

- Consent and Waiver Forms: These are used when all heirs or beneficiaries agree on how the estate should be divided and are willing to waive any formal probate process. It shows a unanimous decision, simplifying the asset distribution process.

- Inventory and Appraisal Form: This document lists all the assets within the estate and their estimated value. It's important for ensuring a fair distribution of assets among heirs and may be required by the court or tax authorities.

- Notice to Creditors: If the estate owes debts, this document notifies creditors of the death, allowing them to make claims against the estate. It’s necessary to ensure all debts are settled before assets are distributed.

- Final Tax Return: This includes both federal and state tax returns that must be filed to settle any outstanding taxes the estate or the deceased might owe. Handling these matters promptly helps avoid potential penalties.

- Receipts and Releases Form: Once the assets have been distributed, this document is signed by the heirs or beneficiaries, acknowledging they received what was due to them and releasing the executor from further responsibility.

Collectively, these documents play crucial roles in the administration of a small estate in Tennessee. They ensure that the process adheres to legal standards and that the rights and obligations of all parties involved are respected and fulfilled. While the Small Estate Affidavit simplifies the process, these accompanying documents ensure thoroughness and compliance with the law.

Similar forms

The Tennessee Small Estate Affidavit form is similar to several other legal documents that are designed to simplify the execution of estates under certain conditions. Like these documents, the Tennessee Small Estate Affidavit aims to streamline the process for small estates, allowing for easier transfer of assets to heirs without the need for a full probate procedure. This form is particularly used in situations where the deceased person's estate falls under a specific value threshold, emphasizing a faster, less complex process.

Affidavit for Collection of Personal Property is one example of a document that bears similarity to the Tennessee Small Estate Affidavit. Both documents empower individuals to claim property without formal probate. Specifically, the Affidavit for Collection of Personal Property is used when someone is entitled to receive personal property of the deceased, such as bank accounts, stocks, or tangible items, and the estate's overall value does not exceed a statutory limit. The process involves swearing an oath to an affidavit, similar to the Tennessee Small Estate Affidavit, to ascertain rightful ownership and facilitate the transfer directly without court intervention.

Another document akin to the Tennessee Small Estate Affidavit is the Transfer on Death Deed (TODD). While the TODD is a proactive measure, allowing property owners to name beneficiaries for real estate that will transfer upon the owner's death, it shares the aim of bypassing the time-consuming and often costly probate process. Both the TODD and the Small Estate Affidavit provide streamlined methods for transferring assets, though the TODD is arranged prior to death, and the Small Estate Affidavit is utilized after death. They similarly reduce the logistical and financial burdens on the survivors by simplifying the asset transfer process.

The Summary Administration process also shares characteristics with the Tennessee Small Estate Affidavit, though on a slightly more complex level. Summary Administration is available in certain jurisdictions for handling small or uncomplicated estates, often requiring less paperwork and fewer court appearances than traditional probate. Like the Tennessee Small Estate Affidavit, Summary Administration is designed to expedite the legal process following an individual's death. However, it involves more oversight from the court and may still require the filing of formal petitions and notices to creditors, distinguishing it from the simpler affidavit process.

Ultimately, these documents and procedures reflect a common goal across jurisdictions: to alleviate the burden on families and heirs by facilitating a quicker, less cumbersome process for transferring assets of small estates. Each has its unique application and requirements, but all serve to simplify the post-death transfer of assets in a manner that lessens the load on loved ones during what is often a challenging time.

Dos and Don'ts

When filling out the Tennessee Small Estate Affidavit form, approaching the task with detailed attention and understanding is crucial. This legal document facilitates the transfer of assets from a deceased person's estate under certain conditions, bypassing the need for a full probate process. To ensure accuracy and compliance, here are essential dos and don'ts worth following:

- Do thoroughly read the entire form before beginning to fill it out. This ensures you understand every requirement and prepare the necessary information.

- Do confirm eligibility for using the small estate process in Tennessee. The total value of the estate must meet the state's threshold, not including certain assets like jointly owned property.

- Do accurately list all assets belonging to the estate. Providing a complete and truthful account is critical for the smooth processing of the form.

- Do obtain and attach necessary documents, such as death certificates and proof of any debts owed by the estate. These documents support the information provided in the affidavit.

- Do have all required parties sign the form in the presence of a notary. This step is essential for the affidavit to be considered valid and legally binding.

- Don't rush through filling out the form. Mistakes or omissions can cause delays or legal issues down the line.

- Don't guess or estimate the value of assets. Use exact figures whenever possible, and seek appraisals for items of substantial value.

- Don't ignore the legal requirements for notifying creditors and paying off debts of the estate. This is a crucial step in settling the estate's affairs properly.

- Don't hesitate to seek professional advice if there's any uncertainty about the process. Consulting with a lawyer can provide clarity and ensure that everything is completed correctly.

Adhering to these guidelines can significantly streamline the process of utilizing the Tennessee Small Estate Affidavit form. With careful attention to detail and a methodical approach, you can effectively manage the small estate matters of your loved one.

Misconceptions

In understanding the complexities of navigating a small estate in Tennessee, indeed, specific misconceptions can lead to misunderstanding and frustration. The following are five common misunderstandings about the Tennessee Small Estate Affidavit form, elucidated to ensure clarity and ease during a time that is often fraught with challenges.

- Misconception 1: The form grants immediate access to all assets.

Many people mistakenly believe that completing the Tennessee Small Estate Affidavit form will immediately grant them access to the deceased's assets. In reality, the process involves a waiting period and the requirement for the affidavit to be approved by a probate court, which can take time. - Misconception 2: The form is applicable regardless of the estate’s value.

There is a misconception that the Small Estate Affidavit can be used for any estate, regardless of its value. However, in Tennessee, the use of this form is limited to estates valued at or below a specific threshold, recently set at $50,000 (excluding certain assets), a figure subject to change. Assets above this value typically require a more formal probate process. - Misconception 3: Real estate can be transferred using the affidavit.

A common misunderstanding is that the Small Estate Affidavit allows for the transfer of real estate owned by the deceased. In Tennessee, this form does not permit the direct transfer of real estate; additional legal processes are required to handle real property, underscoring the importance of consulting with legal professionals regarding estate matters. - Misconception 4: Only family members can file the form.

It is often thought that only family members of the deceased can file the Small Estate Affidavit. While family members frequently initiate this process, Tennessee law allows any interested party who has a legal right or claim against the estate’s assets to file the affidavit, provided they adhere to the state's stipulations. - Misconception 5: The form negates the need for legal advice.

Another widespread misunderstanding is the belief that completing the Small Estate Affidavit is a straightforward process that does not necessitate legal guidance. However, given the potential complexities and variances in law, consulting a legal expert familiar with Tennessee's statutes can ensure that the process is handled correctly and efficiently, avoiding unintentional mistakes that could complicate the estate's settlement.

Through an understanding of these misconceptions, individuals dealing with small estates in Tennessee can better navigate the legal requirements, ensuring a smoother process during a period that requires compassion and thoughtful attention to detail.

Key takeaways

The Tennessee Small Estate Affidavit is an essential document for those handling the estate of a deceased person in Tennessee, where the total value of the estate does not exceed a certain threshold. This document allows for an easier and often quicker way to distribute the deceased person's assets to heirs or beneficiaries without going through the standard probate process. Here are key takeaways about filling out and using the Tennessee Small Estate Affidavit form:

- Eligibility criteria are strict. The total value of the estate, including property and assets, must not exceed $50,000. This amount is subject to change, so it is important to verify the current threshold.

- Accurate valuation of the estate's assets is mandatory. All assets must be listed with their current market value to ensure the estate qualifies under the small estate limit.

- A waiting period is required. In Tennessee, a Small Estate Affaidavit cannot be filed until at least 45 days have passed since the death of the estate owner.

- The affidavit requires detailed information about the deceased, including their full legal name, date of death, and a comprehensive list of all assets.

- Debts and taxes of the estate need to be addressed. The affidavit should include information about any known debts, as well as plans for paying outstanding taxes from the estate’s assets.

- Filing the affidavit with the appropriate Tennessee county probate court is a critical step. The county where the deceased person lived or owned property is typically the correct jurisdiction.

- Legal review is advised. While the Small Estate Affidavit is designed to be a simpler process, obtaining legal advice can help navigate potential complexities and ensure all legal requirements are met.

Completing and using the Tennessee Small Estate Affidavit form requires careful attention to detail and an understanding of the specific requirements set out by Tennessee law. It offers a beneficial method for small estate administration, simplifying the process for individuals entitled to receive property of the deceased. Nonetheless, it's recommended to seek professional guidance to ensure the process is handled correctly and efficiently.

Fill out Popular Small Estate Affidavit Forms for Different States

Affidavit for Collection of Small Estate - The simplicity of the Small Estate Affidavit can alleviate some stress during the mourning period.

Probate Forms Ri - It underscores the importance of legal documents even in the absence of a will, offering a pathway to distribute assets rightfully.