Printable Affidavit of Gift Form for Texas

In the state of Texas, the transition of property or vehicles between two parties without the exchange of money often necessitates the completion of a specific document known as the Texas Affidavit of Gift form. This vital legal instrument serves to officially record the act of gifting, ensuring that the transfer adheres to state laws and taxation regulations. The form plays a crucial role in the avoidance of any misunderstandings or legal complications that may arise from the transfer of ownership. It details the information of both the giver and the recipient, alongside the description of the gift, thereby providing a clear and undisputable record of the transaction. It is particularly important in cases where vehicles are concerned, as it helps in the seamless transfer of titles without the usual financial documentation required in traditional sales. Moreover, it stands as a testament to the fact that the gift is made willingly and without coercion, preserving the integrity of the transfer while also potentially exempting the recipient from certain taxes that would otherwise be applicable in a sale. Understanding and correctly filling out this form not only ensures compliance with state laws but also protects all parties involved in the gifting process.

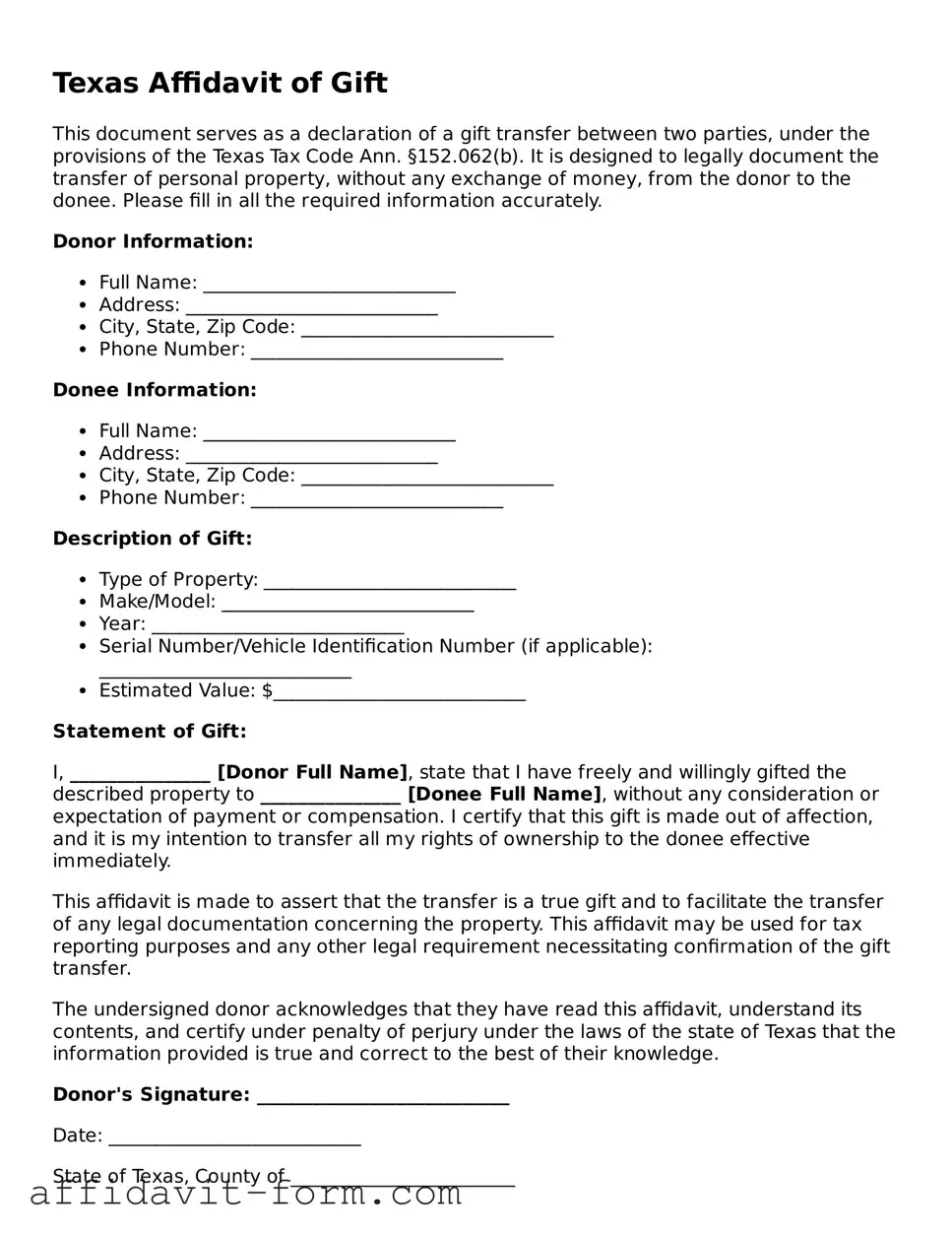

Form Example

Texas Affidavit of Gift

This document serves as a declaration of a gift transfer between two parties, under the provisions of the Texas Tax Code Ann. §152.062(b). It is designed to legally document the transfer of personal property, without any exchange of money, from the donor to the donee. Please fill in all the required information accurately.

Donor Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

- Phone Number: ___________________________

Donee Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

- Phone Number: ___________________________

Description of Gift:

- Type of Property: ___________________________

- Make/Model: ___________________________

- Year: ___________________________

- Serial Number/Vehicle Identification Number (if applicable): ___________________________

- Estimated Value: $___________________________

Statement of Gift:

I, _______________ [Donor Full Name], state that I have freely and willingly gifted the described property to _______________ [Donee Full Name], without any consideration or expectation of payment or compensation. I certify that this gift is made out of affection, and it is my intention to transfer all my rights of ownership to the donee effective immediately.

This affidavit is made to assert that the transfer is a true gift and to facilitate the transfer of any legal documentation concerning the property. This affidavit may be used for tax reporting purposes and any other legal requirement necessitating confirmation of the gift transfer.

The undersigned donor acknowledges that they have read this affidavit, understand its contents, and certify under penalty of perjury under the laws of the state of Texas that the information provided is true and correct to the best of their knowledge.

Donor's Signature: ___________________________

Date: ___________________________

State of Texas, County of ________________________

Subscribed and sworn to (or affirmed) before me on ________ (date) by _________________________ (name of donor), proving to me through government-issued photo identification to be the person whose name is subscribed on this affidavit.

Notary Public's or Authorized Official's Signature: ___________________________

Print Name: ___________________________

My commission expires: _________________________

Document Details

| Fact | Detail |

|---|---|

| Definition | An Affidavit of Gift is a document used in Texas to legally document the gift of a vehicle from one person to another without any payment or consideration in return. |

| Purpose | The form is primarily used to exempt the recipient (giftee) from paying sales tax on the gifted vehicle. |

| Governing Law | This process is governed by the Texas Department of Motor Vehicles (TxDMV) under the Vehicle Title & Registration services. |

| Requirements | Both the donor (giver) and the recipient must fill out and sign the form, and often notarization is required to verify the authenticity of the affidavit. |

| Limitations | The form cannot be used for commercial transactions and is intended solely for transactions where no payment is exchanged between the parties. |

How to Use Texas Affidavit of Gift

When transferring ownership of a vehicle or other property in Texas as a gift, the Affidavit of Gift form is a crucial document. It certifies that the item was given without any expectation of payment or compensation. Filling out this form correctly is vital to ensure the smooth transition of property ownership. Follow these steps carefully to complete the Affidavit of Gift form accurately.

- Start by entering the date of the gift transfer at the top of the form. Make sure the date is entered in the month/day/year format.

- In the section labeled "Donor Information," fill in your full legal name, address, and contact details as the giver of the gift.

- Under "Recipient Information," write the full legal name, address, and contact details of the person receiving the gift.

- Describe the gifted item in the section marked "Description of Gift." If it's a vehicle, include the make, model, year, Vehicle Identification Number (VIN), and any other relevant details.

- Check the appropriate box to indicate your relationship to the recipient. There are often tax implications based on the relationship between the donor and the recipient, so choose the correct option.

- Read the oath section carefully. Both the giver and the recipient must understand that providing false information on this document is a punishable offense.

- Both the donor and the recipient must sign the form in the presence of a notary public. The form typically requires notarization to be considered legally binding.

- Hand the completed and notarized Affidavit of Gift form to the recipient. They will need it for the next steps in officially transferring the ownership and removing or updating the title.

Completing the Affidavit of Gift form is only the beginning of the gift transfer process. The recipient may need to take additional steps, such as submitting the completed affidavit to the Texas Department of Motor Vehicles (DMV) or similar agency, paying a nominal transfer fee, and possibly fulfilling other state-specific requirements. Timely and accurate completion of the Affidavit of Gift ensures that the property transfer proceeds without legal hitches, ultimately saving time, money, and potential frustration for both parties involved.

Listed Questions and Answers

What is an Affidavit of Gift form in Texas?

An Affidavit of Gift form in Texas is a legal document used when one person (the donor) decides to give a vehicle, property, or other significant gifts to another person (the recipient) without expecting payment in return. This form is necessary for officially recording the transfer of the gift and is especially important for motor vehicle transactions. It serves to notify the Texas Department of Motor Vehicles (DMV) that the gift has been made, allowing for the update of ownership records.

When do I need to use an Affidavit of Gift form?

You need to use the Affidavit of Gift form:

- When you are gifting a vehicle to a family member, friend, or any other individual.

- If you are transferring ownership of property without a sale involved and want to make it an official record.

- To ensure the gift is documented properly for tax purposes.

What information is required on the Affididavit of Gift form?

To fill out the Affidavit of Gift form properly, you'll need to provide several pieces of information, including:

- The donor's full name, address, and contact details.

- The recipient's full name, address, and contact information.

- Details about the gifted item (e.g., vehicle make, model, year, and VIN for vehicles).

- The relationship between the donor and the recipient.

- Any conditions related to the gift, if applicable.

Are there any tax implications for using an Affidavit of Gift form?

Yes, there can be tax implications for both the donor and the recipient when using an Affidavit of Gift form. For the donor, if the value of the gift exceeds the annual or lifetime gift tax exclusion amount, there may be a requirement to file a gift tax return. However, most gifts fall under the exclusion limits. For the recipient, there is usually no immediate tax implication, but the value of the gift may affect the cost basis of the item if they decide to sell it in the future. It's always recommended to consult with a tax professional to understand the specific implications for your situation.

Where can I find an Affidavit of Gift form for Texas?

The Texas Affidavit of Gift form can be obtained from several sources, including:

- The Texas Department of Motor Vehicles (DMV) office.

- Online through the official Texas DMV website.

- Legal forms websites that offer state-specific documents.

Common mistakes

-

Not providing complete information on the recipient. It is an essential part of the form to give full details about the recipient, such as their full legal name, address, and relationship to the donor. Skipping or partially filling out this section can lead to the rejection of the affidavit.

-

Failing to clearly state the relationship between the donor and the recipient. The form requires a declaration of the relationship to establish eligibility for a tax exemption. Mistakes or unclear descriptions in this area can result in unnecessary tax assessments.

-

Omitting the details of the gifted property. Specific information about the gifted property, especially if it is a vehicle, such as make, model, vehicle identification number (VIN), and license plate number, should be clearly detailed. Failure to accurately describe the gift may cause complications in the property’s transfer and registration.

-

Not having the affidavit notarized. A critical step in validating the affidavit is the notarization process. When this document is not signed in front of a notary public or if the notary section is incomplete, the entire affidavit may be deemed invalid, and the gift transfer could be delayed or nullified.

Documents used along the form

When a gift, especially a vehicle or significant property, is given in Texas, an Affidavit of Gift form is a vital document. But it's important to remember that this affidavit often doesn't stand alone. Several other documents are commonly used alongside it to ensure the entire process is smooth and legally sound. Whether for the giver, the receiver, or the legal entities involved, having the complete dossier simplifies the transfer and diminishes potential complications.

- Title Certificate: This proves ownership of the property or vehicle being gifted. It must be transferred to the recipient's name by completing the relevant section on the certificate itself.

- Billof Sale: Even though no money is exchanged in a gift, a Bill of Sale can act as extra documentation that the item was transferred willingly from one party to another.

- VIN Inspection Report: If the gift is a vehicle, a VIN (Vehicle Identification Number) inspection report is often required, to verify the vehicle’s identity and condition.

- Odometer Disclosure Statement: This document is necessary for the gifting of a vehicle, confirming the mileage on the vehicle at the time of the gift. It helps in maintaining a transparent history of the vehicle.

- Proof of Insurance: The recipient may need to provide proof of insurance, especially for a vehicle, to complete the transfer and comply with state requirements.

- Release of Lien: If there was a previous loan on the item being gifted, a Release of Lien shows that the loan has been fully paid and the property can be legally transferred.

- Application for Texas Title and/or Registration: For vehicles, this form is essential for registering the vehicle in the recipient’s name after the gift transfer.

- Death Certificate and/or Will: In instances where the gift is part of an inheritance, a death certificate and possibly a copy of the will may be necessary to prove the recipient's right to the gift.

- Gift Tax Returns: While Texas does not have a state gift tax, for federal tax purposes, if the value of the gift exceeds a certain amount, the giver may be required to file a gift tax return with the IRS.

Completing the transfer of a gift involves more than simply handing over an item. It's about ensuring all legal aspects are addressed, which often necessitates a variety of forms and documents. This thorough approach not only protects both parties but also adheres to state and federal requirements. While the process may seem overwhelming, gathering and completing these documents is crucial for a smooth and unquestionable transfer of ownership.

Similar forms

The Texas Affidavit of Gift form is similar to other legal documents that facilitate the transfer of ownership without monetary exchange. These documents share common features, like stating the giver and recipient's details, and specifying the item or property being transferred. They play vital roles in legal and tax considerations, ensuring that gifts are recognized officially and accordingly.

The Texas Affidavit of Gift form is akin to the Gift Letter for Mortgage. Both documents are used to prove that an item of significant value, often cash used for home down payments, has been given as a gift without the expectation of repayment. They must include the donor and recipient's full names, their relationship, and a clear statement that no repayment is implied or required. The main difference resides in their use; while the Affidavit of Gift is used generally for the transfer of personal property, the Gift Letter is specifically tailored for financial transactions involved in property purchases.

It also resembles the Bill of Sale. A Bill of Sale is used during the sale of an item where money is exchanged between the buyer and seller. Similar to the Texas Affidavit of Gift, it includes detailed information about both parties and the item being transferred but it also outlines the amount paid for the item. While the Affidavit of Gift is used for gifting purposes, confirming no payment was made for the transfer, the Bill of Sale is a receipt for a transaction that involves a purchase price.

Similarly, the Transfer on Death Deed (TODD) shares aspects with the Texas Affidavit of Gift. TODD allows property owners to name a beneficiary who will inherit their property after their death, bypassing the need for the property to go through probate. Like the Affidavit of Gift, a TODD makes clear the intention to transfer ownership, but its effect is delayed until the death of the proprietor. Both require detailed information about the parties involved, but the TODD is specifically designed for real estate and becomes effective under different circumstances.

Dos and Don'ts

When completing the Texas Affidavit of Gift form, it's important to follow the right steps to ensure everything is done properly. These are some of the do's and don'ts that can guide you through the process:

- Do ensure all information provided is accurate and truthful. Incorrect information can lead to legal complications or the rejection of the affidavit.

- Do fill out the form legibly. If the form isn’t easily readable, it might delay or impede the process.

- Do verify the recipient's (donee's) full legal name and ensure it matches their identification documents exactly.

- Do check the vehicle identification number (VIN) on the affidavit matches the vehicle being gifted.

- Don't leave any required fields blank. Incomplete forms can result in processing delays or outright denial.

- Don't sign the affidavit without the donee present, unless it is explicitly allowed. Certain conditions may require both parties to be present during the signing.

- Don't forget to notarize the document if required. An affidavit without notarization, where necessary, is not legally binding.

- Don't hesitate to seek legal advice if there are any doubts or questions about the process. Professional guidance can help avoid mistakes.

Misconceptions

When dealing with the Texas Affidavit of Gift form, several misconceptions often arise that can complicate the process of transferring property. It's essential to clarify these misunderstandings to ensure a smooth and compliant transaction.

The form is only for vehicle transfers. While it's commonly used for transferring the ownership of vehicles without payment, the Texas Affidavit of Gift form can also be used for other types of personal property transfers within Texas.

Notarization is optional. Contrary to this belief, notarization is mandatory for the form to be considered valid and legally binding in Texas. The presence of a notary public is crucial to verify the identity of the parties involved in the transfer.

A lawyer must prepare the form. While legal advice can be beneficial, especially in complex situations, individuals are allowed to prepare and submit the form themselves. It is designed to be straightforward for non-professionals to use.

The form covers the transfer of money. The essence of the Affidavit of Gift is to document the transfer of property without any payment or consideration involved. It is not designed for transactions where money exchanges hands.

It serves as a replacement for a title transfer. This form is part of the title transfer process but does not replace it. The recipient must still complete additional steps with the Texas Department of Motor Vehicles (DMV) or appropriate state agency to finalize the transfer.

Any mistake on the form can be easily corrected after submission. Corrections after submission can be complex and may require submitting a new form or additional documentation. Accuracy is crucial when completing the form to avoid delays or issues.

The recipient is responsible for submitting the form. While the recipient can submit the form, the responsibility often lies with the donor, especially since the donor is the one declaring the gift. Both parties should ensure the form's accurate and timely submission.

All gifts are tax-exempt. While many gifts do not require the recipient to pay taxes, there are exceptions and limits under federal and Texas law. It's advisable to consult with a tax professional to understand any potential tax implications of the gift.

Understanding these misconceptions is vital for anyone involved in a property transfer in Texas to ensure compliance with state laws and regulations. It also helps in avoiding potential legal and financial complications arising from incorrect assumptions or misinformation.

Key takeaways

When you're dealing with transferring a vehicle as a gift in Texas, the Texas Affidavit of Gift form plays a critical role. Understanding how to properly fill out and use this form ensures a smooth transition without unexpected complications. Here are some key takeaways to guide you through this process:

- Correct Form: Ensure you're using the latest version of the Texas Affidavit of Gift form to avoid any processing delays or rejections due to outdated information.

- Completeness: Fill out all required sections. Incomplete forms can lead to unnecessary delays. Double-check for any missed fields before submission.

- Personal Information: Accurately provide personal information for both the donor (the person giving the gift) and the recipient (the person receiving the gift). Errors here can cause confusion and delays.

- Vehicle Identification: Include all relevant vehicle information, such as the make, model, vehicle identification number (VIN), and year. This information must be exact to ensure the vehicle is correctly identified in official records.

- No Cash or Consideration: Understand that a gift is a transfer of ownership where no money or consideration is exchanged. If any money changes hands, it might not qualify as a gift, and different rules and taxes might apply.

- Liability Release: Filing the affidavit may help release the donor from future liability related to the vehicle. Once the form is processed, the donor is typically no longer responsible for what happens with the vehicle.

- Notarization: The form requires notarization. Both parties should be present with valid identification at the time of notarization to confirm their signatures.

- Tax Implications: Understand the tax implications of gifting a vehicle. In Texas, the recipient of the gift may still be responsible for certain taxes even though they did not purchase the vehicle.

- Submission: Know where to submit the completed form. The form should be filed with your local county tax assessor-collector’s office.

- Record Keeping: Make copies of the notarized form for both the donor and the recipient’s records. This is important for future reference, should any questions arise about the vehicle’s ownership or gift status.

By closely following these guidelines and ensuring every step of the process is correctly completed, the transfer of a vehicle as a gift can be a smooth and hassle-free experience for all parties involved.

Fill out Popular Affidavit of Gift Forms for Different States

Can You Gift a Car to a Non Family Member in Washington State - In cases of transferring vehicle ownership, the Affidavit of Gift helps the new owner register the vehicle without complications associated with purchasing.

Affidavit for Gifting a Car Florida - The form acts as a protective measure against future claims by third parties who might contest the legitimacy of the gift transfer.