Printable Small Estate Affidavit Form for Virginia

When loved ones pass away, the process of settling their estates can often seem daunting, especially during a time of grieving. Fortunately, for those handling smaller estates in Virginia, the Virginia Small Estate Affidariat form provides a simpler, more streamlined approach. This tool allows for the transfer of the deceased's assets without the need for a formal probate process, provided the total value of the estate falls under a certain threshold. Created with efficiency and ease in mind, this affidavit seeks to alleviate some of the burdens faced by surviving family members or legal representatives. It specifies who is entitled to claim the assets, what documentation is required, and the legal responsibilities of the person filing the form. By understanding the major aspects and proper use of the Virginia Small Estate Affidavit form, individuals can navigate through this challenging time a little more easily, ensuring that the estate is settled promptly and according to the law.

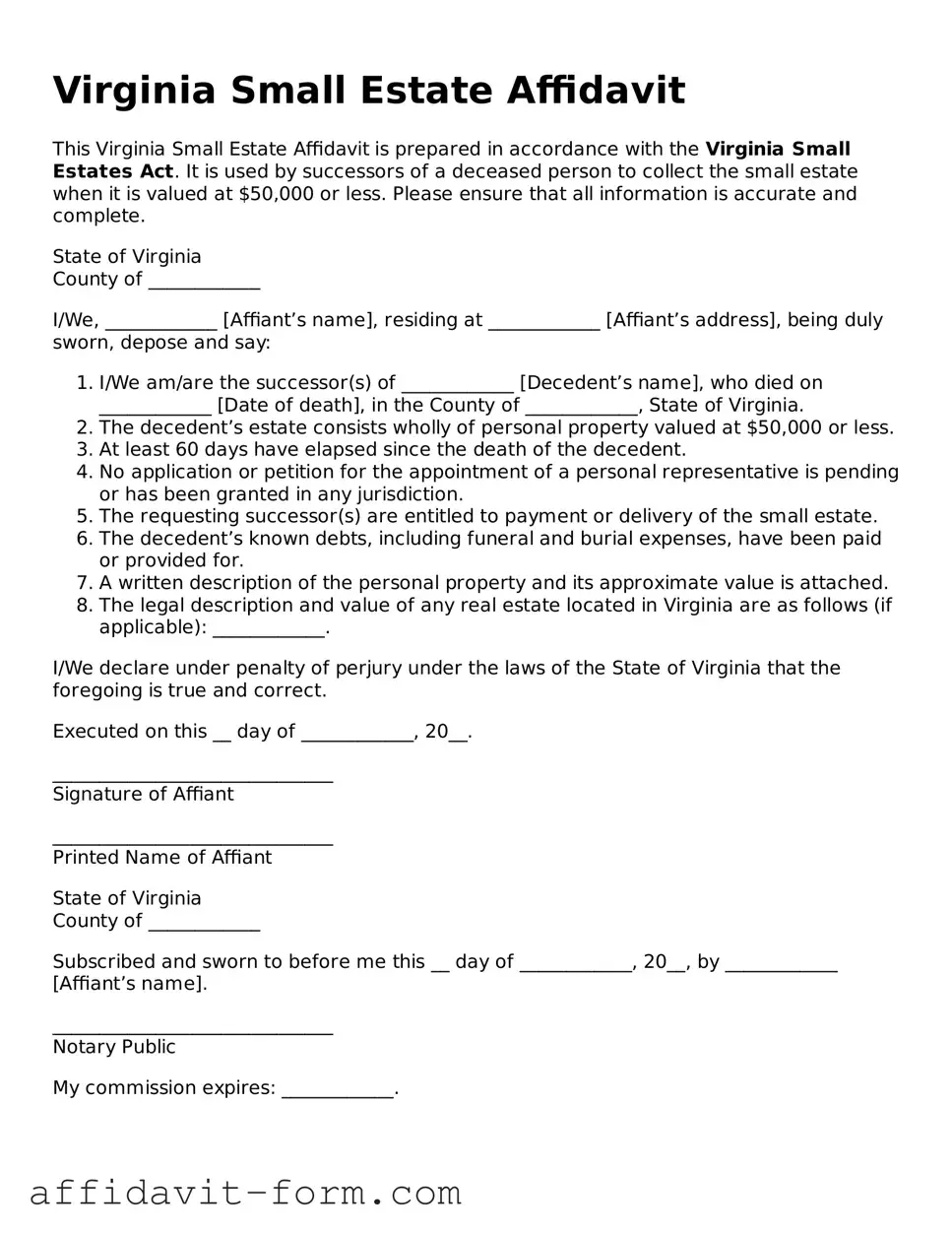

Form Example

Virginia Small Estate Affidavit

This Virginia Small Estate Affidavit is prepared in accordance with the Virginia Small Estates Act. It is used by successors of a deceased person to collect the small estate when it is valued at $50,000 or less. Please ensure that all information is accurate and complete.

State of Virginia

County of ____________

I/We, ____________ [Affiant’s name], residing at ____________ [Affiant’s address], being duly sworn, depose and say:

- I/We am/are the successor(s) of ____________ [Decedent’s name], who died on ____________ [Date of death], in the County of ____________, State of Virginia.

- The decedent’s estate consists wholly of personal property valued at $50,000 or less.

- At least 60 days have elapsed since the death of the decedent.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The requesting successor(s) are entitled to payment or delivery of the small estate.

- The decedent’s known debts, including funeral and burial expenses, have been paid or provided for.

- A written description of the personal property and its approximate value is attached.

- The legal description and value of any real estate located in Virginia are as follows (if applicable): ____________.

I/We declare under penalty of perjury under the laws of the State of Virginia that the foregoing is true and correct.

Executed on this __ day of ____________, 20__.

______________________________

Signature of Affiant

______________________________

Printed Name of Affiant

State of Virginia

County of ____________

Subscribed and sworn to before me this __ day of ____________, 20__, by ____________ [Affiant’s name].

______________________________

Notary Public

My commission expires: ____________.

Document Details

| Fact | Detail |

|---|---|

| Purpose | Used to streamline the process of settling an estate that falls below a certain value threshold, allowing for the transfer of assets without formal probate. |

| Value Threshold | Applies to estates valued at $50,000 or less in Virginia. |

| Governing Law | Virginia Code § 64.2-600 et seq. governs the use of Small Estate Affidavits in the state. |

| Eligibility | Successors, including spouses, heirs, and certain creditors, may use the form to claim assets, provided they meet specified conditions. |

| Filing Requirements | The affidavit must be submitted to the appropriate financial institution or entity holding the decedent's assets, rather than filed with a court. |

| Waiting Period | A waiting period of 60 days after the decedent's death is required before the affidavit can be used. |

| Documentation | Completion of the form requires a certified copy of the death certificate and an itemized list of the decedent's assets subject to the affidavit. |

| Limitations | The affidavit does not apply to real estate holdings and cannot be used to transfer title to real estate. |

How to Use Virginia Small Estate Affidavit

When a loved one passes away, navigating the process of managing their estate can be overwhelming, especially during a time of grief. The Virginia Small Estate Affidavit form is one way to simplify this process for estates that qualify as "small" according to Virginia law. This document allows eligible individuals to claim assets of the deceased without the need for a lengthy probate process. It is designed to expedite the transfer of assets to rightful heirs or beneficiaries. Knowing how to properly complete this form is crucial to ensure the smooth handling of the deceased's assets. Below are the steps to fill out the Virginia Small Estate Affidavit form, meant to assist you through this sensitive time.

- Begin by collecting all required documents that will support the claims made in the affidavit, such as a certified copy of the death certificate, list of all known assets and their values, and any debt or creditor information.

- Read through the entire form first to understand what information is needed. This will help prevent errors and ensure you gather all the necessary details before you start filling it out.

- Enter the full legal name of the decedent (the deceased person) at the top of the form, ensuring the spelling matches the name as it appears on the death certificate.

- Provide the date of death and the county in Virginia where the decedent resided. This information is critical as it affects the eligibility for using the small estate process.

- List all known assets of the estate, such as bank accounts, securities, real estate properties located within Virginia, and other personal property. Beside each asset, note its approximate value at the time of death.

- Identify all debts and liabilities of the decedent, including funeral expenses, outstanding loans, and bills. This information will be necessary to understand the net value of the estate.

- Include the names, relationships, and addresses of all potential heirs or beneficiaries. This ensures that all rightful parties are accounted for in the distribution of the estate.

- Read through the affidavits section carefully. This part requires the claimant to certify their right to the assets, their understanding of the laws governing small estates, and their agreement to use the assets to pay the decedent’s debts and distribute the remainder according to the law.

- Sign and date the form in front of a notary public. It is essential that this step is not overlooked, as the affidavit needs to be notarized to be considered valid and legally binding.

- Finally, file the completed affidavit with the appropriate local court or agency in Virginia. The filing location may vary based on the type of assets and their location. A small filing fee may be required, so it is advisable to contact the court in advance to confirm any fees or additional documents needed.

Once the Virginia Small Estate Affidavit form is properly filled out and filed, the process for transferring the assets can begin. It's a procedure that provides relief during a difficult time, allowing the decedent's assets to be distributed without the need for a lengthy or complex probate process. While this guide aims to direct you through completing the form, it may also be helpful to consult with a legal professional, especially in situations where the estate's status or heirs' entitlements are uncertain.

Listed Questions and Answers

What is a Virginia Small Estate Affidavit?

A Virginia Small Estate Affidavit is a legal document used to settle small estates without formal probate in Virginia. It allows the transfer of the deceased's assets to their heirs if the total value of the estate is below a certain threshold.

What are the requirements for using a Virginia Small Estate Affidavit?

The requirements include:

- The death occurred in Virginia.

- The total value of the estate is $50,000 or less.

- 60 days have passed since the death.

- No application for a personal representative is pending or has been granted in any jurisdiction.

What assets can be transferred with a Virginia Small Estate Affidavit?

Assets that can be transferred include:

- Personal property like bank accounts, stocks, and bonds.

- Tangible personal property such as vehicles and furnishings.

- Wages, salaries, or other compensation owed to the deceased.

Who can file a Virginia Small Estate Affidifavit?

Any successor of the deceased, such as a spouse, child, parent, or named beneficiary, can file the affidavit. Creditors can also file if they meet certain conditions.

How do you file a Virginia Small Estate Affidavit?

File the affidavit with the clerk of the circuit court in the county where the deceased lived or where the property is located. Include a certified copy of the death certificate and a detailed list of the estate’s assets with their estimated values.

Is there a filing fee for the Virginia Small Estate Affidavit?

Yes, there is a nominal filing fee, which varies by county. Contact the local circuit court to find out the exact amount.

How long does it take to process a Virginia Small Estate Affidavit?

The processing time can vary based on the county and the complexity of the estate. Typically, it takes a few weeks from the date of filing for the assets to be released.

Can real estate be transferred using a Virginia Small Estate Affidavit?

No, real estate and certain other types of property that require formal probate proceedings cannot be transferred using a Virginia Small Estate Affidavit. For these assets, a different legal process is necessary.

Common mistakes

Filling out the Virginia Small Estate Affidavit form requires attention to detail and an understanding of specific requirements. Mistakes can delay the process or affect the transfer of assets. Below are common errors that individuals often make when completing this form:

-

Not verifying eligibility before proceeding. Only estates under a certain value threshold qualify for the small estate process.

-

Omitting necessary personal information, such as full legal names, addresses, or Social Security numbers, which are crucial for identification purposes.

-

Failing to provide accurate asset information, including the value and description of each asset belonging to the estate.

-

Incorrectly listing debts of the estate, which can include outstanding bills, loans, or taxes owed by the deceased.

-

Forgetting to include all heirs and beneficiaries, which might lead to disputes or challenges to the affidavit.

-

Misunderstanding the distribution laws and not allocating the assets according to Virginia's legal requirements.

-

Not obtaining or incorrectly filling out required attachments or additional forms that may accompany the affidavit.

-

Signing the affidavit without the presence of a notary, which is required for the document to be legally valid.

-

Failure to distribute the assets within the legally specified timeframe after the affidavit is accepted.

-

Not consulting with legal professionals when faced with uncertainties or complex estate situations, leading to potential legal issues.

Attention to these details can greatly improve the likelihood of a smooth and successful process when handling small estates in Virginia. It's always recommended to seek clarification or assistance when in doubt.

Documents used along the form

When someone passes away in Virginia with a small estate, the loved ones left behind may need to use a range of documents in addition to the Virginia Small Estate Affidavit form. This form is typically used to manage and distribute the assets of the deceased when those assets fall below a certain value threshold, making the process quicker and less demanding than going through a full probate. However, in order to effectively manage and close the deceased's affairs, several other forms and documents may be necessary. Here's a look at some of those additional forms and documents, each playing a unique role in the process.

- Death Certificate: This official document verifies the death. It is required for nearly all transactions involving the deceased's assets, including the execution of the Small Estate Affidavit.

- Last Will and Testament: If available, this document outlines the deceased's wishes for the distribution of their assets and may designate an executor for their estate.

- Letters of Administration: Needed if there's no will. It gives someone the authority to act as the administrator of the estate, allowing them to collect and distribute the estate's assets.

- Vehicle Title Transfer Forms: Used to officially change ownership of vehicles owned by the deceased, if applicable.

- Real Estate Transfer or Affidavit Forms: These forms are necessary for the transfer of real property owned by the deceased. The requirements can vary significantly from one locality to another.

- Bank Account Closure Forms: To access and distribute or close the deceased’s bank accounts, these forms are required by the bank.

- Stock Transfer Forms: If the deceased owned stocks, bonds, or other securities, these forms facilitate the transfer of these assets.

- Life Insurance Claim Forms: Used to claim the proceeds of any life insurance policies the deceased had. Beneficiaries need to fill out these forms to receive the benefits.

- Debt Cancellation Forms: If the deceased had debts, these forms might be necessary to negotiate the cancellation or settlement of outstanding debts.

In conclusion, while the Virginia Small Estate Affidavit aims to simplify the estate settlement process for smaller estates, the reality is that navigating the aftermath of a loved one’s passing involves dealing with a variety of documents and forms. From transferring assets to settling debts, each document serves a purpose in ensuring the deceased’s affairs are properly managed. It's important for the individuals handling the estate to be organized and thorough to ensure a smooth transition during this challenging time.

Similar forms

The Virginia Small Estate Affidavit form is similar to other legal documents used in the process of estate management and property transfer after someone's death. These forms, utilized across various states, share the core objective of streamlining the distribution of assets of individuals who have passed away, especially in situations where the estate is considered small or uncomplicated. Each form, though tailored to the specific legal requirements and thresholds of its jurisdiction, offers a simplified approach to what can otherwise be a complex and time-consuming process.

Transfer on Death Deed (TODD): The Virginia Small Estate Affidavit shares objectives with the Transfer on Death Deed. Both are designed to bypass the probate process for certain assets. The TODD allows property owners to name beneficiaries for real estate, which transfers upon the owner’s death without the need for probate. Similarly, the Small Estate Affidavit allows for the transfer of personal property to rightful heirs or legatees, emphasizing ease and expediency. While the TODD is specific to real estate, the Small Estate Affidavit encompasses a broader range of personal assets.

Joint Tenancy Agreement: This form provides a mechanism for co-owned property to pass to the surviving owner(s) upon the death of one owner. Like the Virginia Small Estate Affiditat, it facilitates the transfer of assets without requiring probate court proceedings. The key similarity lies in their objective to simplify the process of asset transfer after death. However, the Joint Tenancy Agreement is proactive, established by the owners while alive, whereas the Small Estate Affidavit is reactive, used by heirs or legatees following someone’s death.

Beneficiary Designations: Forms such as those used for designating beneficiaries on retirement accounts or life insurance policies share a foundational purpose with the Small Estate Affidavit. Both enable assets to be transferred directly to named individuals without necessitating probate court involvement. Beneficiary designation forms apply specifically to financial accounts or insurance policies, making them narrowly focused compared to the broader applicability of the Small Estate Affidavit, which can encompass various types of personal property.

Dos and Don'ts

Filling out the Virginia Small Estate Affidavit form can be a straightforward process if you follow some key guidelines. Making sure you're well-prepared and aware of the common dos and don'ts will help ensure the process goes smoothly. Here's a list of things to keep in mind:

Do:

- Double-check all the information you include on the form for accuracy. Mistakes or inaccuracies can lead to delays or even rejection of your affidavit.

- Make sure the total value of the estate matches the threshold set by Virginia law for small estates. This threshold changes, so it’s important to verify the current limit before proceeding.

- Gather and attach any required documentation that supports the claims made in your affidavit. This could include death certificates, lists of assets, and proof of your right to claim these assets.

- Consult with a legal professional if you have any questions or uncertainties about the process. While the form may seem straightforward, estate laws can be complex, and professional guidance can be invaluable.

Don't:

- Attempt to use the form if the estate’s value exceeds the monetary limit for small estates in Virginia. This could result in legal complications and potential financial liability.

- Forget to sign and notarize the affidavit as required. An unsigned or unnotarized document is typically considered invalid and will not be processed.

- Overlook any specific instructions or sections of the form. Each part of the affidavit serves a purpose, and missing information can cause unnecessary delays.

- Assume that filling out the form is the final step in the process. Depending on the estate and its assets, there may be additional requirements or steps to follow through with after the submission of the affidavit.

Misconceptions

Managing the estate of a loved one after they've passed can be a daunting process, often filled with complex legal procedures. In Virginia, the Small Estate Affidavit form is a tool designed to simplify this process for estates of a certain size. However, there are several misconceptions about this form and its use. Let's clear up some of these misunderstandings.

It automatically allows access to all assets. One common myth is that filling out the Virginia Small Estate Affidavit form grants immediate and unrestricted access to all of the deceased's assets. In reality, this form only applies to personal property, such as bank accounts and stocks, up to a specific value limit. Real estate and other types of property are not covered by this form and may require a different process.

It’s applicable regardless of the total estate value. Another misconception is that the Small Estate Affidavit can be used for any estate just because it seems "small" to the inheritor. However, the state of Virginia has a specific threshold defining a "small estate," and this value is subject to change. As of the last update, estates must be valued at $50,000 or less to qualify.

It avoids probate completely. While it's true that the Virginia Small Estate Affidavit form can simplify the process and may allow you to bypass the full probate process, it doesn’t eliminate the need for all types of probate. Some assets may still require formal probate, depending on their nature and how they were owned.

It transfers real estate. A significant misunderstanding is the belief that this affidavit can be used to transfer real estate. This form is strictly for the handling of personal property. Transferring real estate that belonged to the deceased involves a separate process and may require legal proceedings or other forms, depending on the situation.

It’s only for immediate family members to use. Finally, there’s the misconception that only immediate family members can file the Small Estate Affidavit. In fact, while priority is given to certain relatives, under Virginia law, if no relative steps forward within 60 days, an unrelated individual who has a valid interest in the estate (such as a creditor) may file the affidavit, provided they comply with the state's laws and regulations.

Understanding the limitations and specific requirements of the Virginia Small Estate Affidavit form can significantly ease the process of settling small estates. It is always recommended to consult with a legal professional to ensure that you are taking the right steps and that all legal requirements are being met.

Key takeaways

When dealing with the aftermath of a loved one's passing, the Virginia Small Estate Affidavit form can offer a simpler means of handling their estate, bypassing the often lengthy probate process. This document is designed for estates that fall under a certain value threshold and contains specific requirements for its use. Below are key takeaways to understand when filling out and using this form effectively.

- Eligibility Criteria: Before proceeding, it's vital to confirm that the estate qualifies for handling via this affidavit. In Virginia, the total value of the estate assets subject to probate must not exceed $50,000.

- Timeframe: There is a waiting period involved; the affidavit can only be filed 60 days after the decedent's death. This delay allows for a more accurate assessment of the estate's value and outstanding debts.

- Documentation: Completing the form requires meticulous attention to detail. It necessitates a comprehensive list of the decedent's assets, including but not limited to bank accounts, stocks, and personal property. Proper documentation and proof of the decedent's ownership of these assets will be needed.

- No Real Estate: It's important to note that real estate holdings cannot be transferred using the Virginia Small Estate Affidavit. This form is strictly for the transfer of personal property.

- Beneficiaries and Heirs: The form asks for detailed information about the decedent's legal heirs or beneficiaries. Accurately identifying these individuals is crucial, as they are the rightful recipients of the estate's assets.

- Legal and Financial Responsibilities: The person who fills out and submits the affidavit assumes certain responsibilities. They must ensure that debts and obligations of the estate are satisfied from the estate's assets before any distribution to heirs or beneficiaries. This may include funeral expenses, taxes, and other outstanding debts.

Using the Virginia Small Estate Affidavit can streamline the estate settlement process, but it requires careful attention to legal and financial details. It's often advisable to seek legal guidance to navigate this process smoothly and ensure compliance with all applicable laws and regulations.

Fill out Popular Small Estate Affidavit Forms for Different States

Small Estate Affidavit Massachusetts - Various states have different criteria and thresholds for utilizing the Small Estate Affidavit, making it important for claimants to familiarize themselves with local laws to ensure compliance and validity.

Affidavit of Succession - By completing this affidavit, the signee attests to the accuracy of the information regarding the deceased's estate and heirs.

How Long Does Probate Take in Tennessee - It verifies the claimant's right to receive property from the estate, based on the stated qualifications and limitations.