Printable Affidavit of Gift Form for Washington

When an individual decides to give a vehicle or boat as a gift in Washington State, navigating through the legal requirements can seem daunting at first glance. At the heart of this process lies the Washington Affidavit of Gift form, a crucial document that facilitates the smooth transfer of ownership without the exchange of money. This form not only serves as proof that the item was given as a gift but also plays a significant role in tax exemption claims, thereby making it an essential component for both the giver and the receiver. It delineates the relationship between the donor and the recipient, further underscoring the gift's legitimacy and aligning with state regulations to ensure compliance. Completing this form accurately is paramount, as it impacts the legal standing of the vehicle or boat’s ownership transfer, and ensures that both parties are protected under the law. Understanding the nuances of this form can immensely simplify the process, allowing for a seamless transition of ownership while adhering to the state's legal framework.

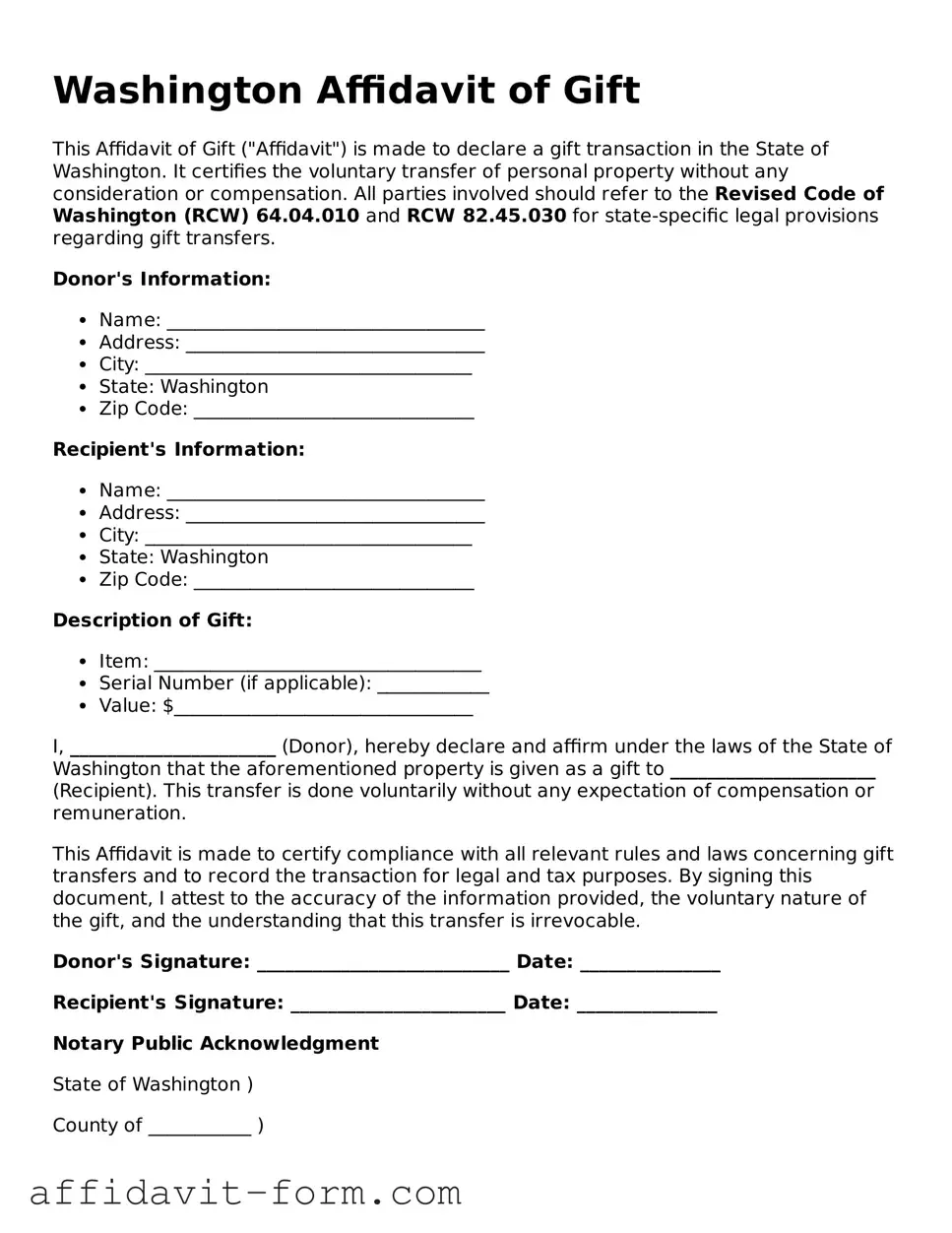

Form Example

Washington Affidavit of Gift

This Affidavit of Gift ("Affidavit") is made to declare a gift transaction in the State of Washington. It certifies the voluntary transfer of personal property without any consideration or compensation. All parties involved should refer to the Revised Code of Washington (RCW) 64.04.010 and RCW 82.45.030 for state-specific legal provisions regarding gift transfers.

Donor's Information:

- Name: __________________________________

- Address: ________________________________

- City: ___________________________________

- State: Washington

- Zip Code: ______________________________

Recipient's Information:

- Name: __________________________________

- Address: ________________________________

- City: ___________________________________

- State: Washington

- Zip Code: ______________________________

Description of Gift:

- Item: ___________________________________

- Serial Number (if applicable): ____________

- Value: $________________________________

I, ______________________ (Donor), hereby declare and affirm under the laws of the State of Washington that the aforementioned property is given as a gift to ______________________ (Recipient). This transfer is done voluntarily without any expectation of compensation or remuneration.

This Affidavit is made to certify compliance with all relevant rules and laws concerning gift transfers and to record the transaction for legal and tax purposes. By signing this document, I attest to the accuracy of the information provided, the voluntary nature of the gift, and the understanding that this transfer is irrevocable.

Donor's Signature: ___________________________ Date: _______________

Recipient's Signature: _______________________ Date: _______________

Notary Public Acknowledgment

State of Washington )

County of ___________ )

On __________________ (date), before me, __________________________, a Notary Public in and for said state, personally appeared ________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

Notary Public: ___________________________________

My commission expires: ___________________________

Document Details

| Fact Number | Fact Detail |

|---|---|

| 1 | The Washington Affidavit of Gift is specific to the state of Washington and is governed by its state laws. |

| 2 | This form is typically used to document the transfer of a vehicle or boat as a gift. |

| 3 | It helps to formally record the transfer and the details of the gift for both legal and tax purposes. |

| 4 | By using this affidavit, the giver certifies that the item is indeed a gift and no payment was exchanged. |

| 5 | It is imperative for avoiding misunderstandings about the nature of the transfer with state tax authorities. |

| 6 | The affidavit needs the identification numbers of the gifted property, such as the Vehicle Identification Number (VIN) for vehicles. |

| 7 | Completion and submission of this form are required for the new owner to register the vehicle or boat in their name without being charged sales tax. |

| 8 | The form must be signed by the giver and, in some cases, also by the recipient acknowledging the gift. |

| 9 | Filing requirements and the necessity for notarization can vary, so it's crucial to check the latest guidelines provided by the Washington State Department of Licensing. |

| 10 | Failure to properly complete and file the Affidavit of Gift can result in legal complications and possible tax liabilities for both parties. |

How to Use Washington Affidavit of Gift

When a generous gift comes your way, such as a car from a family member, taking the right steps to officially document the gift is crucial. The Washington Affidavit of Gift form is your go-to document for this purpose, ensuring that everything is squared away smoothly. This form is vital for legalizing the transfer and can save a lot of time and potential headaches down the line. Here's a straightforward guide to help you fill it out correctly.

- Start with the vehicle information section. Input the make, model, and year of the vehicle being gifted. Don't forget to include the Vehicle Identification Number (VIN) – this is crucial for the identification of the vehicle.

- Next, move on to the section dedicated to the giver (donor) of the gift. You'll need to provide the full legal name of the person giving the vehicle as a gift, along with their complete address.

- Now, focus on the receiver (donee) of the gift. Similar to the above step, fill in the full legal name and the address of the person receiving the gift.

- This part is essential. State the relationship between the giver and the receiver. Whether it's parent to child, spouse to spouse, or friend to friend, this information is crucial because it helps clarify the nature of the gift.

- Clarify the details of the gift. Indicate if the vehicle is paid off or if there is still an outstanding loan. If there's an outstanding loan, mention who will be responsible for the remaining payments.

- One of the most crucial steps is the signature part. Both the giver and the receiver must sign the form. Ensure these signatures are dated – this is key for the document's validity.

- Finally, verify if a notary public needs to witness the signatures. Some states may require this step for the affidavit to be legally binding. If required, make sure to sign the form in front of a notary.

After filling out the form, the next steps involve submitting it to the appropriate government agency, usually the Department of Motor Vehicles (DMV) or a similar entity. This step is essential for the vehicle's title to be transferred officially. Remember, handling this documentation promptly can make the gift even more enjoyable by ensuring all legal requirements are met with ease.

Listed Questions and Answers

What is the Washington Affidavit of Gift form?

The Washington Affidavit of Gift form is a legal document used in the state of Washington. It serves as proof that an item of significant value, such as a vehicle, has been given as a gift. This form is often required by the Department of Licensing (DOL) to exempt the recipient from paying taxes on the transfer.

Why do I need to fill out an Affididavit of Gift form in Washington?

Filling out an Affidavit of Gift form is necessary when you are giving someone a valuable item without expecting payment in return. This form helps establish the transfer as a genuine gift, making the recipient eligible for a tax exemption on the item. It ensures that the transaction complies with state laws and provides a record for both parties.

Who is required to sign the Washington Affididavit of Gift form?

The person giving the gift (the donor) and the recipient of the gift (the donee) are required to sign the Washington Affidavit of Gift form. Their signatures must be witnessed by a Notary Public to verify the authenticity of the document.

What information is needed to complete the form?

The following information is typically required to fill out the Washington Affididavit of Gift form:

- The full name and address of the donor

- The full name and address of the recipient

- A description of the item being gifted (e.g., vehicle, make, model, year)

- The vehicle identification number (VIN), if applicable

- The date the gift was given

- Signatures of the donor, the recipient, and a Notary Public

Is there a fee to file the Washington Affididavit of Gift form?

No, there is no fee to file the Washington Affidavit of Gift form itself. However, there may be a nominal fee to have the document notarized, depending on the notary service used.

Where can I obtain a Washington Affididavit of Gift form?

The Washington Affididavit of Gift form can be obtained from the Washington State Department of Licensing (DOL) website. It is also available at local DOL offices.

How do I submit the completed form?

After completing and notarizing the Washington Affididavit of Gift form, it should be submitted to the Department of Licensing. The form can be mailed or delivered in person to a local DOL office, depending on the office's submission guidelines.

How long does it take for the form to be processed?

The processing time can vary depending on the volume of submissions and specific office procedures. Typically, it is advisable to allow several weeks for the form to be processed by the Department of Licensing.

Can I gift a vehicle without a Washington Affidavit of Gift form?

While it is possible to transfer ownership of a vehicle without using the Washington Affidavit of Gift form, doing so may result in the recipient being responsible for paying gift tax on the transaction. Utilizing the form helps to clearly establish the transaction as a gift, potentially exempting the recipient from such taxes.

Common mistakes

-

Failing to double-check the Vehicle Identification Number (VIN): It’s easy to overlook a digit or transpose numbers. Since the VIN is critical for correctly identifying the vehicle, this mistake can make the document invalid.

-

Not using the legal name of both the giver and the receiver: Sometimes people use nicknames or incomplete names. However, it's important to use the full legal names as they appear on official identification to avoid questions about the affidavit's validity.

-

Omitting required signatures: Both the giver and the receiver must sign the affidavit. Missing signatures can render the document non-binding and necessitate starting the process over.

-

Incorrect date of gift: The date the gift is made should be accurately recorded. Incorrect dates can cause confusion and potential legal issues, particularly if the timing of the ownership transfer is critical.

-

Overlooking the requirement to disclose any liens on the vehicle: If the vehicle has any outstanding loans or other claims against it, these must be disclosed. Failing to do so could lead to legal complications for the receiver.

-

Not specifying the relationship between the giver and the receiver: Some exemptions or tax implications depend on the relationship, so it's essential to clarify this on the affidavit.

-

Leaving blank fields: Every field on the form should be completed. If a section doesn’t apply, it’s better to mark it as “N/A” (not applicable) rather than leaving it blank, to show that it was not overlooked.

-

Misunderstanding the purpose of the form: Sometimes people think this form is all that’s needed to transfer the title. Remember, the affidavit of gift is part of the process, but you may need to complete additional steps to legally transfer vehicle ownership.

By avoiding these common mistakes, you ensure the process goes smoothly. Attention to detail when filling out the Washington Affidavit of Gift form ensures that the generosity intended by the gift is not overshadowed by administrative oversights.

Documents used along the form

In the state of Washington, transferring ownership of property through gifting often involves more paperwork than just the Affidavit of Gift form. This form facilitates the legal process of giving without compensation, but several other documents may be necessary to ensure the transaction complies fully with state laws and regulations. These documents help in establishing the veracity of the gift, the identities of the parties involved, and any terms or conditions that may be applicable. Additionally, they ensure that the transfer adheres to tax laws and protects both the giver and the receiver from future legal disputes. Here's a closer look at these complementary documents.

- Bill of Sale: This document provides proof of the transfer of ownership from the giver to the receiver. It acts as a receipt for the transaction, even if no money exchanges hands, and is particularly crucial when gifting vehicles or large assets.

- Release of Liability: Often used together with a Bill of Sale for vehicle gifts, this form releases the giver from liability for what the receiver may do with the gift after the transfer. It's vital for protecting the giver from future legal responsibilities associated with the gifted item.

- Gift Letter: A gift letter may be required by financial institutions when the gift involves a sum of money or property with significant value. It articulates that the transfer is indeed a gift and not a loan, specifying that no repayment is expected.

- Title Transfer Form: For gifts involving vehicles or real estate, this form officially transfers the title of the property from the giver to the receiver, ensuring the receiver becomes the rightful owner in public records.

- Real Estate Deed Transfer: In the event of gifting real estate, this document changes the ownership on the official deed. Depending on the specifics, it can be a warranty deed, quitclaim deed, or another type appropriate to the circumstances of the gift.

- Gift Tax Return Form (IRS Form 709): For gifts that exceed the annual or lifetime gift tax exclusion amount, this form must be filed with the federal government. It ensures that the gift complies with federal tax regulations.

- Vehicle Registration Application: When gifting a vehicle, the new owner needs to register the vehicle in their name. This document is submitted to the state's department of licensing.

- Proof of Insurance: For vehicle gifts, proof of insurance is necessary to complete the transfer. The new owner must provide evidence of an insurance policy in their name for the gifted vehicle.

- Personal Property Gift Agreement: This document lays out the terms and conditions of the gift, especially for personal property that may not require titles or deeds but still has significant value. It clarifies any conditions attached to the gift and the intention of both parties.

These documents work in concert with the Washington Affidavit of Gift form to guarantee that all aspects of the gifting process are above board and legally sound. Whether you're gifting a vehicle, real estate, or a significant amount of money, using the correct forms and documents can help avoid potential misunderstandings or legal issues in the future. The giver and receiver should keep copies of all documents for their records. It's always wise to consult with a legal professional to ensure each document is correctly filled out and filed according to the specific requirements of Washington State and federal law.

Similar forms

The Washington Affidavit of Gift form is similar to other legal documents that are used in the transfer of property without a financial exchange. These documents often serve to legally document the intention behind the transfer, ensuring that it complies with state laws and provides a clear record. Among these, a few notable examples stand out due to their specific purposes and applications.

Bill of Sale: The form shares similarities with a Bill of Sale document, albeit with a notable difference in the transaction's nature. While a Bill of Sale is used to record the sale and purchase of items, indicating a transfer of property for monetary value, the Affidavit of Gift focuses on the transfer of property as a gift without any financial consideration involved. Both documents require detailed information about the parties involved and the item or property being transferred, and they serve as proof of the change in ownership. However, the Affidit of Gift specifically exempts the transaction from certain taxes that typically apply to sales, underlining the non-commercial essence of the transaction.

Transfer-on-Death Deed: Another document comparable to the Affidavit of Gift form is the Transfer-on-Death (TOD) deed, used in estate planning to name beneficiaries for real estate. Like the Affidavit of Gift, a TOD deed allows property to be passed on without going through probate after the owner's death. While the Affidavit of Gift takes effect immediately, transferring ownership rights upon completion, the TOD deed becomes effective only after the death of the property owner. Both documents bypass the often lengthy and costly legal processes, ensuring a smoother transition of ownership under specified conditions.

Donor’s Affidavit: This document is very closely related to the Washington Affidavit of Gift form, as it also pertains to the gifting of property. A Donor’s Affidavit, however, is typically more focused on the donor's intent and compliance with tax laws, especially in the context of sizable gifts that may affect the donor's tax obligations. It may require detailed documentation of the item or property's value and the donor's understanding of tax implications. The Affidavit of Gift and the Donor’s Affidavit both aim to clearly document the gifting transaction and intent, but the Donor’s Affidavit places a heavier emphasis on the tax aspects and the legalities of the gift from the perspective of the donor.

Dos and Don'ts

When you're filling out the Washington Affidavit of Gift form, it's important to approach it with careful consideration to ensure the document is valid and accurately reflects your intentions. Here are some dos and don'ts that can guide you through the process:

Do:- Read instructions carefully: Start by thoroughly reading through all the provided instructions to understand every requirement. This prevents mistakes and ensures you fill out the form correctly.

- Use black ink: To ensure clarity and legibility, fill out the form in black ink. This makes it easier to photocopy or scan without losing any details.

- Provide accurate details: Make sure all the information about the gift (like vehicle or property details) and the recipient is accurate. Errors could complicate or invalidate the form.

- Double-check for completeness: Before finalizing, re-examine each section to confirm that no required information is missing. Incomplete forms may be rejected.

- Sign in the presence of a notary: Many forms, including this affidavit, require notarization. Ensure you sign the document in the presence of a notary to fulfill this legal requirement.

- Keep a copy: After the form is filled out, keep a copy for your records. This could be helpful for future reference or in case of legal inquiries.

- Submit according to instructions: Carefully follow the submission guidelines provided with the form. This might include specific offices or departments where the form should be submitted.

- Rush through the process: Take your time to avoid mistakes that could render the affidavit void or cause delays.

- Use pencil or colored inks: These can smudge or fade over time, making the document difficult to read or photocopy.

- Leave blanks unless instructed: Unfilled sections can lead to misunderstandings or rejections. If a section doesn’t apply, consider marking it as ‘N/A’ (not applicable).

- Forget the date: The date is crucial for the document’s validity and legal effectiveness. Make sure it is filled in correctly.

- Sign without a notary, if required: Unsigned or improperly notarized documents are usually considered invalid. Follow notarization requirements strictly.

- Lose your patience: Dealing with legal documents can be frustrating, but maintaining patience is key to ensuring everything is done properly.

- Ignore instructions on submission: Submitting the form to the wrong place or in the wrong manner could delay or invalidate the process. Pay close attention to the submission guidelines.

By adhering to these guidelines, you can ensure that your Washington Affidavit of Gift form is filled out accurately and compliantly, aiding a smooth transfer of property or gift to its intended recipient.

Misconceptions

When it comes to transferring a vehicle or property as a gift in Washington State, the Affidavit of Gift form is a crucial document used to formalize the process without incurring the typical taxes associated with such transfers. However, there are several misconceptions surrounding this form that often confuse or mislead individuals in the process. Let's explore some of these misunderstandings to clarify the use and requirements of the Washington Affidavit of Gift form.

- Misconception #1: It’s only for vehicle transfers. While the Affidavit of Gift form is frequently used for transferring ownership of vehicles without a sale, it can also be applied to other types of personal property transfers under specific circumstances.

- Misconception #2: Any transfer of property can qualify as a gift. In reality, for a transfer to be considered a gift under the eyes of the law, no payment or consideration is expected or received in return. This distinction is vital to prevent misuse of the form for evading taxes.

- Misconception #3: Using the Affidavit of Gift form is a complicated process. Many people think that using this form is complex and laden with legal jargon. However, the form is designed to be straightforward and user-friendly, with clear instructions to guide you through the process.

- Misconception #4: The form requires notarization. This is a common misunderstanding. While some legal documents require notarization to verify the signer's identity, the Washington Affidavit of Gift form does not necessarily need to be notarized to be valid. However, requirements can change, so it’s always a good idea to check the most current instructions.

- Misconception #5: The form immediately transfers ownership. Simply completing and submitting the form does not instantly transfer ownership. The recipient must submit the completed form, along with any other required documents, to the appropriate state department to legally transfer the title.

- Misconception #6: There’s no need to report the gift to the IRS. Although the Affidavit of Gift form facilitates the transfer of ownership at the state level, it does not absolve the giver or receiver from federal tax obligations. For significant gifts, the transfer may need to be reported to the IRS to determine if gift taxes apply.

- Misconception #7: It can only be used once per individual. Some believe that you can only use the Affidavit of Gift form once per recipient or donor. In fact, there is no limit on how many times an individual can give or receive gifts using this form, as long as each transaction meets the legal definition of a gift and adheres to the relevant laws and regulations.

Understanding the correct use and requirements of the Washington Affidavit of Gift form can help individuals navigate the process with confidence and ensure that their generous acts of gifting meet all legal criteria. Always keep updated on the latest regulations and seek professional advice if needed to navigate the complexities of gift transfers.

Key takeaways

When transferring a vehicle or other valuable item as a gift in Washington state, it's important to understand how to correctly fill out and use the Affidavit of Gift form. This process ensures a smooth transition of ownership without unexpected tax implications. Here are several key takeaways:

- Eligibility: The Affidavit of Gift form is designed for individuals who are giving or receiving a vehicle, boat, or other eligible personal property as a gift within Washington state. This form verifies that the item is indeed a gift and not a sale, which can affect the taxes owed.

- No Monetary Exchange: To use this form, there must be no payment between the giver and the receiver. This includes an exchange of goods or services. The form is strictly for items given freely, without financial consideration.

- Accurate Information: Filling out the form requires accurate information about both the giver and the receiver. This includes full legal names, addresses, and relevant identification numbers. Accuracy is vital for the proper transfer of ownership.

- Description of the Gift: The form needs a thorough description of the gifted item. For vehicles, this includes the make, model, year, and VIN (Vehicle Identification Number). Providing detailed information helps avoid any confusion regarding the gift's identity.

- Transfer Fees: While gifting a vehicle may exempt the receiver from paying sales tax, there are still transfer fees associated with the process. Ensure these fees are understood and paid to complete the transfer legally.

- Notarization: In some instances, the Affidavit of Gift form requires notarization. This step validates the signatures on the form, certifying that the parties involved are indeed who they claim to be. Check current requirements, as they can vary.

- Submission: Once completed, the form must be submitted to the relevant Washington state department, typically the Department of Licensing. The submission process finalizes the change of ownership, so it's crucial to follow through promptly.

Understanding these key points ensures that the process of gifting personal property is done correctly and in compliance with state laws. Completing the Affidavit of Gift form accurately is crucial for a seamless transition of ownership without any legal hiccups.

Fill out Popular Affidavit of Gift Forms for Different States

Title Transfer Texas - Utilizing an Affidavit of Gift safeguards both parties from potential legal issues and solidifies the transaction's integrity.

How to Gift a Car in Missouri - An Affidavit of Gift form is a legal document used to declare that an item was given as a gift, proving no payment was exchanged.

Affidavit for Gifting a Car Florida - When it comes to family-owned businesses, an Affidavit of Gift can assist in the seamless transfer of ownership shares to family members.