Printable Affidavit of Death Form for Texas

When it comes to handling the estates of deceased individuals in Texas, the Affidavit of Death form plays a crucial role. This document serves as a formal declaration, ensuring that the death of a property owner is officially recorded and acknowledged. Its primary use involves clarifying and confirming the change in property ownership, which is especially vital in cases where the deceased did not leave a will. Moreover, the Texas Affidavit of Death form simplifies the process of transferring assets, reducing the need for a protracted legal process. It's carefully crafted to provide peace of mind for the deceased's loved ones, ensuring that the transition of estate affairs is handled with dignity and in accordance with the law. Processing this affidavit requires attention to detail and an understanding of its significance in the statutory framework, making it an indispensable tool in the administration of estates in Texas.

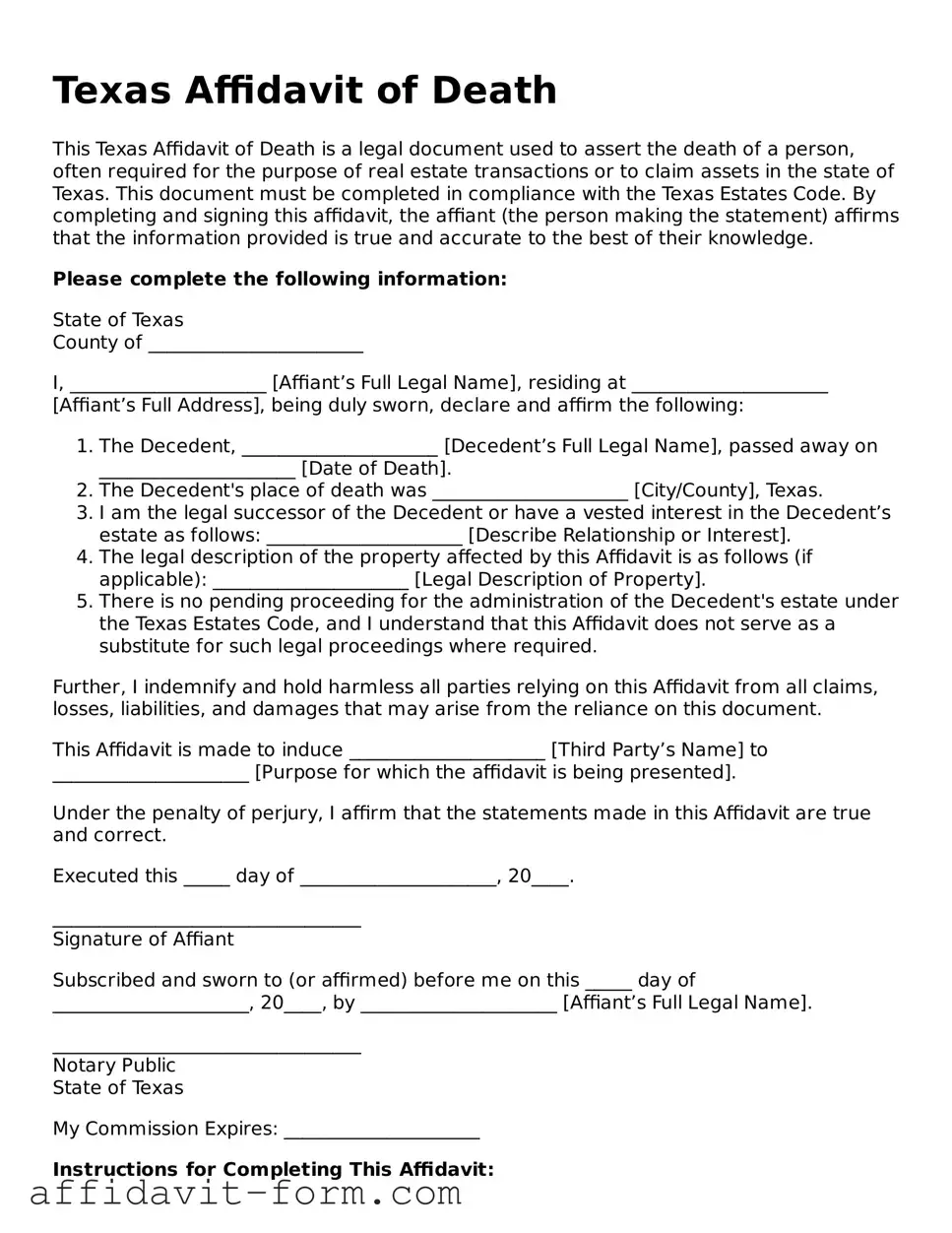

Form Example

Texas Affidavit of Death

This Texas Affidavit of Death is a legal document used to assert the death of a person, often required for the purpose of real estate transactions or to claim assets in the state of Texas. This document must be completed in compliance with the Texas Estates Code. By completing and signing this affidavit, the affiant (the person making the statement) affirms that the information provided is true and accurate to the best of their knowledge.

Please complete the following information:

State of Texas

County of _______________________

I, _____________________ [Affiant’s Full Legal Name], residing at _____________________ [Affiant’s Full Address], being duly sworn, declare and affirm the following:

- The Decedent, _____________________ [Decedent’s Full Legal Name], passed away on _____________________ [Date of Death].

- The Decedent's place of death was _____________________ [City/County], Texas.

- I am the legal successor of the Decedent or have a vested interest in the Decedent’s estate as follows: _____________________ [Describe Relationship or Interest].

- The legal description of the property affected by this Affidavit is as follows (if applicable): _____________________ [Legal Description of Property].

- There is no pending proceeding for the administration of the Decedent's estate under the Texas Estates Code, and I understand that this Affidavit does not serve as a substitute for such legal proceedings where required.

Further, I indemnify and hold harmless all parties relying on this Affidavit from all claims, losses, liabilities, and damages that may arise from the reliance on this document.

This Affidavit is made to induce _____________________ [Third Party’s Name] to _____________________ [Purpose for which the affidavit is being presented].

Under the penalty of perjury, I affirm that the statements made in this Affidavit are true and correct.

Executed this _____ day of _____________________, 20____.

_________________________________

Signature of Affiant

Subscribed and sworn to (or affirmed) before me on this _____ day of _____________________, 20____, by _____________________ [Affiant’s Full Legal Name].

_________________________________

Notary Public

State of Texas

My Commission Expires: _____________________

Instructions for Completing This Affidavit:

- Ensure all blanks are filled with accurate information.

- Verify that all information accurately reflects the death and related matters as they pertain to Texas law.

- Consult with a legal professional if you have any questions about completing or using this affidavit.

Document Details

| Fact | Description |

|---|---|

| 1. Purpose | The Texas Affidavit of Death form is used to legally formalize the death of an individual in the state of Texas, particularly for the transfer of title on assets solely in the deceased's name. |

| 2. Governing Law | It is governed by the Texas Estates Code, which provides the legal framework for probate, wills, and the administration of estates. |

| 3. Necessary Information | The form requires detailed information about the deceased, including their full name, date of death, and a legal description of the property affected. |

| 4. Who Can File | Typically, the form is filed by the surviving spouse or a close relative of the deceased, though an executor or legal representative of the estate can also file it. | }

| 5. Where to File | It must be filed in the county where the property is located or, if there is no property, in the county of the deceased's residence. |

| 6. Impact on Property Transfer | Once filed and approved, it can facilitate the transfer of property titles from the deceased to their heirs or beneficiaries without formal probate. |

| 7. Affidavit Requirements | The affidavit must be signed in the presence of a notary public, who verifies the identity of the filer and the truthfulness of the document. |

| 8. Supplemental Documentation | A certified copy of the death certificate is often required as an attachment to the affidavit to substantiate the death. |

| 9. Public Record | Once filed, the affidavit becomes a public record, making the information contained within it accessible to interested parties. |

| 10. Filing Fee | There is typically a filing fee associated with the affidavit, which varies by county in Texas. |

How to Use Texas Affidavit of Death

Completing a Texas Affidavit of Death is a crucial step in managing the deceased's affairs, ensuring that real estate and other assets are correctly transferred to the rightful heirs or designated parties. This document serves as a formal statement of death, necessitated by financial institutions, courts, and other entities to finalize the deceased's accounts and property matters. Accuracy and attention to detail are paramount when filling out this affidavit to avoid delays or legal complications during what is already a challenging time.

- Begin by providing the legal name of the deceased as it appears on official documents.

- Indicate the deceased's date of death by filling in the correct day, month, and year.

- List the deceased’s last known address, ensuring it matches the address on record with government and financial entities.

- Specify the Social Security Number of the deceased, if requested, to confirm their identity.

- Describe the relationship between the affiant (the person filling the affidavit) and the deceased to establish the affiant’s legal standing.

- Detail the legal description or address of the real estate property, if applicable, to identify the asset(s) in question.

- Attach a certified copy of the death certificate to the affidavit as proof of death.

- Include any additional documents required by the Texas county where the real estate is located, as each county may have specific requirements.

- Review the affidavit for accuracy, ensuring all information is correct and matches the official documents.

- Sign the affidavit in front of a notary public, who will also need to sign and provide their seal, making the document legally binding.

Once the Texas Affidavit of Death is properly filled out and notarized, the next step is to file it with the appropriate county records office. This filing officially documents the death in regard to the deceased’s property and assets within that jurisdiction. The filing process may include a nominal fee, and the requirements can vary by county, so it is advisable to contact the county office beforehand. Timely filing of this document is essential to ensure that estate matters are handled efficiently and according to the deceased's wishes or estate plan.

Listed Questions and Answers

What is a Texas Affidavit of Death?

An Affidavit of Death is a legal document used in Texas to formally recognize the death of an individual. It's often used to notify businesses, courts, and agencies about the passing in order to update records or transfer assets, such as real estate or vehicles, that were in the deceased's name. The document typically includes details about the deceased, the date of death, and may be required to claim benefits or manage the decedent's affairs.

Who can file a Texas Affidavit of Death?

In Texas, typically an heir, close relative, or executor of the estate can file an Affidavit of Death. Specific eligibility can vary based on the situation and the asset involved. It's important to ensure that the person filing the affidavit has a legitimate interest in the estate or is duly authorized to act on behalf of the deceased's affairs.

What information is needed to complete the form?

To complete an Affidavit of Death form in Texas, you will need to provide:

- The full name of the deceased

- The deceased's date of death

- A certified copy of the death certificate

- Details about the property or asset being transferred, if applicable

- Relationship of the filer to the deceased

- Any additional information required by the specific circumstances, such as details on joint tenancy or community property, if relevant

Where do you file an Affidavit of Death in Texas?

The Affidavit of Death should be filed with the county clerk's office in the Texas county where the property or asset is located. If it pertains to general estate matters, it should be filed in the county where the decedent resided. It's essential to contact the specific office directly to confirm filing requirements and fees.

Is a lawyer necessary to file an Affidavit of Death in Texas?

While a lawyer is not strictly necessary to file an Affidavit of Death, consulting with a legal professional experienced in estate or probate law can be very beneficial. They can provide guidance on the process, ensure the form is completed correctly, and address any complex issues that may arise during the filing process or asset transfer.

What are the filing fees for an Affidait of Death in Texas?

Filing fees for an Affidavit of Death vary by county in Texas. Generally, there is a nominal fee required for recording the document with the county clerk’s office. It’s recommended to contact the specific county clerk’s office for the most accurate and up-to-date information regarding filing fees.

How long does it take to process an Affidavit of Death?

The processing time for an Affidavit of Death can vary widely depending on the county and the current workload of the clerk's office. It can take anywhere from a few days to several weeks. Expedited services might be available for an additional fee. Contacting the county clerk's office directly will provide a more specific timeline.

Can an Affidavit of Death transfer real estate in Texas?

Yes, an Affidavit of Death can be used to facilitate the transfer of real estate in Texas, but only under certain conditions. If the property was held in joint tenancy or as community property with right of survivorship, this affidavit might be sufficient to transfer the deceased's interest in the property to the surviving owner(s). However, for properties solely in the deceased's name or in cases with more complexity, a formal probate process may be necessary.

Does the Affidavit of Death need to be notarized?

Yes, in Texas, the Affidavit of Death must be notarized to be considered a valid legal document. The person filing the affidavit must sign it in front of a notary public, affirming the truth of the information contained within under oath.

Are there any penalties for filing a false Affidavit of Death?

Filing a false Affidavit of Death is considered a serious offense in Texas. Individuals who knowingly submit false information on an affidavit can face legal penalties, including fines and potentially criminal charges. It is crucial to ensure all information provided in the affidavit is accurate and truthful.

Common mistakes

When filling out the Texas Affiditat of Death form, accuracy and thoroughness are key. However, it's easy to make mistakes, especially during times of stress or grief. Below are nine common mistakes people often make on this important document:.

Not verifying personal information: One common error is failing to double-check the deceased's personal information, such as the full name, date of birth, and Social Security number. Accuracy is crucial for the document to be legally valid.

Incorrect date of death: Another mistake is recording the wrong date of death. This date must be exact for legal and financial purposes.

Omitting the cause of death: While not always required, the cause of death may be necessary for certain legal or financial processes. Leaving this out can cause delays.

Forgetting to sign and date the form: An unsigned or undated form is not legally valid. The person completing the form must remember to sign and date it in the presence of a notary.

Not using a notary: Many people overlook the importance of having the form notarized. Notarization is essential to verify the authenticity of the document.

Misunderstanding the relationship to the deceased: Incorrectly stating the relationship of the signatory to the deceased can lead to questions about the document's validity.

Failing to include necessary attachments: Sometimes, additional documents, such as a copy of the death certificate or proof of relationship to the deceased, are required. Failing to attach these can result in processing delays.

Using incorrect terminology: Legal documents need precise language. Using incorrect terms or unclear language can cause confusion or necessitate corrections.

Not consulting with a professional: Finally, a common mistake is not seeking advice from a legal professional when unsure about the process. A small oversight on a form like the Affidavit of Death can have significant implications, and professional guidance can be invaluable.

Each of these mistakes can hinder the affidavit's processing or effectiveness, potentially complicating an already challenging time. Being aware of these pitfalls and seeking appropriate help when necessary can ensure the document is filled out correctly and efficiently.

Documents used along the form

When dealing with the matter of a person's death in Texas, several documents besides the Affidavit of Death Form are commonly required to ensure that the deceased's assets and responsibilities are appropriately managed and transferred. These documents play a vital role in the legal and administrative processes that follow a person's passing.

- Certificate of Title: This document is crucial when transferring ownership of a deceased person's vehicle to the heirs or beneficiaries. It officially records the change of ownership and is necessary for vehicles titled in the state of Texas.

- Transfer on Death Deed: Often used in real estate, this form allows property to be passed directly to a beneficiary without the need for prob, safeguarding the property from being tied up in lengthy court proceedings.

- Last Will and Testament: This legal document is essential for distributing the deceased's assets according to their wishes. It outlines who will inherit property, assets, and handle important responsibilities such as care for minor children.

- Statement of Heirship: When a person dies intestate (without a will), this document helps establish the rightful heirs and is often required by courts and financial institutions to distribute the deceased's assets according to state laws.

Together, these documents facilitate the smooth transition of the deceased's assets to their rightful heirs or beneficiaries and ensure that all legal and fiscal responsibilities are addressed. Handling these documents swiftly and accurately can significantly reduce the complexities often associated with estate and asset management following a person's death.

Similar forms

The Texas Affidavit of Death form is similar to various legal documents used to establish or confirm certain facts in the wake of someone's death. These documents are utilized across multiple jurisdictions for purposes like transferring property, claiming benefits, or settling estates. Typically, they must be filed in relevant legal or governmental institutions and are integrated into the broader probate or estate settlement processes. The similarity among these documents largely lies in their function of formalizing the impact of a death on legal and financial matters, though the specifics of their use and legal requirements can vary.

Affidavit of Heirship: This document is quite similar to the Texas Affidavit of Death in that it serves to legally establish who the heirs or beneficiaries are after someone dies, particularly when the deceased did not leave a will. An Affidavit of Heirship is often used to transfer title to property, helping to streamline the transfer process without going through probate court. It details the family history and the heirs of the deceased, providing a legal pathway for the transfer of assets. Both documents require detailed information about the deceased and rely on the affidavit being signed in the presence of a notary public.

Death Certificate: In many ways, a Death Certificate is the most official document confirming someone's death. Issued by a governmental authority, it states the date, location, and cause of death. While the Texas Affidavit of Death is used to assert the fact of someone's death primarily for legal or commercial matters, such as transferring titles or claiming benefits, a Death Certificate serves as the definitive proof of death across all needs. It is the foundational document upon which the Affidavit of Death and similar legal instruments depend, as it provides the official confirmation of death required by these other documents.

Transfer on Death Deed: The Transfer on Death Deed (TODD) is a legal document that automatically transfers the ownership of real property upon the death of the owner to a named beneficiary, bypassing the probate process. Similar to the Texas Affidavit of Death, which helps in managing property transfers after death, the TODD is designed to facilitate the smooth transition of real estate. However, the TODD must be executed by the property owner before their death, whereas the Affidavit of Death is a post-mortem document filed by someone else. Despite this difference, both documents play crucial roles in ensuring the deceased's real property is transferred according to their wishes or to the rightful heirs.

Dos and Don'ts

When dealing with the Texas Affidavit of Death form, it's crucial to handle the documentation with accuracy and attention to detail. This form plays an essential role in various legal processes, including the transfer of property and settlement of estates. Here are some guiding steps on what you should and shouldn't do to ensure the form is filled out correctly.

What You Should Do:

- Verify all information: Ensure that all the details you provide, especially the deceased's personal information and death-related specifics, are accurate and match official documents.

- Consult with relevant parties: If needed, speak with family members, executors, or attorneys to confirm that the details you're including are correct and that you're using the most current form.

- Keep it legible: Fill out the form in clear, readable handwriting if completing it by hand, or use a typewriter or computer to fill it out digitally, ensuring that all entries are easy to read.

- Review before submitting: Go over the completed form thoroughly to check for any errors or omissions. It may also be helpful to have another person review the document for any mistakes you might have missed.

What You Shouldn't Do:

- Leave sections incomplete: Avoid leaving any required fields empty. If a section does not apply, write "N/A" (not applicable) instead of leaving it blank.

- Guess on specifics: Do not make assumptions about any information. If you're unsure about certain details, it's better to verify them first rather than guessing or leaving them incorrect.

- Use unofficial forms: Make certain that the form you're using is the one officially recognized by Texas state. Using outdated or unofficial documents could invalidate your affidavit.

- Sign without a notary: Remember, your signature must be notarized for the Affidavit of Death to be legally binding. Do not sign the document until you are in the presence of a notary public.

By paying close attention to these dos and don'ts, you can accurately complete the Texas Affidavit of Death form. This will aid in streamlining the legal processes that require this document, thus making things a bit easier during often challenging times.

Misconceptions

When dealing with the aftermath of a loved one's passing in Texas, the Affidavit of Death form is often mentioned. However, there are several misconceptions about this document that need clarification.

It serves as a will: Some believe that this document can serve as a will or substitute for one, but that is not its purpose. The Affidavit of Death is used to officially record someone's death and is not a tool for distributing the deceased's assets.

It's required for all estates: Not every estate in Texas requires the filing of an Affidavit of Death. Its necessity often depends on the specific circumstances surrounding the estate and the types of assets involved.

It transfers property automatically: The notion that filling out and submitting this form will automatically transfer property to heirs is incorrect. While it is used to facilitate the transfer of property, other legal processes and documents are typically necessary.

Only family members can file it: While family members often file the Affidavit of Death, in Texas, anyone who has a vested interest in the deceased's estate can file the form.

The process is complicated: The process of completing and filing an Affidavit of Death is relatively straightforward. However, it's important to ensure that all information provided is accurate and that the form is filed in the appropriate place.

No legal assistance is needed: While it's possible to complete and file an Affidavit of Death without legal assistance, consulting with a professional can help navigate any complexities related to the deceased's estate and ensure that the process is handled correctly.

It eliminates the need for probate: This is a common misconception. An Affidavit of Death by itself does not eliminate the need for probate. Probate might still be necessary depending on the estate's size and what it comprises.

There's a universal form for all states: Each state has its own version of the Affididavit of Death form and requirements for filing it. The Texas form is specific to Texas and may not satisfy the legal requirements of other states.

Understanding these misconceptions can help individuals navigate the legal steps after a loved one's death more effectively. While the process might seem daunting, correct information and, where necessary, the assistance of a legal professional can make it manageable.

Key takeaways

When managing the aftermath of a loved one’s passing, handling their assets can be a significant concern. The Texas Affidavit of Death form serves as an official declaration, providing necessary information to transfer or release assets. Here are four key takeaways regarding filling out and using this form:

- The form requires detailed information about the deceased, including full name, date of death, and details about the property or asset. This precision ensures the correct handling of the deceased’s estate.

- It is essential to have the affidavit notarized. This process involves signing the document in front of a notary public, affirming the truth of the information. Notarization adds a layer of legal validity, which is crucial for the document’s acceptance by financial institutions and government agencies.

- The Texas Affidavit of Death must be filed with the appropriate county recorder’s office. Filing with the county where the property is located is necessary for real estate matters, ensuring a correct public record of property ownership transitions.

- Understanding the limitations of the affidavit is vital. This document is primarily used for non-probate transfers or to clarify records; it does not replace a will or serve as a tool for distributing the estate among heirs. A clear comprehension of its purpose will guide individuals in its application.

Using the Texas Affidavit of Death form with these considerations in mind will facilitate a smoother transition during a challenging time. By adhering to these key takeaways, individuals can ensure the proper and lawful management of their loved one’s assets.

Fill out Popular Affidavit of Death Forms for Different States

Affidavit of Death Form Pdf - It is typically signed by a witness who can affirm the death of the individual, often a close relative.

Petition for Possession Louisiana - Provides a legally recognized document to support funeral arrangements and the final dispositions of remains.

Death Certificate Affidavit - It aids in the process of claiming survivor benefits, such as social security or veterans' benefits, by providing necessary documentation of death.