Printable Small Estate Affidavit Form for Texas

When the unfortunate event of a loved one's passing occurs, managing their estate can become a pressing concern for the surviving family members. In the state of Texas, a practical mechanism exists for the expedited distribution of a deceased person's assets when those assets fall beneath a certain value threshold. This mechanism is embodied in the Texas Small Estate Affidavit form, a document designed to simplify the probate process for eligible estates, thereby reducing the financial and emotional burden on the bereaved. By allowing for the direct transfer of property to heirs without the need for a protracted court proceeding, this form serves as a valuable tool for families seeking a straightforward solution in a time of grief. Central to this process is the requirement that the total value of the estate, excluding homestead property and exempt items, does not exceed a specified limit. Additionally, the affidavit must be filled out with meticulous attention to detail, including a comprehensive list of the estate's assets, debts, and the rightful heirs according to Texas law. It is imperative that those considering this route consult with legal counsel or thoroughly research the stipulations laid out by Texas statutes to ensure compliance and to understand fully the rights and responsibilities conferred upon them by the completion and submission of this form.

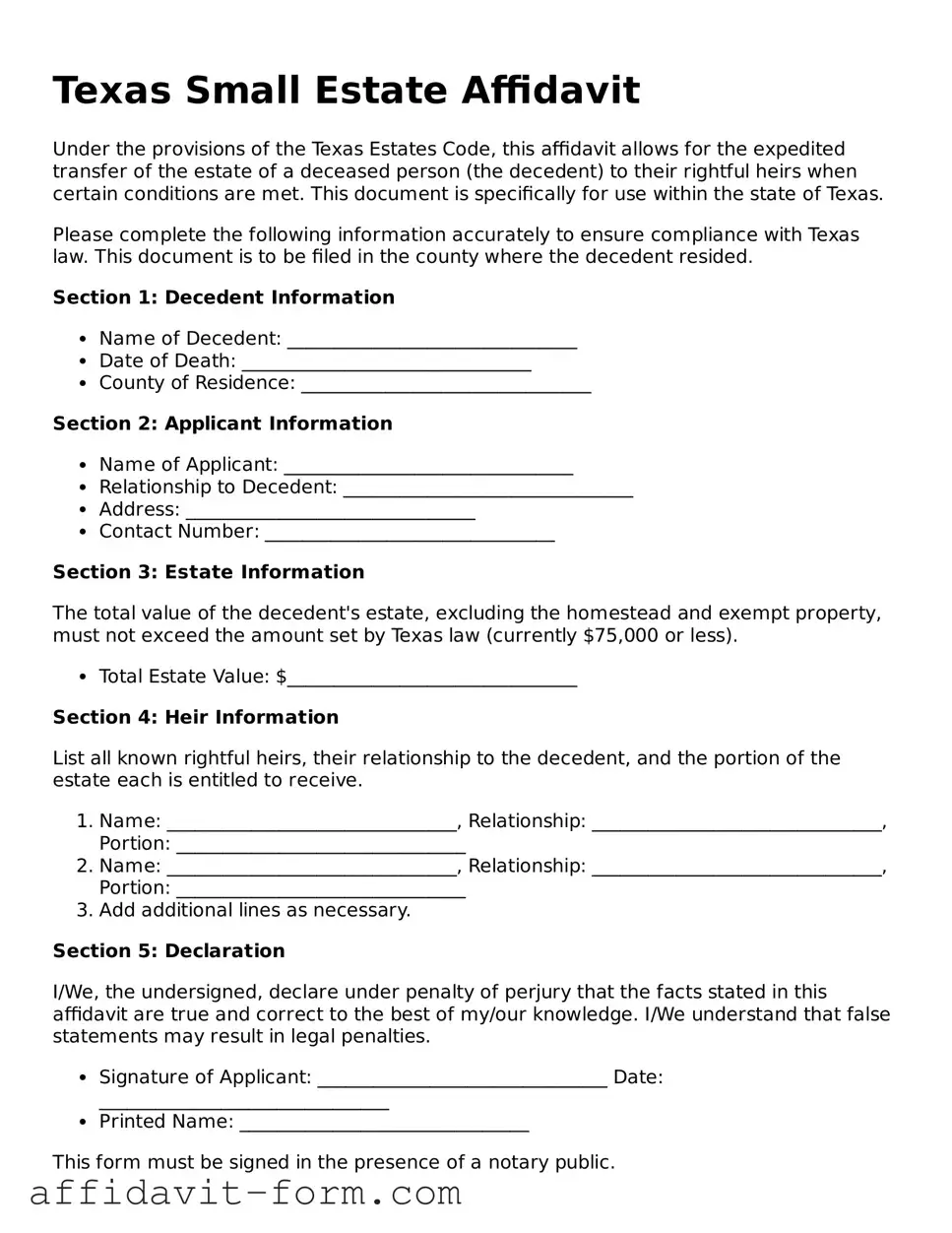

Form Example

Texas Small Estate Affidavit

Under the provisions of the Texas Estates Code, this affidavit allows for the expedited transfer of the estate of a deceased person (the decedent) to their rightful heirs when certain conditions are met. This document is specifically for use within the state of Texas.

Please complete the following information accurately to ensure compliance with Texas law. This document is to be filed in the county where the decedent resided.

Section 1: Decedent Information

- Name of Decedent: _______________________________

- Date of Death: _______________________________

- County of Residence: _______________________________

Section 2: Applicant Information

- Name of Applicant: _______________________________

- Relationship to Decedent: _______________________________

- Address: _______________________________

- Contact Number: _______________________________

Section 3: Estate Information

The total value of the decedent's estate, excluding the homestead and exempt property, must not exceed the amount set by Texas law (currently $75,000 or less).

- Total Estate Value: $_______________________________

Section 4: Heir Information

List all known rightful heirs, their relationship to the decedent, and the portion of the estate each is entitled to receive.

- Name: _______________________________, Relationship: _______________________________, Portion: _______________________________

- Name: _______________________________, Relationship: _______________________________, Portion: _______________________________

- Add additional lines as necessary.

Section 5: Declaration

I/We, the undersigned, declare under penalty of perjury that the facts stated in this affidavit are true and correct to the best of my/our knowledge. I/We understand that false statements may result in legal penalties.

- Signature of Applicant: _______________________________ Date: _______________________________

- Printed Name: _______________________________

This form must be signed in the presence of a notary public.

Document Details

| Fact | Description |

|---|---|

| 1. Purpose | The Texas Small Estate Affidavit is utilized to manage and distribute a deceased person's estate without formal probate proceedings when the estate's total value, excluding homestead and exempt property, does not exceed $75,000. |

| 2. Governing Law | This form is governed by Section 205 of the Texas Estates Code, which outlines the conditions under which the affidavit can be used and the process for its approval by a probate court. |

| 3. Eligibility Criteria | An estate qualifies for the Small Estate Affidavit process if the deceased did not leave a will, the assets (excluding homestead and exempt property) are worth $75,000 or less, and the assets exceed the debts of the estate. |

| 4. Required Signatures | The affidavit must be signed by two disinterested witnesses and all heirs, followed by notarization to be considered valid. |

| 5. Court Approval | After submission, the affidavit requires approval from a probate court. The court will review the affidavit to determine if it meets all legal requirements and, if so, will issue an order allowing for the distribution of the estate. |

| 6. Filing Location | The affidavit should be filed with the probate court in the county where the deceased person lived at the time of their death. |

| 7. Time Frame for Filing | There is no specific timeline mentioned in the Texas Estates Code for filing the affidavit, but generally, it is recommended to file within 30 days following the 30-day waiting period after the decedent's death, though it may be submitted later as practical necessities dictate. |

How to Use Texas Small Estate Affidavit

When someone passes away with a small estate in Texas, their heirs may be able to use the Small Estate Affidavit (SEA) process for a simpler transfer of assets. This approach is designed for estates that qualify under Texas law, allowing for a more streamlined handling of the deceased's assets. Filling out the Small Estate Affidate correctly is crucial for this process to proceed smoothly. Below are the step-by-step instructions to ensure accurate completion of the form.

- Gather all necessary documents: Before filling out the form, collect the deceased's death certificate, any existing will, and an inventory of assets and debts.

- Identify the heirs: List all legal heirs and their relationships to the deceased. Make sure to include full legal names and contact information.

- Calculate the estate value: Determine the total value of the estate’s assets and also list any known debts. The estate’s value must qualify under the Texas Small Estate threshold.

- Complete the affidavit form: Fill in the deceased person's full name, date of death, and declare that the estate qualifies for SEA processing according to Texas law.

- Describe the assets: Detail all assets within the estate, including bank accounts, real estate, and personal property. Provide account numbers and descriptions as required.

- List the debts: Include a comprehensive list of the deceased’s debts, such as mortgages, loans, and credit card bills.

- Sign and notarize the affidavit: All heirs must sign the affidavit in the presence of a notary public. It's crucial for avoiding any legal issues.

- File the affidavit with the court: Submit the completed affidavit along with any required fees to the appropriate county clerk’s office in Texas where the deceased resided.

- Await approval: The court will review the affidavit and, if everything is in order, distribute the assets according to the affidavit’s statements.

After submitting the affidavit, the court’s approval process may vary in length, typically depending on the county and its current caseload. Patience is often required. Once approved, assets can be legally transferred to the heirs as outlined in the affidavit, simplifying the process of settling a small estate in Texas.

Listed Questions and Answers

What is a Texas Small Estate Affidavit?

A Texas Small Estate Affidavit is a legal document used in Texas to settle smaller estates. It allows the estate of someone who has passed away to be distributed without a formal probate procedure, as long as the total value of the estate being transferred through the affidavit does not exceed certain limits. This process is generally faster and less costly than traditional probate proceedings.

Who can use a Texas Small Estate Affidavit?

To use a Texas Small Estate Affidavit, the following conditions must typically be met:

- The person who has passed away must have died without a will, or if they had a will, it does not need to be probated for certain reasons.

- The total value of the estate, excluding homestead property and exempt personal property, must not exceed a specific amount defined by Texas law.

- At least 30 days have passed since the death.

- All debts and taxes of the estate have been paid or properly accounted for.

What is the maximum value for an estate to qualify for a Texas Small Estate Affidavit?

The maximum value that qualifies an estate for a Small Estate Affidavit in Texas is subject to change but is typically set by state law. As of the latest information, the estate's total value cannot exceed $75,000. This amount does not include exempt property such as the homestead and certain personal property.

What steps are involved in filing a Texas Small Estate Affidate?

Filing a Texas Small Estate Affidavit involves several steps:

- Gather important documents of the deceased, including proof of death.

- Ensure the estate meets all criteria for using a Small Estate Affidavit, such as value and debt clearance.

- Complete the Small Estate Affidavit form, making sure to list all assets and liabilities accurately.

- Have all heirs sign the affidavit in the presence of a notary public.

- File the affidavit with the probate court in the county where the deceased lived.

How long does it take for a Texas Small Estate Affidavit to be approved?

The approval time for a Texas Small Estate Affidavit can vary depending on several factors including the county's caseload and the specifics of the estate. Generally, it may take anywhere from a few weeks to a couple of months for the affidavit to be processed and approved by the court.

Are there any costs associated with filing a Texas Small Estate Affidavit?

Yes, there are costs associated with filing a Texas Small Estate Affidavit. These costs can include filing fees, which vary by county, and possibly attorney fees if you choose to seek legal assistance. Some counties also charge fees for certified copies of the affidavit, which may be required by financial institutions or others when transferring assets.

Can real estate be transferred with a Texas Small Estate Affidavit?

Yes, real estate can be transferred using a Texas Small Estate Affidait, but with some restrictions. The deceased's homestead, which is the primary residence, can be transferred to the heirs under the affidavit process. However, any other real estate the deceased owned cannot be transferred through a Small Estate Affidavit and may require a different legal process.

Common mistakes

Filling out a Texas Small Estate Affidavit form can be a straightforward process, but some common mistakes can lead to delays or complications. Here are six of the most frequent errors people make:

-

Not meeting eligibility requirements: Before starting, people often overlook whether the estate actually qualifies under Texas law. The total assets, excluding homestead property and exempt items, must not exceed a certain value.

-

Incorrect or incomplete list of assets: One common mistake is not properly listing all the assets of the estate. It’s crucial to include everything the deceased owned, such as bank accounts, vehicles, and real property, with accurate descriptions.

-

Omitting debts and liabilities: Failing to list all debts and liabilities of the estate can cause problems. Everything from credit card debts to utility bills needs to be acknowledged.

-

Signature issues: All heirs must sign the affidavit in the presence of a notary public. Sometimes, individuals submit the form with missing signatures, which invalidates the document.

-

Not obtaining a death certificate: A certified copy of the death certificate needs to be attached to the affidavit. This step is often overlooked or forgotten, leading to an incomplete application.

-

Incorrectly identifying heirs: Accurately identifying and listing all legal heirs is essential. Mistakes or omissions in this section can significantly delay the process.

To avoid these errors, take the time to carefully review the requirements and ensure all information provided is complete and accurate. Ensuring all heirs are in agreement and understand the process can also streamline the completion of the Texas Small Estate Affiffidavit.

Documents used along the form

When dealing with the aftermath of a loved one's passing in Texas, the handling of their estate can be both emotionally and legally challenging. The Texas Small Estate Affidavit form is a tool designed to simplify the process for estates that fall below a certain value threshold. However, this form often requires the support of additional documents to accurately and completely manage the deceased's estate. Below are four common types of documents that are frequently used alongside the Texas Small Estate Affidavit form to ensure the process is executed smoothly and in compliance with state laws.

- Death Certificate: A certified copy of the death certificate is foundational. It serves as the official document to prove the death of the individual. Institutions and courts often require this document to process any claims or to transfer assets as dictated by the Small Estate Affidavit.

- Copy of the Will (if applicable): If the decedent left behind a will, a copy of this document is crucial. It outlines the deceased's wishes regarding the distribution of their assets. Even though the Texas Small Estate Affidavit is typically used when there is no will, presenting a will can clarify the decedent's intentions and help resolve any potential disputes among heirs or beneficiaries.

- Property List: A detailed list of the decedent’s property is essential. This document should outline all tangible and intangible assets owned by the deceased at the time of their death, which fall under the small estate's value limit. Including bank accounts, real estate, vehicles, and personal belongings, this comprehensive list ensures that all assets are accounted for and distributed according to the affidavit.

- Heirship Affidavit: In cases where verifying the heirs of the estate becomes complex, an Heirship Affidavit may be necessary. This document, completed by a disinterested third party, attests to the familial relationships and rights of heirs to the estate. It is particularly useful when no will exists or when the will is contested or unclear, providing a clear lineage and claim to the estate’s assets.

The process of settling an estate, even one considered small, involves navigating through various legal requirements and paperwork. Each document plays a crucial role in ensuring that the deceased's estate is managed and distributed fairly and according to the laws of Texas. By understanding and preparing these documents in conjunction with the Texas Small Estate Affidavit, individuals can make the process more manageable and ensure that the final wishes of their loved ones are honored accurately and respectfully.

Similar forms

The Texas Small Estate Affidavit form is similar to several other documents used in probate and estate planning processes. These documents include the Transfer on Death Deed, Last Will and Testament, and the Durable Power of Attorney. Each serves unique purposes but shares commonalities in handling a person's assets and intentions after they pass away.

Transfer on Death Deed (TODD): Like the Texas Small Estate Affidavit, the Transfer on Death Deed allows for the transfer of property to a beneficiary upon the death of the property owner without the need for a complex probate process. Both forms help in simplifying the transfer of assets, but the TODD is specifically focused on real estate. It must be completed and recorded before the owner's death to be effective, similar to how the Small Estate Affidavit requires specific criteria to be met to distribute the decedent’s assets.

Last Will and Testament: This document is also akin to the Texas Small Estate Affidavit in that it specifies the distribution of a person's assets after death. However, the Last Will and Testament is prepared in anticipation of death, detailing how assets should be distributed among heirs and any other final wishes. While the Small Estate Affidavit is utilized after death and without a will, or with a will not mandating formal probate, it similarly ensures assets are transferred to rightful heirs or beneficiaries.

Durable Power of Attorney: Although differing in primary function, the Durable Power of Attorney shares a likeness with the Small Estate Affidavit in managing assets. The Durable Power of Attorney allows an individual to appoint someone to manage their financial affairs if they become incapacitated. Unlike the Small Estate Affidatum, which is used after death, this document is operative during the life of the person making it. Both forms facilitate the handling of assets, ensuring they are managed according to the individual’s wishes either in incapacity or after death.

Dos and Don'ts

Filing out the Texas Small Estate Affidavit form is a critical step in managing the estate of a loved one who has passed away. This document allows for the transfer of a decedent's estate when it meets specific criteria, usually affecting estates of smaller value. It's crucial to approach this process with care and precision to ensure a smooth legal procedure. Here are 10 guidelines—five dos and five don'ts—to help navigate the completion of this form successfully.

Do:Make sure the estate qualifies under Texas law, meaning the total value of the estate, excluding homestead and exempt property, is $75,000 or less.

Gather all necessary information before filling out the form, including a detailed list of the estate's assets, debts, and heirs.

Accurately list all known assets and their values at the time of the decedent's death in the affidavit, ensuring everything is accounted for.

Ensure all heirs sign the affidavit in front of a notary public, as Texas law requires all signatures to be notarized.

Check and double-check the affidavit for accuracy and completeness before submitting it to the proper Texas court, usually in the county where the decedent resided.

Attempt to use the small estate affidavit if the estate's value exceeds the $75,000 limit or if the estate's complexity requires formal probate.

Omit any known debts or try to hide assets from the affidavit, as this can lead to legal complications and potential penalties.

Fill out the form without consulting all involved heirs, as each has a legal right to input and agreement on how the estate is distributed.

Forget to attach a certified copy of the death certificate to the affidavit, as it's a required document for processing.

Submit the form without carefully reviewing it for errors or missing information, as even small mistakes can result in delays or rejection of the affidavit.

By adhering to these guidelines, individuals can navigate the process of utilizing a Texas Small Estate Affidavit more effectively, ensuring a smoother transition of estate assets to rightful heirs.

Misconceptions

When dealing with the aftermath of a loved one’s passing, understanding the correct procedures for handling their estate is crucial. In Texas, a Small Estate Affidavit is often mentioned as a simplified process for estate distribution. However, there are several misconceptions about its use, requirements, and benefits. It’s important to clarify these misunderstandings to ensure individuals are well-informed when considering this option.

- A Small Estate Affidavit can be used for any size estate. This statement is incorrect. In Texas, a Small Estate Affidavit can only be used if the total estate assets, excluding homestead property and exempt property, do not exceed $75,000. This limitation is designed to facilitate the distribution of smaller estates.

- Real estate cannot be transferred using a Small Estate Affid/+affidavit. This is a common misconception. In fact, a Small Estate Affidavit can be used to transfer real estate to the decedent’s heirs, provided the estate meets specific criteria set by Texas law, including the total value of the estate and the classification of the property.

- All heirs must agree to use a Small Estate Affidavit. Understanding the agreement of heirs is crucial. While it is true that the heirs must work together to file the affidavit, it is not merely a matter of agreement. Each heir must sign the affidavit, asserting their rights to the decedent’s property according to Texas law, and the court must then approve the affidavit.

- The process is immediate. Many people believe that the Small Estate Affidavit process is instant. However, this is not the case. After filing the affidavit with the necessary documents, there is a waiting period for the court to review and approve the document. This process can take several weeks, depending on the court’s workload and the affidavit's specifics.

- There is no need for a court hearing. While the Small Estate Affidavit process is designed to be less cumbersome than traditional probate, in some instances, a court hearing may be necessary. This can occur if there is a dispute among heirs or if the court needs clarification on any part of the affidavit. Therefore, it's important to prepare for the possibility of a hearing.

- A lawyer is not needed to file a Small Estate Affidavit. Though it is possible to file a Small Estate Affidavit without legal assistance, consulting with a lawyer is often beneficial. Legal advice can help navigate the complexities of estate law, ensure the correct completion of the affidavit, and address any potential issues that might arise during the process.

Clearing up these misconceptions helps ensure that individuals are better equipped to handle the estate of a loved one. It’s always advisable to seek professional guidance to navigate the legal aspects surrounding the death of a family member, especially in matters concerning the distribution of their assets.

Key takeaways

When it comes to settling the estate of a loved one who has passed away in Texas, understanding the Texas Small Estate Affidavit form is essential. This form serves as a simplified way to manage and distribute the estate of a person who died without a will, known as "intestate," under certain conditions. Here are the key takeaways to keep in mind:

- Eligibility Requirements: The total value of the estate must not exceed $75,000, excluding the value of the homestead and exempt property. This threshold is designed to streamline the process for smaller estates, making it quicker and less expensive than going through probate court.

- Exclusions: Real estate outside of the homestead and certain types of property may not qualify under the Small Estate Affidavit. It's important to understand what assets are considered part of the estate.

- Homestead Property: If the deceased owned a home that was their primary residence, it might be transferred to the heirs through the Small Estate Affidavit, subject to specific conditions.

- Proper Filing: The affidavit must be filed in the county court where the deceased person lived. Ensuring the form is filed correctly is crucial for the process to proceed smoothly.

- Required Documentation: Along with the affidavit, certain documents, including a certified copy of the death certificate, must be provided. These documents help establish the validity of the claim.

- Legal Descriptions: For property, especially real estate, a precise legal description must be included in the affidavit. This entails more than just an address and may require assistance from a legal professional or a title company.

- Heirs’ Agreement: All heirs must agree on how the estate will be divided and sign the affidavit. If there is any disagreement among the heirs, the small estate process may not be the appropriate path.

- Waiting Period: There is a waiting period after the death of the individual before the Small Estate Affidavit can be filed. This period allows creditors to come forward with any claims against the estate.

- Legal Guidance: While the Small Estate Affidavit process is designed to be simpler than traditional probate, consulting with a legal expert can help navigate any complexities and ensure all requirements are met

Handling someone's estate can be an overwhelming task, especially during a time of grief. Nevertheless, by following these guidelines and possibly seeking professional legal advice, individuals can manage their loved one's estate with clarity and peace of mind.

Fill out Popular Small Estate Affidavit Forms for Different States

Kansas Simplified Estates Act - Aiding in the distribution of the deceased’s property, the affidavit affirms the claimant’s right, making asset retrieval more efficient.

How to File Probate Without a Lawyer - It's an indispensable document for smaller estates, ensuring that assets are passed on without undue delay or excessive legal fees.