Printable Small Estate Affidavit Form for Utah

In Utah, navigating the aftermath of a loved one's death can bring not just emotional strain but also the complexity of legal procedures. Among these, the Utah Small Estate Affidavit form represents a light in a potentially dark tunnel for those who find the probate process daunting and financially burdensome. Designed for estates that fall beneath a certain value threshold, this document offers a simplified path for the transfer of assets to rightful heirs without the need for a lengthy and complicated probate court process. It serves as a legal instrument that verifies the claimant's right to collect the property of the deceased, conditioned upon the estate meeting specific criteria set forth by the state law. By understanding the eligibility requirements, how to properly complete the form, and the legal weight it carries, individuals can efficiently manage small estates, ensuring assets are distributed according to the decedent's wishes or the state’s succession laws, thereby reducing the administrative burden during a period of grieving.

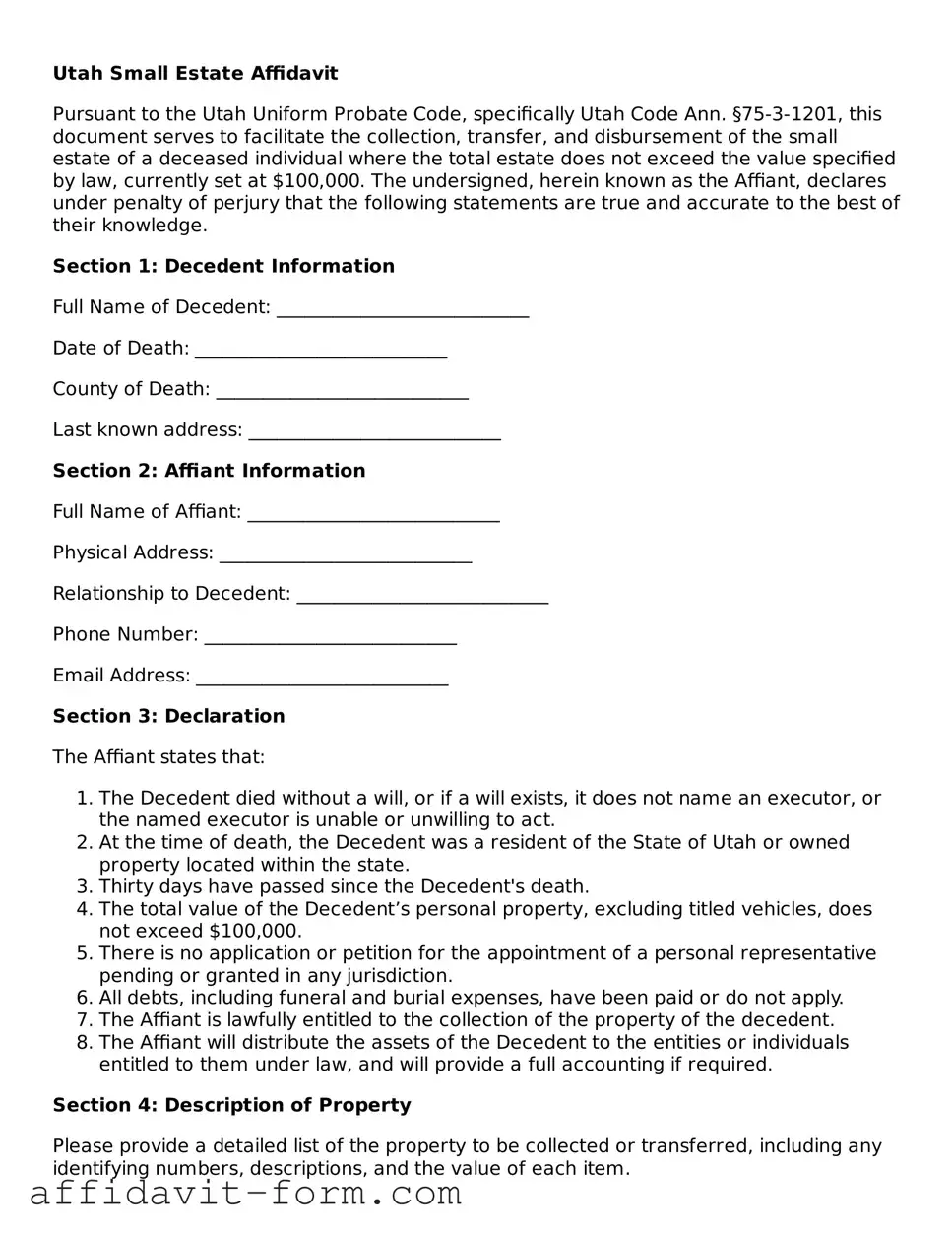

Form Example

Utah Small Estate Affidavit

Pursuant to the Utah Uniform Probate Code, specifically Utah Code Ann. §75-3-1201, this document serves to facilitate the collection, transfer, and disbursement of the small estate of a deceased individual where the total estate does not exceed the value specified by law, currently set at $100,000. The undersigned, herein known as the Affiant, declares under penalty of perjury that the following statements are true and accurate to the best of their knowledge.

Section 1: Decedent Information

Full Name of Decedent: ___________________________

Date of Death: ___________________________

County of Death: ___________________________

Last known address: ___________________________

Section 2: Affiant Information

Full Name of Affiant: ___________________________

Physical Address: ___________________________

Relationship to Decedent: ___________________________

Phone Number: ___________________________

Email Address: ___________________________

Section 3: Declaration

The Affiant states that:

- The Decedent died without a will, or if a will exists, it does not name an executor, or the named executor is unable or unwilling to act.

- At the time of death, the Decedent was a resident of the State of Utah or owned property located within the state.

- Thirty days have passed since the Decedent's death.

- The total value of the Decedent’s personal property, excluding titled vehicles, does not exceed $100,000.

- There is no application or petition for the appointment of a personal representative pending or granted in any jurisdiction.

- All debts, including funeral and burial expenses, have been paid or do not apply.

- The Affiant is lawfully entitled to the collection of the property of the decedent.

- The Affiant will distribute the assets of the Decedent to the entities or individuals entitled to them under law, and will provide a full accounting if required.

Section 4: Description of Property

Please provide a detailed list of the property to be collected or transferred, including any identifying numbers, descriptions, and the value of each item.

_______________________________________________________

_______________________________________________________

_______________________________________________________

_______________________________________________________

Section 5: Signatures

This affidavit is executed under the penalties of perjury. The undersigned Affiant swears that the information provided herein is accurate and complete to the best of their knowledge, and that this affidavit is made to collect the property of the Decedent as entitled by the laws of the State of Utah.

Signature of Affiant: ___________________________ Date: ____________

Printed Name: ___________________________

State of Utah )

County of ____________ ) ss.

Subscribed and sworn to before me on this ____ day of ____________, 20__.

__________________________________

Notary Public

My commission expires: ______________

Document Details

| Fact | Detail |

|---|---|

| 1. Purpose | Used to collect a deceased person's assets without a formal probate proceeding. |

| 2. Eligibility | Applies when the value of the estate does not exceed $100,000. |

| 3. Waiting Period | A 30-day waiting period is required after the death before the affidavit can be used. |

| 4. Required Documentation | A death certificate must accompany the affidavit. |

| 5. Real Property | Cannot be used to transfer real property, such as houses or land. |

| 6. Asset Types | Applicable for bank accounts, vehicles, and other personal property. |

| 7. Governing Law | Governed by Section 75-3-1201 of the Utah Code. |

| 8. Signature Requirement | The affidavit must be signed by the claimant in the presence of a notary public. |

| 9. Filing Location | Presented to the entity holding the decedent's assets, not filed with the court. |

How to Use Utah Small Estate Affidavit

In Utah, navigating through the process of settling a small estate without a formal probate can be simpler with the usage of a Small Estate Affidavit. This document allows for a more straightforward transfer of property to heirs without the need for a prolonged court process. It's vital, however, to ensure every detail is accurately filled out to prevent any delays or issues. Here's how to properly fill out the Utah Small Estate Affidavit form, broken down into a clear, step-by-step guide.

- Begin by identifying the deceased person (referred to as the decedent). Include their full legal name, date of death, and the county in which they were domiciled at the time of their passing.

- Next, detail your personal information as the affidavit. This includes your full name, address, and your relationship to the decedent. It's crucial to establish your legal right to act in this capacity.

- Enumerate all known assets of the decedent within Utah. This includes, but is not limited to, bank accounts, vehicles, and real property. For each asset, you should provide a description and estimated value.

- Outline all debts and liabilities of the decedent, including funeral expenses, outstanding loans, or consumer debts. This information is necessary to understand the estate's net value.

- Include information regarding the decedent’s surviving spouse, children, or other heirs. For each, provide their names, addresses, and their relationship to the decedent. This information ensures that property is distributed according to Utah law.

- Attach a copy of the death certificate to the affidavit. This official document is required to prove the decedent’s passing.

- Review the affidavit to ensure all provided information is accurate and truthful. Making a false statement can lead to legal consequences.

- Sign the affidavit in front of a notary public. The notary must witness your signature and provide their seal, affirming the document's authenticity.

After completing these steps, the affidavit is ready to be presented to entities holding the decedent's assets, such as banks or the DMV. By following this process, heirs can expedite the transfer of assets, avoiding the complexities and costs associated with formal probate proceedings.

Listed Questions and Answers

What is a Utah Small Estate Affidavit?

A Utah Small Estate Affidavit is a legal document used by heirs to claim assets from a deceased person’s estate without going through formal probate proceedings. This process is available in Utah if the total value of the estate, after subtracting any liens and encumbrances, does not exceed the state’s specified threshold. It simplifies the transfer of assets to rightful heirs.

Who can file a Utah Small Estate Affidavit?

To file a Utah Small Estate Affidavit, an individual must be a legally recognized heir or designated beneficiary of the deceased person. Typically, this includes:

- Spouses

- Children

- Parents

- Legally appointed guardians

- Any other persons nominated under a valid will, if applicable

What is the value limit for a Utah Small Estate?

The current value limit for a small estate in Utah is subject to change, but it is determined by subtracting any debts, liens, and encumbrances from the total assets of the estate. If the remaining value falls under the set threshold, the estate qualifies as "small" according to state law. To find the most current limit, it is advisable to consult the latest Utah statutes or seek legal advice.

What documents are needed to file a Small Estate Affidavit in Utah?

To file a Small Estate Affidavit in Utah, several documents may be required, including but not limited to:

- A certified copy of the death certificate

- The completed Small Estate Affidavit form

- Proof of the filer's relationship to the deceased

- Documentation of the estate's assets

- Any outstanding debts and liens against the estate

How do I file a Utah Small Estate Affidavit?

Filing a Small Estate Affidavit in Utah involves completing the form with accurate and comprehensive information about the deceased, their assets, and the heirs. Once filled out:

- Ensure all required supporting documents are attached.

- Check the form for completeness and accuracy.

- Submit the form and documents to the appropriate local jurisdiction, typically where the deceased owned property or resided.

How long does it take to process a Utah Small Estate Affidavit?

The processing time for a Small Estate Affidavit in Utah can vary based on the specifics of the estate, the accuracy of the paperwork, and the workload of the local jurisdiction’s office. Typically, it might take several weeks to a few months. Engaging with legal assistance can sometimes help expedite this process by ensuring that the application is complete and accurately reflects the estate's situation.

Common mistakes

Filling out the Utah Small Estate Affidavit form can seem straightforward, but it's not uncommon for mistakes to occur. These errors can delay the process of settling an estate, leading to unnecessary complications. It's crucial to approach this task with care and attention to detail. Here are four common mistakes people often make when completing the Utah Small Estate Affidavit form:

-

Not verifying the total value of the estate. The law in Utah allows the use of a small estate affidavit only if the estate's total value falls below a certain threshold. It's essential to accurately calculate the value of all assets to ensure they meet the state's criteria. Failing to do so can result in rejection of the affidavit.

-

Skipping important details about the assets. Every asset included in the estate needs to be listed with complete and accurate information. This includes detailed descriptions and, where applicable, serial numbers or account numbers. Generic or incomplete descriptions can lead to questions or delays.

-

Omitting required legal documents. The affidavit process often requires attaching legal documents, such as the death certificate of the deceased and proof of relation to the deceased. Not including these essential documents can result in the affidavit being seen as incomplete.

-

Improper witness or notarization process. Utah law specifies that the affidavit must be signed in the presence of a notary public. Additionally, the signatory may need witnesses depending on the circumstances. Ignoring these requirements can render the affidavit invalid.

Avoiding these common mistakes can help ensure the process moves forward smoothly. When in doubt, seeking advice from a legal professional knowledgeable about Utah's small estate process can provide clarity and guidance. It's always better to proceed with caution and thoroughness when dealing with legal documents.

Documents used along the form

When managing the affairs of a loved one who has passed away, the Utah Small Estate Affidavit form is a highly useful document for simplifying the process of transferring assets. However, it's often not the only document required to fully administer an estate, no matter the size. Several other forms and documents frequently accompany the Small Estate Affidmodation, each serving its unique purpose in the probate or estate administration process.

- Death Certificate: This is an official certificate issued by the government upon a person's death. It is essential for legal and financial processes following a death, including the execution of the Small Estate Affidavit form, as it officially records the person's date, location, and cause of death.

- Last Will and Testament: This document outlines the deceased's wishes regarding how their assets should be distributed and who will manage the estate until its final distribution. If the deceased had a will, it could dictate the necessity and use of a Small Estate Affidavit.

- Letters of Administration: Should there be no will, or if the will does not name an executor, the court may issue Letters of Administration. This document appoints an administrator to handle the estate, giving them the authority needed to collect and distribute the deceased's assets.

- Notice to Creditors: This document officially informs creditors of the death, allowing them to make claims against the estate for any debts owed. While the Small Estate Affidavit process might simplify asset distribution, it's crucial to address outstanding debts as part of the estate's closure.

- Inventory and Appraisement Form: This form lists all the assets within the estate, often required even when using a Small Estate Affidavit. It helps identify the estate's value and ensures that all assets are accounted for during the process.

Understanding these documents and their roles can significantly smooth the process of estate administration, particularly when utilizing a Utah Small Estate Affidavit. Each document complements the Small Estate Affidavit, aiding in a more comprehensive approach to managing the deceased's affairs. This integrated approach ensures that all legal, financial, and administrative aspects of the estate are handled efficiently and according to the law.

Similar forms

The Utah Small Estate Affidavit form is similar to other legal documents used to manage and settle estates with minor distinctions based on jurisdictional nuances and the specific circumstances surrounding an estate. Although devoid of the content of the Small Estate Affidavit form file, an understanding of the general purpose and commonalities with other legal instruments can still be offered. These documents ease the process of estate resolution by providing a legal pathway that circumvents the often lengthy and complex probate process for qualified estates.

Affidavit for the Collection of Personal Property of the Decedent is one document that shares a fundamental purpose with the Utah Small Estate Affidavit form. Similar to the Small Estate Affidavit, this document allows for the collection and distribution of a deceased person's personal property without the need for a formal probate proceeding. It is utilized when the total assets of the deceased do not exceed a certain value, a threshold that varies from one jurisdiction to another. Both forms require the affiant to attest to key details about the deceased, the estate, and the claimant's right to the assets, simplifying the transfer of property.

Transfer on Death Deed (TODD) bears similarity to the Utah Small Estate Affidavit in its function of enabling property transfers upon the death of the owner, but it differs in its execution and applicability. A Transfer on Death Deed is a proactive document that an individual completes during their lifetime, designating a beneficiary to receive a piece of real property upon their death, bypassing probate. While the TODD is prepared ahead of time and specifically concerns real property, the Small Estate Affidavit is utilized after death and can apply to various asset types, offering a post-mortem solution for relatively small estates.

Joint Tenancy with Right of Survivorship Agreement shares a similarity with the Small Estate Affidavit in that it provides a mechanism to avoid the probate process for certain assets. In a Joint Tenancy with Right of Survivorship, two or more people hold property in a manner that upon the death of one tenant, the property automatically transfers to the surviving tenant(s) without the need for probate. Although different in their approach—since joint tenancy is a form of property ownership and the Small Estate Affidavit is a legal document for estate settlement—both serve to expedite the transfer of assets upon death, sidestepping the probate court.

Dos and Don'ts

When dealing with the Utah Small Estate Affidavit form, certain practices should be followed to ensure that the process is completed correctly and efficiently. The measures you take can protect the assets of the estate and simplify the legal process for all individuals involved. Here’s a comprehensive guideline:

- Do ensure that the total value of the estate meets the criteria for a small estate in Utah. This is a crucial step before you proceed with the affidavit to avoid unnecessary legal complications.

- Don’t rush through the paperwork. Carefully review each section of the affidavit to provide accurate and complete information. Errors or omissions can delay the process.

- Do consult with a legal professional if you have doubts or questions. Although the form is designed to be straightforward, legal advice can clarify any uncertainties and provide peace of mind.

- Don’t distribute assets before the affidavit is completed and approved. It’s important to follow legal procedures to avoid personal liability.

- Do verify the deceased’s debts are paid or accounted for before distributing assets. Overlooking debts can lead to legal consequences for the person completing the affidavit.

- Don’t neglect to obtain consent from other heirs. If the state law requires it, or if it could prevent disputes later on, make sure all heirs are in agreement with the distribution of assets as outlined in the affidavit.

- Do keep accurate records of all transactions and communications related to the estate. This documentation can be critical if questions or disputes arise later.

- Don’t use the affidavit for real estate transactions without cross-checking state laws. In some cases, additional steps or different forms may be necessary to transfer real estate.

- Do file the affidavit in the appropriate local court, if required. Filing the affidavit in the wrong jurisdiction can invalidate the process.

Handling a small estate requires attention to detail and an understanding of the legal framework. By following these dos and don'ts, you can manage the estate more effectively and with greater confidence in the accuracy and legality of the process.

Misconceptions

When dealing with the administration of estates in Utah, the Small Estate Affidavit process is often misunderstood. Below are common misconceptions that need clarification to help navigate this procedure more effectively.

- Anyone can file a Small Estate Affidavit. - In reality, only successors entitled to the property, such as lawful heirs or those designated in a will, can file this affidavit.

- It allows immediate access to all assets. - While it simplifies the process, some assets might still require additional documentation or steps before they can be distributed.

- There's no value limit for using the affidavit. - Utah law specifies that the total value of the estate must not exceed a certain amount, which is periodically adjusted for inflation.

- The form guarantees transfer of real estate. - The Small Estate Affidavit is mainly designed for personal property. Transferring real estate often requires a more complex legal process.

- It eliminates the need for a will. - While it can be used for estates where a will is not present, having a will can still guide the distribution of assets and designate beneficiaries.

- It absolves the estate from debts. - The affidavit does not relieve the estate from its responsibility to pay outstanding debts; creditors still have a claim to the estate's assets.

- It can be filed immediately after death. - There is usually a mandatory waiting period after the decedent’s death before the affidavit can be filed, allowing time for all aspects of the estate to be accounted for.

- Filing the affidavit is costly. - Compared to the traditional probate process, using a Small Estate Affidavit is a more cost-effective approach, although there may still be minimal filing fees.

- Legal assistance is not necessary. - While it is designed to be a simpler process, consulting with a legal professional can ensure that all legal requirements are met and help avoid potential issues.

Understanding these misconceptions is crucial for those navigating the process of managing a small estate in Utah. Proper knowledge can lead to a smoother, more efficient handling of a loved one's affairs.

Key takeaways

When dealing with the affairs of someone who has passed away in Utah, a Small Estate Affidavit can simplify the process significantly. This document allows for the transfer of the deceased's assets to their heirs without the need for a lengthy probate process. Here are some key takeaways about filling out and using the Utah Small Estate Affidavit form:

- Eligibility criteria must be met before using the Small Estate Affidavit. In Utah, this generally means the total value of the estate must fall below a certain threshold, which is subject to change. It's important for individuals to verify the current limit to determine eligibility.

- Accurate and complete information is essential when filling out the form. This includes the full legal names of the deceased and the heirs, a thorough inventory of the estate's assets, and the value of each asset. Incorrect information can lead to delays or legal complications.

- Notarization of the affidavit is usually required to authenticate the document. Once filled out, the form must be signed in front of a notary public. This step is critical for the affidavit to be recognized by financial institutions and others who will be releasing assets.

- Legal advice may be beneficial, especially in situations where the estate's affairs are complex or the eligibility of the estate for a Small Estate Affidavit is uncertain. Consulting with a legal professional can help heirs navigate any potential obstacles more effectively.

Understanding these key aspects of the Utah Small Estate Affidiffavit form can make the process of settling an estate much smoother and more straightforward. It's a helpful tool for heirs to access their inheritance without the need for a more formal probate proceeding.

Fill out Popular Small Estate Affidavit Forms for Different States

New Jersey Small Estate Affidavit - An affidavit that helps in the direct transfer of property like bank accounts and securities to heirs.

Wisconsin Small Estate Affidavit Form Pr-1831 - This document is a critical resource for efficiently managing the assets of a deceased person’s estate under a specific financial threshold.

How to File Probate Without a Lawyer - By bypassing probate, the Small Estate Affidavit accelerates the closure process of an estate, allowing families to move forward more quickly after a loss.

How Long Does Probate Take Indiana - It's a legal form that asserts the value of the deceased’s estate falls under a certain threshold, as defined by state law.