Printable Small Estate Affidavit Form for Vermont

When a loved one passes away in Vermont, handling their estate can feel overwhelming amidst the grief of loss. However, for smaller estates, the process may be simplified thanks to the Vermont Small Estate Affididavit form. This tool is designed to streamline the legal steps necessary to distribute the deceased's assets to the rightful heirs without the need for a complicated and often lengthy probate process. It's particularly relevant for estates that fall below a certain value threshold, thus making it an efficient route for many Vermonters. The form itself requires detailed information about the deceased, their assets, and the potential heirs, ensuring that the process is carried out with transparency and fairness. By navigating through this process with the Vermont Small Estate Affidavit form, individuals can find a path to closure and resolution during a challenging time, affording them more space to honor the memory of their loved one while dealing practically with their estate.

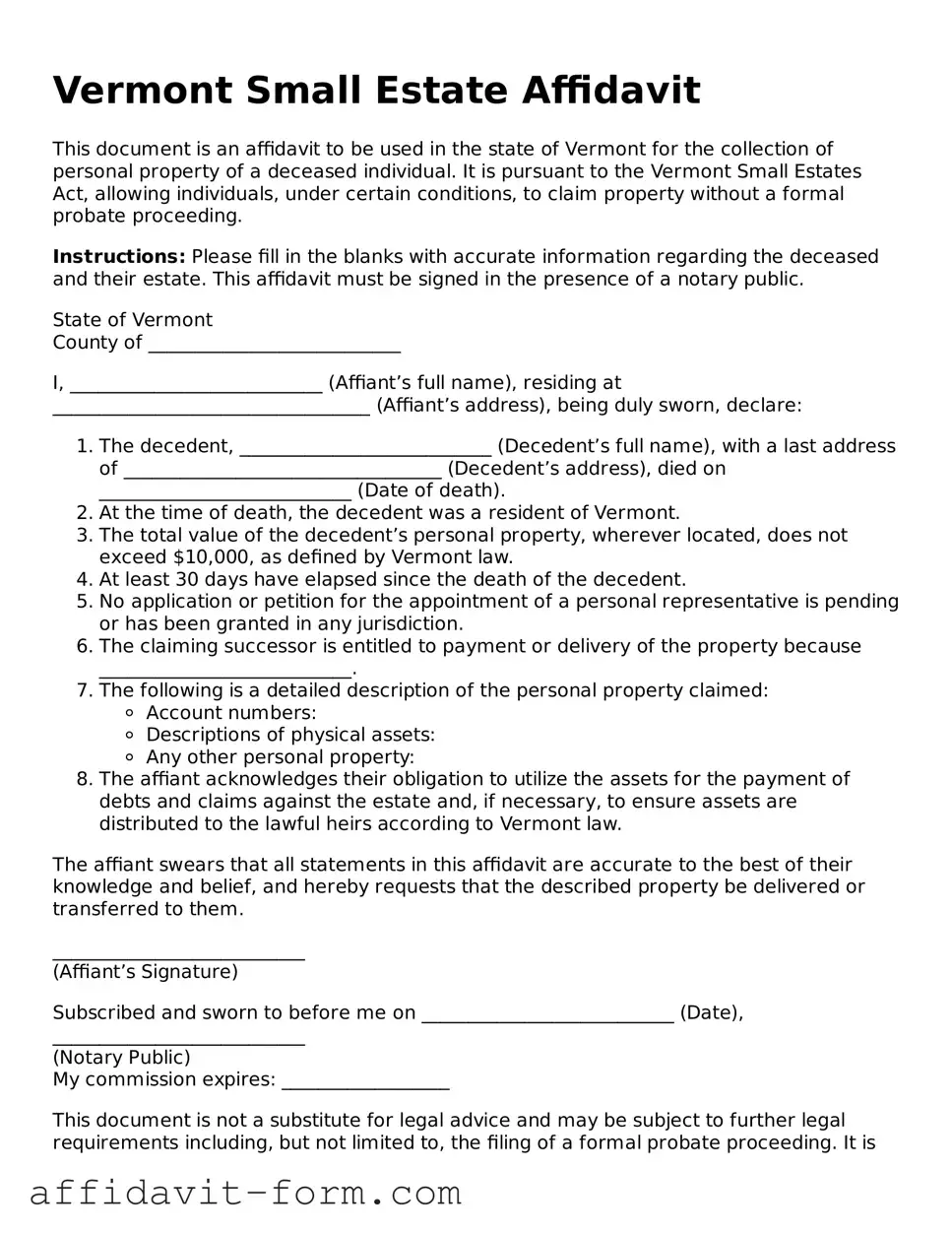

Form Example

Vermont Small Estate Affidavit

This document is an affidavit to be used in the state of Vermont for the collection of personal property of a deceased individual. It is pursuant to the Vermont Small Estates Act, allowing individuals, under certain conditions, to claim property without a formal probate proceeding.

Instructions: Please fill in the blanks with accurate information regarding the deceased and their estate. This affidavit must be signed in the presence of a notary public.

This document is not a substitute for legal advice and may be subject to further legal requirements including, but not limited to, the filing of a formal probate proceeding. It is recommended that individuals consult with a legal professional to ensure compliance with all applicable laws and regulations.

Document Details

| Fact Name | Description |

|---|---|

| Eligibility | Estates with personal property valued at $10,000 or less may use the form. |

| Governing Law | Vermont Statutes Title 14, Section 1902 governs the use of the Small Estate Affidavit. |

| Real Estate Inclusion | The form does not apply to real estate; it is intended for personal property only. |

| Waiting Period | A 30-day waiting period after the decedent's death is required before the form can be filed. |

| Claimants | Legally recognized successors or claimants can file the form to claim the estate. |

| Required Documentation | Affidavit must be accompanied by a death certificate and a detailed list of the property. |

| Filing Location | The form is filed with the probate court in the county where the decedent lived or owned property. |

How to Use Vermont Small Estate Affidavit

Completing a Vermont Small Estate Affidavit is a procedure tailored for instances where a deceased person's estate is valued below a certain threshold, thereby simplifying the usually longer and more complex process of probate. This affidavit allows the transfer of the deceased's assets to their rightful heirs without the need for extensive court involvement. The form requires attention to detail and accuracy to ensure all information is correctly reported and complies with Vermont laws. By following the outlined steps below, individuals can navigate this process more swiftly, guaranteeing a smoother transition during what is often a difficult time.

- Begin by gathering all necessary documents related to the deceased's estate, including a death certificate, an inventory of assets, and any existing will.

- Read through the entire Vermont Small Estate Affidavit form to familiarize yourself with the information required and the declarations you will be making.

- Fill in the full name and the date of death of the deceased in the designated areas at the top of the form.

- Provide your name and address, stating your relationship to the deceased, and affirm your legal right to act on behalf of the estate.

- List all known assets of the deceased within Vermont, including but not limited to bank accounts, vehicles, and real estate, along with their estimated value at the time of death.

- If applicable, identify any debts owed by the deceased, including funeral expenses, taxes, and other outstanding liabilities.

- Detail the names and addresses of all beneficiaries entitled to receive assets from the estate, specifying the relationship of each beneficiary to the deceased.

- Review the affidavit statement carefully, which often includes legal affirmations regarding the truthfulness of the information provided and compliance with Vermont estate laws.

- Sign the affidavit in the presence of a notary public, ensuring that the document is notarized to verify its authenticity.

- Attach any required supplementary documents, such as the death certificate and list of assets, to the affidavit before submission.

- Submit the completed and notarized Vermont Small Estate Affidavit form to the appropriate local entity, which may be a bank holding the deceased's accounts, the Bureau of Motor Vehicles for vehicle titles, or a court office if required.

Once submitted, the affidavit will undergo review by the entity to which it was presented. If approved, it will facilitate the transfer of the deceased's assets to the indicated beneficiaries. It's important to keep copies of all documents submitted for your records and to follow up as necessary to ensure all assets are properly transferred. The efficiency of this process can significantly ease the burden on grieving families by simplifying the legal transfer of assets during a period of loss.

Listed Questions and Answers

What is a Vermont Small Estate Affidiff Process?

In Vermont, the small estate affidavit process is a simplified court procedure available for the estates of deceased persons that meet certain criteria. It allows the assets of the estate to be distributed without a full probate process, making it faster and less expensive for the beneficiaries.

Who is eligible to use the Vermont Small Estate Affidavit?

Eligibility for using a small estate affidavit in Vermont is generally determined by the total value of the estate’s assets. If the estate's total value, minus liens and encumbrances, does not exceed a specific threshold set by Vermont law, it may qualify as a small estate. Additionally, certain types of beneficiaries, such as surviving spouses or other close relatives, may have the right to use this affidavit under specific circumstances.

What assets can be transferred using a Small Estate Affidavit in Vermont?

The types of assets that can be transferred through a Vermont Small Estate Affidavit include personal property such as bank accounts, vehicles, and other tangible property that belonged to the deceased. Real estate cannot typically be transferred using this affidavit unless specific conditions are met, depending on Vermont’s current laws.

What is the value limit for a Small Estate Affidavit in Vermont?

The value limit for an estate to be considered small and thus eligible for the affidavit process in Vermont is subject to change. As of the most recent update, estates valued at $10,000 or less may qualify. It is important to consult the current Vermont statutes or a legal professional to confirm the most up-to-date threshold.

How does one file a Vermont Small Estate Affidavit?

To file a Small Estate Affidavit in Vermont, the following steps should be taken:

- Confirm that the estate meets the criteria for a small estate in terms of total value and type of assets.

- Obtain the Small Estate Affidavit form from the Vermont Probate Court or website.

- Fill out the form accurately, including all required information about the deceased's assets.

- Sign the affidavit in front of a notary public.

- Submit the completed and notarized affidavit to the appropriate Vermont Probate Court, along with any required fees.

Are there any fees associated with filing a Small Estate Affidavit in Vermont?

Yes, there are filing fees associated with submitting a Small Estate Affidiff in Vermont. The amount of these fees can vary, so it's important to check with the local Probate Court for the most current fee schedule. In some cases, waivers or reductions may be available for individuals who cannot afford these fees.

How long does the Small Estate Affiavify process take in Vermont?

The timeframe for completing the small estate affidavit process in Vermont can vary depending on several factors, including the court's caseload and whether all paperwork is properly completed and filed. Generally, the process can be completed within a few weeks, but it may take longer in some circumstances.

Can real estate be transferred using a Small Estate Affidavit in Vermont?

Typically, real estate cannot be directly transferred using a Small Estate Affidavit in Vermont. However, exceptions may apply under certain conditions. For real estate and other more complex estate matters, consulting with a legal professional who is knowledgeable about Vermont estate law is strongly recommended.

Common mistakes

-

Failing to confirm eligibility: Before proceeding, one must ensure the estate qualifies under Vermont’s specific criteria for a "small estate". The threshold involves the total value of the estate not exceeding a statutory limit.

-

Incorrect asset valuation: Assets must be accurately valued at the date of the decedent's death. Overvaluing or undervaluing assets can lead to significant complications, including tax issues or disputes among beneficiaries.

-

Omitting assets or debts: A comprehensive list of all assets and debts is critical. Leaving out any information can result in an incomplete or inaccurate affidavit, possibly leading to legal challenges.

-

Not identifying all heirs and beneficiaries correctly: Each heir and beneficiary must be accurately identified. Errors in this area can result in benefits being distributed to the wrong individuals or legal contests.

-

Misunderstanding the role of the affiant: The person completing the affidavit must understand their legal obligations and responsibilities. This role often involves managing the assets according to the law and distributing them to the rightful beneficiaries.

-

Inadequate documentation: When submitting the affidavit, supporting documentation such as death certificates, asset valuations, and proof of entitlement may be required. Lack of adequate documentation can cause delays or rejection.

-

Improper use of the form for certain assets: Not all assets can be transferred using a Small Estate Affidavit. For instance, real property often requires a different process. Understanding which assets are eligible is essential.

-

Failing to follow state-specific amendments: Vermont law may have unique requirements or updates to the Small Estate Affidiffvidavit process. Ignoring these specifics can result in the affidavit being invalid.

-

Missing deadlines: Timeliness is crucial in legal processes. Submitting the affidavit beyond any deadlines can result in complications, potentially delaying the distribution of the estate.

Each of these mistakes can hinder the smooth processing of a small estate in Vermont. Attention to detail and an understanding of legal obligations are paramount in executing the Small Estate Affidavit accurately and efficiently.

Documents used along the form

When managing the estate of someone who has passed away in Vermont, the Small Estate Affidavit form is often the first step for those facing the challenge without a will. This document allows for the collection, distribution, and management of the deceased's assets without formal probate proceedings, simplifying the process significantly. However, to complete the estate management smoothly and ensure legal compliance, other documents are frequently required alongside the Small Estate Affidavit. Understanding these documents can provide clarity and ease the administrative burden during a challenging time.

- Death Certificate: This official document confirms the death of the individual. It is required to prove the decedent's passing to various institutions and agencies. The Death Certificate is often needed when filing the Small Estate Affidavit to establish the starting point for estate processing.

- Consent and Waiver Forms: These forms are used when all heirs agree on how the estate should be managed and distributed. They signify that the heirs are waiving their rights to a formal probate proceeding and are consenting to the distribution as outlined by the executor or administrator handling the estate.

- Inventory of Assets: An important companion to the Small Estate Affidavit, this document lists all the assets of the deceased, including bank accounts, securities, real estate, and personal property. It provides a clear overview of what the estate comprises and assists in the equitable distribution among heirs.

- Notice to Creditors: This announcement, when required, informs creditors of the decedent’s death and the ongoing small estate proceedings, giving them a chance to make claims against the estate. It’s crucial for settling debts and ensuring a clean transition of assets to the beneficiaries.

- Receipts and Disbursements Ledger: This is a record of all transactions made by the estate's administrator, including payments to creditors and distributions to heirs. It provides accountability and a clear financial history of the estate’s management through the settlement process.

Each of these documents plays a vital role in the comprehensive handling of a small estate in Vermont. They work together to streamline the process, ensuring that all legal, financial, and personal aspects of estate management are covered comprehensively. Navigating through these procedures can be a daunting task but understanding the purpose and importance of each document can make the process more approachable, allowing for a smoother transition during a period of loss.

Similar forms

The Vermont Small Estate Affidavit form is similar to other legal documents designed to expedite the probate process and facilitate the transfer of assets from a deceased person to their beneficiaries or heirs. This document shares commonalities with the Transfer on Death Deed (TODD) and the Payable on Death (POD) account designation in that all three allow for the bypassing of the traditional, often lengthy, probate process. Each of these documents serves as a tool to make the transfer of assets smoother and less bureaucratic, yet their applications and details vary significantly.

Transfer on Death Deed (TODD)

Like the Vermont Small Estate Affidavit, the Transfer on Death Deed (TODG) is a handy document for skipping the complex probate process. Specifically, TODD allows property owners to name beneficiaries who will inherit their real estate upon the owner's death, without the property having to go through probate. Here's how they are alike and differ:

- Both instruments avoid probate: The main similarity is their ability to bypass the lengthy and often costly probate process.

- Asset specificity: While the Small Estate Affidavit can apply to various assets, TODD is specifically for real estate properties.

- Flexibility until death: Both documents allow the current owner to maintain control over the property or assets and make any changes or revocations as long as they live.

Payable on Death (POD) Account Designation

Similarly, the Payable on Death (POD) account designation mirrors the Vermont Small Estate Affidait in its probate avoidance mechanism. By naming a beneficiary for bank accounts or other financial accounts, the POD designation simplifies the transfer of funds without getting the probate court involved. Here's a comparison:

- Avoidance of probate: Just like the Vermont Small Estate Affidavit, a properly designated POD account bypasses probate, granting direct access to the named beneficiary.

- Scope of application: While the Small Estate Affidavit covers a range of personal assets, the POD designation is exclusively for financial accounts.

- Revocability: Owners retain the right to change or revoke the beneficiary designation at any time before death, a flexibility shared with the Small Estate Affiday.

Dos and Don'ts

When dealing with the Vermont Small Estate Affidavit form, which allows the transfer of a deceased person's property without a formal probate process if the estate meets certain criteria, there are specific steps you should follow and others you should avoid. Follow these guidelines to ensure the process is handled correctly:

Do's:

- Ensure Eligibility: Confirm that the total value of the estate falls under the threshold set by Vermont law, making it eligible for the Small Estate process.

- Gather Accurate Information: Collect all necessary information about the deceased's assets, debts, and heirs. Accurate information is crucial for filling out the form correctly.

- Sign in Front of a Notary: Vermont law requires that the Small Estate Affidavit form be signed in the presence of a Notary Public. This step is mandatory and ensures the document’s legality.

- File Promptly: Submit the completed form to the appropriate local court promptly. Timely filing is important to initiate the process and avoid potential delays.

Don'ts:

- Guess on Details: Do not fill in any part of the form with guesses or uncertain information. Every detail must be accurate and verifiable.

- Omit Relevant Information: Avoid leaving out any required information regarding the estate's assets, debts, or heirs, as this could lead to the affidavit being rejected.

- Attempt to Use for Ineligible Estates: Don't try to use the Small Estate Affidavit for an estate that exceeds the value limit set by Vermont law or does not meet other specific criteria.

- Forget to Notify Interested Parties: It's important to inform all interested parties, such as heirs and creditors, about the affidavit and the small estate process. Failure to do so could result in legal complications later on.

Misconceptions

When handling the affairs of a deceased person in Vermont, the Small Estate Affidavit is a useful tool designed to simplify the process. However, there are misconceptions surrounding its use that can lead to confusion. Below are five common misunderstandings about the Vermont Small Estate Affidavit form:

- Any estate qualifies regardless of its value. One common misconception is that the value of the estate doesn't matter when it comes to using a Small Estate Affidavit. In Vermont, only estates valued at $10,000 or less, which excludes real estate, qualify for this simplified process.

- It transfers real estate. Another misunderstanding is that this form can be used to transfer real estate. The Vermont Small Estate Affidavit is not designed for the transfer of real estate. Its use is limited to personal property, such as bank accounts, stocks, and other non-real property assets.

- It grants immediate access to assets. While the Small Estate Affidavit can streamline access to the deceased's assets, it doesn't provide immediate access. Creditors have a period during which they can make claims against the estate, and certain procedures must be followed before assets can be distributed.

- A lawyer is required to file it. Some may believe that hiring a lawyer is a requirement for filing a Small Estate Affidavit. While legal advice can be invaluable, especially in complex cases, Vermont does not mandate legal representation to file this affidavit. One can complete and file the necessary paperwork without an attorney.

- It overrides a will. This is a common misconception. The Small Estate Affidavit process does not override the decedent's will. If the deceased left a will, the assets must be distributed according to its terms, as long as they do not contradict the state's succession laws.

Clearing up these misunderstandings can help ensure that the Vermont Small Estate Affidavit form is used correctly and effectively, facilitating a smoother process for those dealing with a deceased loved one's estate.

Key takeaways

The Vermont Small Estate Affidavit form serves as a tool for efficiently managing the distribution of a deceased person’s estate in situations where the total value does not exceed a specific threshold. Here are ten key takeaways regarding filling out and using this document:

- The form is intended to be used for estates valued at $10,000 or less, streamlining the process by avoiding the standard probate procedure.

- Before filing, applicants must wait a mandatory period of 30 days following the death of the estate owner.

- Applicants must provide thorough documentation, including a certified copy of the death certificate and an itemized list of the estate’s assets.

- Only individuals who are legal heirs or have been named in the will of the deceased can file the Small Estate Affidavit in Vermont.

- Debts and taxes owed by the estate must be clearly outlined and are required to be paid from the estate’s assets before distribution.

- The affidavit must be signed in the presence of a Notary Public to ensure its validity and enforceability.

- Filing the form with the appropriate Vermont probate court is a critical step, and jurisdiction is typically determined based on the residence of the deceased.

- Financial institutions and other entities holding assets of the deceased may request a copy of the completed affidavit before releasing assets.

- Disputes among claimants or questions about the affidavit's validity might require legal advice or intervention by the court.

- Contacting the probate court clerk in the county where the affidavit is to be filed can provide additional guidance and clarify any filing fees or requirements.

Utilizing the Vermont Small Estate Affidavit can significantly simplify the process involved in settling small estates, but it's important that all steps are followed correctly to ensure the smooth transfer of assets.

Fill out Popular Small Estate Affidavit Forms for Different States

How Long Does Probate Take in Tennessee - A pivotal document for heirs to navigate the legal landscape of estate distribution with minimal judicial involvement.

Small Estate Affidavit Washington - Heirs or successors must swear to the truth of the information provided in the affidavit.

Small Estate Affidavit Montana - A Small Estate Affidavit form simplifies the process of estate distribution for estates below a certain value, avoiding lengthy probate proceedings.