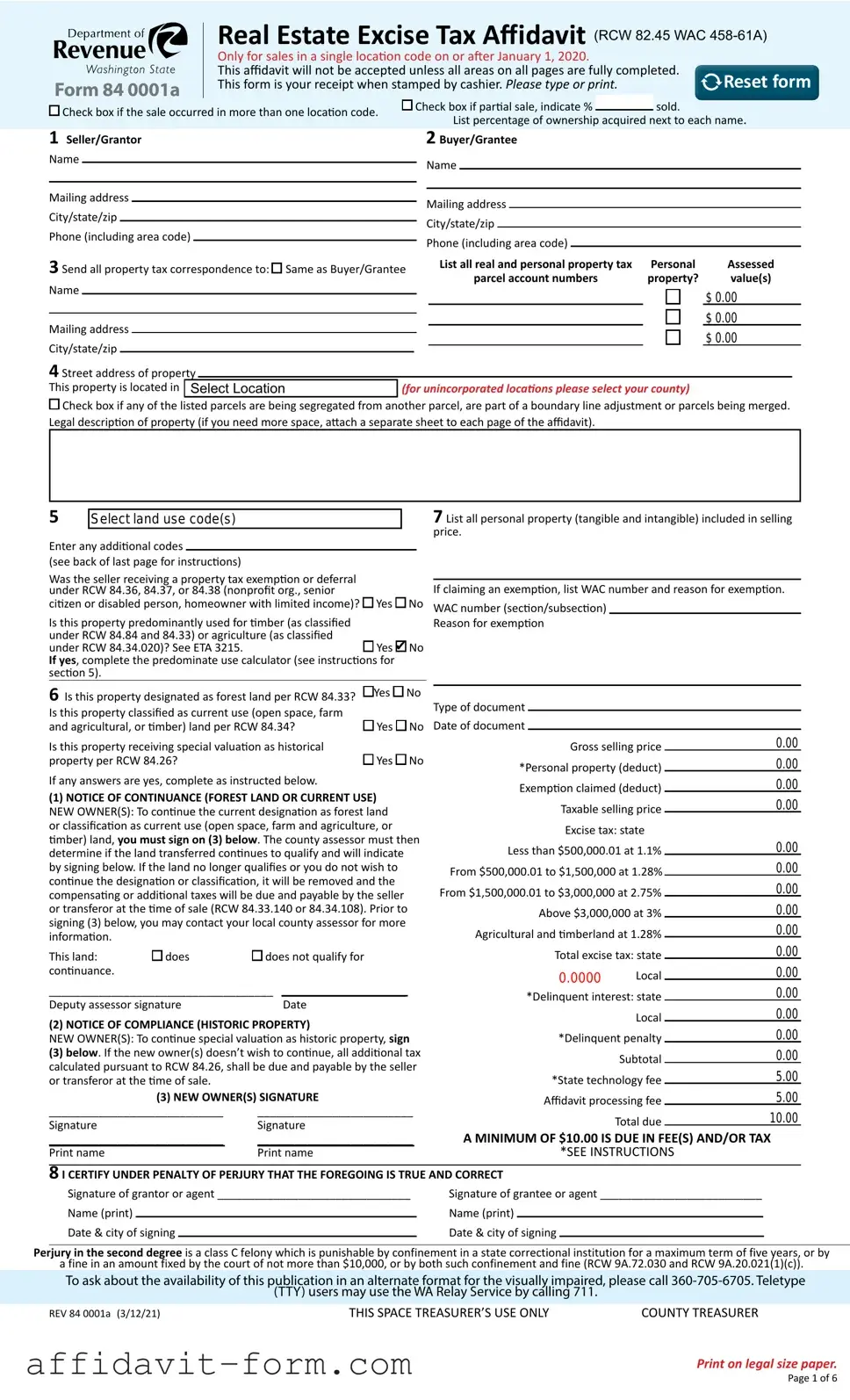

Blank Washington Real Estate Excise Tax Affidavit PDF Template

When individuals or entities decide to transfer real estate property in Washington State, an important step in this process involves the completion and submission of the Washington Real Estate Excise Tax Affidavit form. This document is not only essential for the legal transfer of property but also serves as a basis for calculating and paying the excise tax owed by the seller. The excise tax is a type of sales tax specifically applied to the sale of real estate and varies depending on the location of the property and the sale price. The affidavit requires detailed information about the seller, buyer, and the property itself, along with the sale price and any terms or conditions that could affect the tax computation. By accurately completing this affidavit, parties involved ensure compliance with state tax laws, thereby avoiding potential legal and financial penalties. Furthermore, the information gleaned from these affidavits aids in the compilation of valuable data regarding real estate transactions within the state, contributing to various economic and regulatory analyses.

Form Example

|

|

|

|

|

|

|

|

Real Estate Excise Tax Affidavit (RCW 82.45 WAC |

||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

Only for sales in a single location code on or after January 1, 2020. |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

This affidavit will not be accepted unless all areas on all pages are fully completed. |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

Reset form |

|

||||||||||||||||

|

Form 84 0001a |

This form is your receipt when stamped by cashier. Please type or print. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

Check box if partial sale, indicate % |

|

|

sold. |

|

|

|

|

|

||||||||||||||

|

Check box if the sale occurred in more than one location code. |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

List percentage of ownership acquired next to each name. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

1 Seller/Grantor |

|

|

|

|

|

2 Buyer/Grantee |

|

|

|

|

|

|

|

||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Phone (including area code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

Phone (including area code) |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

3 Send all property tax correspondence to: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Same as Buyer/Grantee |

|

|

|

List all real and personal property tax |

Personal |

Assessed |

|||||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

parcel account numbers |

property? |

value(s) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Street address of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

This property is located in |

Select Location |

|

(for unincorporated locations please select your county) |

|

|

|

|

||||||||||||||||||

Check box if any of the listed parcels are being segregated from another parcel, are part of a boundary line adjustment or parcels being merged. Legal description of property (if you need more space, attach a separate sheet to each page of the affidavit).

5 |

|

Select land use code(s) |

Enter any additional codes

(see back of last page for instructions)

Was the seller receiving a property tax exemption or deferral under RCW 84.36, 84.37, or 84.38 (nonprofit org., senior

citizen or disabled person, homeowner with limited income)? Yes No

Is this property predominantly used for timber (as classified under RCW 84.84 and 84.33) or agriculture (as classified

under RCW 84.34.020)? See ETA 3215.Yes No If yes, complete the predominate use calculator (see instructions for section 5).

7 List all personal property (tangible and intangible) included in selling price.

If claiming an exemption, list WAC number and reason for exemption.

WAC number (section/subsection) Reason for exemption

6 Is this property designated as forest land per RCW 84.33? |

Yes |

No |

|

|

|

|

|

|

|

|

|

||||

|

Type of document |

|

|

|

|

|

|||||||||

Is this property classified as current use (open space, farm |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Date of document |

|

|

|

|

|

|

|||||

and agricultural, or timber) land per RCW 84.34? |

Yes |

No |

|

|

|

|

|

|

|||||||

|

|

Gross selling price |

|

0.00 |

|||||||||||

Is this property receiving special valuation as historical |

|

|

|

|

|

|

|

|

|

||||||

property per RCW 84.26? |

|

Yes |

No |

|

|

*Personal property (deduct) |

|

0.00 |

|||||||

If any answers are yes, complete as instructed below. |

|

|

|

|

|

0.00 |

|||||||||

|

|

|

|

|

Exemption claimed (deduct) |

|

|||||||||

(1) NOTICE OF CONTINUANCE (FOREST LAND OR CURRENT USE) |

|

|

|

|

0.00 |

||||||||||

|

|

|

|

|

|

|

Taxable selling price |

|

|||||||

NEW OWNER(S): To continue the current designation as forest land |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|||||||

or classification as current use (open space, farm and agriculture, or |

|

|

|

|

|

|

|

Excise tax: state |

|

||||||

timber) land, you must sign on (3) below. The county assessor must then |

|

|

|

|

|

0.00 |

|||||||||

|

Less than $500,000.01 at 1.1% |

|

|||||||||||||

determine if the land transferred continues to qualify and will indicate |

|

|

|

|

|||||||||||

|

|

|

|

0.00 |

|||||||||||

by signing below. If the land no longer qualifies or you do not wish to |

|

|

|

From $500,000.01 to $1,500,000 at 1.28% |

|

||||||||||

continue the designation or classification, it will be removed and the |

|

|

|

|

0.00 |

||||||||||

|

|

|

From $1,500,000.01 to $3,000,000 at 2.75% |

|

|||||||||||

compensating or additional taxes will be due and payable by the seller |

|

|

|

|

|||||||||||

|

|

|

|

0.00 |

|||||||||||

or transferor at the time of sale (RCW 84.33.140 or 84.34.108). Prior to |

|

|

|

|

Above $3,000,000 at 3% |

|

|||||||||

signing (3) below, you may contact your local county assessor for more |

|

|

|

|

|

|

|

0.00 |

|||||||

|

|

|

Agricultural and timberland at 1.28% |

|

|||||||||||

information. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

0.00 |

|||||||

This land: |

does |

does not qualify for |

|

|

|

|

|

|

|

Total excise tax: state |

|

||||

|

|

|

|

|

|

|

|

|

|||||||

continuance. |

|

|

|

|

|

|

0.0000 |

Local |

|

0.00 |

|||||

____________________________________ ____________________ |

|

|

|

0.00 |

|||||||||||

|

|

|

|

*Delinquent interest: state |

|||||||||||

Deputy assessor signature |

Date |

|

|

|

|

|

|

|

|

|

Local |

|

0.00 |

||

(2) NOTICE OF COMPLIANCE (HISTORIC PROPERTY) |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||

|

|

|

|

|

|

|

*Delinquent penalty |

|

|||||||

NEW OWNER(S): To continue special valuation as historic property, sign |

|

|

|

|

|

||||||||||

(3) below. If the new owner(s) doesn’t wish to continue, all additional tax |

|

|

|

|

|

|

Subtotal |

|

0.00 |

||||||

calculated pursuant to RCW 84.26, shall be due and payable by the seller |

|

|

|

|

|

|

|

5.00 |

|||||||

|

|

|

|

*State technology fee |

|

||||||||||

or transferor at the time of sale. |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

5.00 |

||||||

|

(3) NEW OWNER(S) SIGNATURE |

|

|

|

|

|

|

|

Affidavit processing fee |

|

|||||

____________________________ |

_________________________ |

|

|

|

|

|

|

|

Total due |

|

10.00 |

||||

Signature |

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

____________________________ |

_________________________ |

|

|

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX |

|||||||||||

Print name |

|

|

Print name |

|

|

|

|

|

|

|

|

*SEE INSTRUCTIONS |

|

||

8 I CERTIFY UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT |

|

|

|

||||||||||||

Signature of grantor or agent _______________________________ |

|

Signature of grantee or agent __________________________ |

|

||||||||||||

Name (print) |

|

|

|

|

|

|

|

Name (print) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Date & city of signing |

|

|

|

|

|

|

Date & city of signing |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

Perjury in the second degree is a class C felony which is punishable by confinement in a state correctional institution for a maximum term of five years, or by

a fine in an amount fixed by the court of not more than $10,000, or by both such confinement and fine (RCW 9A.72.030 and RCW 9A.20.021(1)(c)).

To ask about the availability of this publication in an alternate format for the visually impaired, please call |

||

|

(TTY) users may use the WA Relay Service by calling 711. |

|

84 0001a (3/12/21) |

THIS SPACE TREASURER’S USE ONLY |

COUNTY TREASURER |

Print on legal size paper.

Page 1 of 6

|

|

|

|

|

|

|

|

|

Real Estate Excise Tax Affidavit (RCW 82.45 WAC |

|||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

Only for sales in a single location code on or after January 1, 2020. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

This affidavit will not be accepted unless all areas on all pages are fully completed. |

|

|

|

||||||||||||

|

Form 84 0001a |

|

|

This form is your receipt when stamped by cashier. Please type or print. |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

Check box if partial sale, indicate % |

|

|

sold. |

|

|

|

|||||||||||||

|

Check box if the sale occurred in more than one location code. |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

List percentage of ownership acquired next to each name. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

1 Seller/Grantor |

|

|

|

|

|

|

2 Buyer/Grantee |

|

|

|

|

|

|||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

City/state/zip |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Phone (including area code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

Phone (including area code) |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

3 Send all property tax correspondence to: Same as Buyer/Grantee |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

List all real and personal property tax |

Personal |

Assessed |

||||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

parcel account numbers |

property? |

value(s) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Street address of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

This property is located in |

|

Select Location |

(for unincorporated locations please select your county) |

|

|

|

|||||||||||||||||

Check box if any of the listed parcels are being segregated from another parcel, are part of a boundary line adjustment or parcels being merged. Legal description of property (if you need more space, attach a separate sheet to each page of the affidavit).

5 |

|

Select land use code(s) |

Enter any additional codes

(see back of last page for instructions)

Was the seller receiving a property tax exemption or deferral under RCW 84.36, 84.37, or 84.38 (nonprofit org., senior

citizen or disabled person, homeowner with limited income)? Yes No

Is this property predominantly used for timber (as classified under RCW 84.84 and 84.33) or agriculture (as classified

under RCW 84.34.020)? See ETA 3215.Yes No If yes, complete the predominate use calculator (see instructions for section 5).

7 List all personal property (tangible and intangible) included in selling price.

If claiming an exemption, list WAC number and reason for exemption.

WAC number (section/subsection) Reason for exemption

6 Is this property designated as forest land per RCW 84.33? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Type of document |

|

|

|

|

|

|

|

|

|||||||||

Is this property classified as current use (open space, farm |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Date of document |

|

|

|

|

|

|

|

|

|

|||||

and agricultural, or timber) land per RCW 84.34? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Gross selling price |

|

|

0.00 |

||||||||||||

Is this property receiving special valuation as historical |

|

|

|

|

|

|

|

|

|

|

|

|||||||

property per RCW 84.26? |

|

Yes |

No |

|

|

*Personal property (deduct) |

|

|

0.00 |

|||||||||

If any answers are yes, complete as instructed below. |

|

|

|

|

|

|

0.00 |

|||||||||||

|

|

|

|

|

Exemption claimed (deduct) |

|

|

|||||||||||

(1) NOTICE OF CONTINUANCE (FOREST LAND OR CURRENT USE) |

|

|

|

|

|

0.00 |

||||||||||||

|

|

|

|

|

|

|

|

Taxable selling price |

|

|

||||||||

NEW OWNER(S): To continue the current designation as forest land |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

or classification as current use (open space, farm and agriculture, or |

|

|

|

|

|

|

|

|

Excise tax: state |

|

||||||||

timber) land, you must sign on (3) below. The county assessor must then |

|

|

|

|

|

|

0.00 |

|||||||||||

|

Less than $500,000.01 at 1.1% |

|

|

|||||||||||||||

determine if the land transferred continues to qualify and will indicate |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||

by signing below. If the land no longer qualifies or you do not wish to |

|

|

|

From $500,000.01 to $1,500,000 at 1.28% |

|

|

||||||||||||

continue the designation or classification, it will be removed and the |

|

|

|

|

|

0.00 |

||||||||||||

|

|

|

From $1,500,000.01 to $3,000,000 at 2.75% |

|

|

|||||||||||||

compensating or additional taxes will be due and payable by the seller |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||

or transferor at the time of sale (RCW 84.33.140 or 84.34.108). Prior to |

|

|

|

|

|

Above $3,000,000 at 3% |

|

|

||||||||||

signing (3) below, you may contact your local county assessor for more |

|

|

|

|

|

|

|

|

0.00 |

|||||||||

|

|

|

Agricultural and timberland at 1.28% |

|

|

|||||||||||||

information. |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

0.00 |

|||||||||

This land: |

does |

does not qualify for |

|

|

|

|

|

|

|

|

Total excise tax: state |

|

||||||

|

|

|

|

|

|

|

|

|

||||||||||

continuance. |

|

|

|

|

|

|

|

|

|

Local |

|

0.00 |

||||||

|

|

|

|

|

|

|

0.0000 |

|

|

|

||||||||

____________________________________ ____________________ |

|

|

|

0.00 |

||||||||||||||

|

|

|

|

*Delinquent interest: state |

||||||||||||||

Deputy assessor signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

Local |

|

|

0.00 |

||

(2) NOTICE OF COMPLIANCE (HISTORIC PROPERTY) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||||

|

|

|

|

|

|

|

|

*Delinquent penalty |

|

|

||||||||

NEW OWNER(S): To continue special valuation as historic property, sign |

|

|

|

|

|

|

||||||||||||

(3) below. If the new owner(s) doesn’t wish to continue, all additional tax |

|

|

|

|

|

|

|

Subtotal |

|

0.00 |

||||||||

calculated pursuant to RCW 84.26, shall be due and payable by the seller |

|

|

|

|

|

|

|

|

5.00 |

|||||||||

|

|

|

|

|

*State technology fee |

|

|

|||||||||||

or transferor at the time of sale. |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

5.00 |

|||||||||

|

(3) NEW OWNER(S) SIGNATURE |

|

|

|

|

|

|

|

|

Affidavit processing fee |

|

|||||||

____________________________ |

_________________________ |

|

|

|

|

|

|

|

|

Total due |

|

|

10.00 |

|||||

Signature |

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

____________________________ |

_________________________ |

|

|

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX |

||||||||||||||

Print name |

|

|

Print name |

|

|

|

|

|

|

|

|

|

*SEE INSTRUCTIONS |

|

||||

8 I CERTIFY UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT |

|

|

|

|

|

|||||||||||||

Signature of grantor or agent _______________________________ |

|

Signature of grantee or agent __________________________ |

|

|||||||||||||||

Name (print) |

|

|

|

|

|

|

|

Name (print) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Date & city of signing |

|

|

|

|

|

|

Date & city of signing |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Perjury in the second degree is a class C felony which is punishable by confinement in a state correctional institution for a maximum term of five years, or by

a fine in an amount fixed by the court of not more than $10,000, or by both such confinement and fine (RCW 9A.72.030 and RCW 9A.20.021(1)(c)).

To ask about the availability of this publication in an alternate format for the visually impaired, please call |

||

|

(TTY) users may use the WA Relay Service by calling 711. |

|

84 0001a (3/12/21) |

THIS SPACE TREASURER’S USE ONLY |

COUNTY ASSESSOR |

Print on legal size paper.

Page 2 of 6

|

|

|

|

|

|

|

|

Real Estate Excise Tax Affidavit (RCW 82.45 WAC |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

Only for sales in a single location code on or after January 1, 2020. |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

This affidavit will not be accepted unless all areas on all pages are fully completed. |

|

|

|

|||||||||||||

|

Form 84 0001a |

|

|

|

This form is your receipt when stamped by cashier. Please type or print. |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

Check box if partial sale, indicate % |

|

|

sold. |

|

|

|

|||||||||||

|

Check box if the sale occurred in more than one location code. |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

List percentage of ownership acquired next to each name. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

1 Seller/Grantor |

|

|

|

|

|

|

|

|

2 Buyer/Grantee |

|

|

|

|

|

|||||||||

|

Name |

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Phone (including area code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Phone (including area code) |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

3 Send all property tax correspondence to: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Same as Buyer/Grantee |

|

|

|

List all real and personal property tax |

Personal |

Assessed |

|||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

parcel account numbers |

property? |

value(s) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Street address of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

This property is located in |

Select Location |

|

(for unincorporated locations please select your county) |

|

|

|

|||||||||||||||||

Check box if any of the listed parcels are being segregated from another parcel, are part of a boundary line adjustment or parcels being merged. Legal description of property (if you need more space, attach a separate sheet to each page of the affidavit).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

7 List all personal property (tangible and intangible) included in selling |

|||||||||||

|

Select land use code(s) |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

price. |

|

|

|

|

|||||

|

Enter any additional codes |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(see back of last page for instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Was the seller receiving a property tax exemption or deferral |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

If claiming an exemption, list WAC number and reason for exemption. |

||||||||||||||||

|

under RCW 84.36, 84.37, or 84.38 (nonprofit org., senior |

|

|

|

|

|

||||||||||||||||

|

citizen or disabled person, homeowner with limited income)? |

Yes |

No |

|

WAC number (section/subsection) |

|

|

|

|

|||||||||||||

Is this property predominantly used for timber (as classified |

|

|

|

|

|

Reason for exemption |

|

|

|

|

||||||||||||

|

under RCW 84.84 and 84.33) or agriculture (as classified |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

under RCW 84.34.020)? See ETA 3215. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If yes, complete the predominate use calculator (see instructions for |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

section 5). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

6 |

Is this property designated as forest land per RCW 84.33? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Type of document |

|

|

|

|

|

|

|

|||||||||||||

|

Is this property classified as current use (open space, farm |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

Date of document |

|

|

|

|

|

|

|

|

||||||||

|

and agricultural, or timber) land per RCW 84.34? |

Yes |

No |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

Gross selling price |

|

0.00 |

||||||||||||||||

|

Is this property receiving special valuation as historical |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

property per RCW 84.26? |

|

Yes |

No |

|

|

*Personal property (deduct) |

|

0.00 |

|||||||||||||

|

If any answers are yes, complete as instructed below. |

|

|

|

|

|

|

0.00 |

||||||||||||||

|

|

|

|

|

|

|

Exemption claimed (deduct) |

|

||||||||||||||

|

(1) NOTICE OF CONTINUANCE (FOREST LAND OR CURRENT USE) |

|

|

|

|

0.00 |

||||||||||||||||

|

|

|

|

|

|

|

|

|

Taxable selling price |

|

||||||||||||

|

NEW OWNER(S): To continue the current designation as forest land |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||

|

or classification as current use (open space, farm and agriculture, or |

|

|

|

|

|

|

|

|

Excise tax: state |

|

|||||||||||

|

timber) land, you must sign on (3) below. The county assessor must then |

|

|

|

|

|

|

0.00 |

||||||||||||||

|

|

Less than $500,000.01 at 1.1% |

|

|||||||||||||||||||

|

determine if the land transferred continues to qualify and will indicate |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||||||

|

by signing below. If the land no longer qualifies or you do not wish to |

|

|

|

From $500,000.01 to $1,500,000 at 1.28% |

|

||||||||||||||||

|

continue the designation or classification, it will be removed and the |

|

|

|

|

0.00 |

||||||||||||||||

|

|

|

|

From $1,500,000.01 to $3,000,000 at 2.75% |

|

|||||||||||||||||

|

compensating or additional taxes will be due and payable by the seller |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||||||

|

or transferor at the time of sale (RCW 84.33.140 or 84.34.108). Prior to |

|

|

|

|

|

Above $3,000,000 at 3% |

|

||||||||||||||

|

signing (3) below, you may contact your local county assessor for more |

|

|

|

|

|

|

|

0.00 |

|||||||||||||

|

|

|

|

Agricultural and timberland at 1.28% |

|

|||||||||||||||||

|

information. |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||||||||

|

This land: |

does |

does not qualify for |

|

|

|

|

|

|

|

|

|

Total excise tax: state |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

continuance. |

|

|

|

|

|

|

|

|

|

0.0000 |

|

Local |

|

0.00 |

|||||||

____________________________________ ____________________ |

|

|

|

0.00 |

||||||||||||||||||

|

|

|

|

*Delinquent interest: state |

||||||||||||||||||

|

Deputy assessor signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

Local |

|

0.00 |

|||||

|

(2) NOTICE OF COMPLIANCE (HISTORIC PROPERTY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

*Delinquent penalty |

|

|||||||||||

|

NEW OWNER(S): To continue special valuation as historic property, sign |

|

|

|

|

|

|

|||||||||||||||

|

(3) below. If the new owner(s) doesn’t wish to continue, all additional tax |

|

|

|

|

|

|

|

Subtotal |

|

0.00 |

|||||||||||

|

calculated pursuant to RCW 84.26, shall be due and payable by the seller |

|

|

|

|

|

|

|

|

5.00 |

||||||||||||

|

|

|

|

|

|

*State technology fee |

|

|||||||||||||||

|

or transferor at the time of sale. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

5.00 |

|||||||||||

|

|

|

|

(3) NEW OWNER(S) SIGNATURE |

|

|

|

|

|

|

|

|

|

Affidavit processing fee |

|

|||||||

____________________________ |

_________________________ |

|

|

|

|

|

|

|

|

Total due |

|

10.00 |

||||||||||

|

Signature |

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

____________________________ |

_________________________ |

|

|

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX |

||||||||||||||||||

|

Print name |

|

|

|

Print name |

|

|

|

|

|

|

|

|

|

|

*SEE INSTRUCTIONS |

|

|||||

|

8 I CERTIFY UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT |

|

|

|

|

|||||||||||||||||

|

|

Signature of grantor or agent _______________________________ |

|

Signature of grantee or agent __________________________ |

|

|||||||||||||||||

|

|

Name (print) |

|

|

|

|

|

|

|

|

|

Name (print) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Date & city of signing |

|

|

|

|

|

|

|

|

Date & city of signing |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Perjury in the second degree is a class C felony which is punishable by confinement in a state correctional institution for a maximum term of five years, or by

a fine in an amount fixed by the court of not more than $10,000, or by both such confinement and fine (RCW 9A.72.030 and RCW 9A.20.021(1)(c)).

To ask about the availability of this publication in an alternate format for the visually impaired, please call |

||

|

(TTY) users may use the WA Relay Service by calling 711. |

|

84 0001a (3/12/21) |

THIS SPACE TREASURER’S USE ONLY |

DEPARTMENT OF REVENUE |

Print on legal size paper.

Page 3 of 6

|

|

|

|

|

|

|

|

Real Estate Excise Tax Affidavit (RCW 82.45 WAC |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

Only for sales in a single location code on or after January 1, 2020. |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

This affidavit will not be accepted unless all areas on all pages are fully completed. |

|

|

|

|||||||||||||

|

Form 84 0001a |

|

|

|

This form is your receipt when stamped by cashier. Please type or print. |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

Check box if partial sale, indicate % |

|

|

sold. |

|

|

|

|||||||||||

|

Check box if the sale occurred in more than one location code. |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

List percentage of ownership acquired next to each name. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

1 Seller/Grantor |

|

|

|

|

|

|

|

|

2 Buyer/Grantee |

|

|

|

|

|

|||||||||

|

Name |

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Phone (including area code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

Phone (including area code) |

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

3 Send all property tax correspondence to: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Same as Buyer/Grantee |

|

|

|

List all real and personal property tax |

Personal |

Assessed |

|||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

parcel account numbers |

property? |

value(s) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City/state/zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Street address of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

This property is located in |

Select Location |

|

(for unincorporated locations please select your county) |

|

|

|

|||||||||||||||||

Check box if any of the listed parcels are being segregated from another parcel, are part of a boundary line adjustment or parcels being merged. Legal description of property (if you need more space, attach a separate sheet to each page of the affidavit).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

7 List all personal property (tangible and intangible) included in selling |

|||||||||||||

|

Select land use code(s) |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

price. |

|

|

|

|

|

||||||

|

Enter any additional codes |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(see back of last page for instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Was the seller receiving a property tax exemption or deferral |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

If claiming an exemption, list WAC number and reason for exemption. |

||||||||||||||||||

|

under RCW 84.36, 84.37, or 84.38 (nonprofit org., senior |

|

|

|

|

|

||||||||||||||||||

|

citizen or disabled person, homeowner with limited income)? |

Yes |

No |

|

WAC number (section/subsection) |

|

|

|

|

|

||||||||||||||

Is this property predominantly used for timber (as classified |

|

|

|

|

|

Reason for exemption |

|

|

|

|

|

|||||||||||||

|

under RCW 84.84 and 84.33) or agriculture (as classified |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

under RCW 84.34.020)? See ETA 3215. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

If yes, complete the predominate use calculator (see instructions for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

section 5). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

6 |

Is this property designated as forest land per RCW 84.33? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Type of document |

|

|

|

|

|

|

|

|

||||||||||||||

|

Is this property classified as current use (open space, farm |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

Date of document |

|

|

|

|

|

|

|

|

|

|

||||||||

|

and agricultural, or timber) land per RCW 84.34? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

Gross selling price |

|

|

0.00 |

||||||||||||||||

|

Is this property receiving special valuation as historical |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

property per RCW 84.26? |

|

Yes |

No |

|

|

*Personal property (deduct) |

|

|

0.00 |

||||||||||||||

|

If any answers are yes, complete as instructed below. |

|

|

|

|

|

|

|

0.00 |

|||||||||||||||

|

|

|

|

|

|

|

Exemption claimed (deduct) |

|

|

|||||||||||||||

|

(1) NOTICE OF CONTINUANCE (FOREST LAND OR CURRENT USE) |

|

|

|

|

|

0.00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Taxable selling price |

|

|||||||||||||

|

NEW OWNER(S): To continue the current designation as forest land |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

or classification as current use (open space, farm and agriculture, or |

|

|

|

|

|

|

|

|

|

Excise tax: state |

|

||||||||||||

|

timber) land, you must sign on (3) below. The county assessor must then |

|

|

|

|

|

|

|

0.00 |

|||||||||||||||

|

|

Less than $500,000.01 at 1.1% |

|

|

||||||||||||||||||||

|

determine if the land transferred continues to qualify and will indicate |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||||||||

|

by signing below. If the land no longer qualifies or you do not wish to |

|

|

|

From $500,000.01 to $1,500,000 at 1.28% |

|

||||||||||||||||||

|

continue the designation or classification, it will be removed and the |

|

|

|

|

0.00 |

||||||||||||||||||

|

|

|

|

From $1,500,000.01 to $3,000,000 at 2.75% |

|

|

||||||||||||||||||

|

compensating or additional taxes will be due and payable by the seller |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

0.00 |

|||||||||||||||||||

|

or transferor at the time of sale (RCW 84.33.140 or 84.34.108). Prior to |

|

|

|

|

|

|

Above $3,000,000 at 3% |

|

|||||||||||||||

|

signing (3) below, you may contact your local county assessor for more |

|

|

|

|

|

|

|

|

0.00 |

||||||||||||||

|

|

|

|

Agricultural and timberland at 1.28% |

|

|

||||||||||||||||||

|

information. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

0.00 |

|||||||||||||

|

This land: |

does |

does not qualify for |

|

|

|

|

|

|

|

|

|

|

Total excise tax: state |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

continuance. |

|

|

|

|

|

|

|

|

|

|

|

Local |

|

0.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

0.0000 |

|

|

|

||||||||||

____________________________________ ____________________ |

|

|

|

0.00 |

||||||||||||||||||||

|

|

|

|

*Delinquent interest: state |

||||||||||||||||||||

|

Deputy assessor signature |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Local |

|

|

0.00 |

|||||

|

(2) NOTICE OF COMPLIANCE (HISTORIC PROPERTY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

*Delinquent penalty |

|

|

|||||||||||

|

NEW OWNER(S): To continue special valuation as historic property, sign |

|

|

|

|

|

|

|

||||||||||||||||

|

(3) below. If the new owner(s) doesn’t wish to continue, all additional tax |

|

|

|

|

|

|

|

|

Subtotal |

|

0.00 |

||||||||||||

|

calculated pursuant to RCW 84.26, shall be due and payable by the seller |

|

|

|

|

|

|

|

|

|

5.00 |

|||||||||||||

|

|

|

|

|

|

|

*State technology fee |

|

|

|||||||||||||||

|

or transferor at the time of sale. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

5.00 |

||||||||||||

|

|

|

|

(3) NEW OWNER(S) SIGNATURE |

|

|

|

|

|

|

|

|

|

|

Affidavit processing fee |

|

||||||||

____________________________ |

_________________________ |

|

|

|

|

|

|

|

|

|

Total due |

|

|

10.00 |

||||||||||

|

Signature |

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

____________________________ |

_________________________ |

|

|

A MINIMUM OF $10.00 IS DUE IN FEE(S) AND/OR TAX |

||||||||||||||||||||

|

Print name |

|

|

|

Print name |

|

|

|

|

|

|

|

|

|

|

|

*SEE INSTRUCTIONS |

|

||||||

|

8 I CERTIFY UNDER PENALTY OF PERJURY THAT THE FOREGOING IS TRUE AND CORRECT |

|

|

|

|

|

||||||||||||||||||

|

|

Signature of grantor or agent _______________________________ |

|

Signature of grantee or agent __________________________ |

|

|||||||||||||||||||

|

|

Name (print) |

|

|

|

|

|

|

|

|

|

Name (print) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Date & city of signing |

|

|

|

|

|

|

|

|

Date & city of signing |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Perjury in the second degree is a class C felony which is punishable by confinement in a state correctional institution for a maximum term of five years, or by

a fine in an amount fixed by the court of not more than $10,000, or by both such confinement and fine (RCW 9A.72.030 and RCW 9A.20.021(1)(c)).

To ask about the availability of this publication in an alternate format for the visually impaired, please call |

||

|

(TTY) users may use the WA Relay Service by calling 711. |

|

84 0001a(3/12/21) |

THIS SPACE TREASURER’S USE ONLY |

TAXYPAYER |

Print form

Print form

Print on legal size paper.

Page 4 of 6

Instructions

Note: To report a transfer of a controlling interest in real property, please use the Real Estate Excise Tax Affidavit Controlling Interest Transfer Return, Revenue Form No.

Section 1:

If the sale involves property in more than one location code, use the Multiple Location Real Estate Excise Tax Affidavit. If sale is less than 100%, check the box “Check if partial sale” and bill in the percentage sold.

Enter the name(s) of seller/grantor exactly as listed on the legal conveyance document including the method of holding title.

Section 2:

Enter the name(s) of buyer/grantee exactly as listed on the legal conveyance document including the method of holding title. List the percentage acquired after each name.

Sect on 3:

•Enter the name and address where you would like all future property tax information sent.