Printable Small Estate Affidavit Form for Washington

In the aftermath of a loved one's passing, the process of managing and distributing their assets can be emotionally challenging and legally complex. For individuals in Washington State seeking a streamlined method to handle small estates, the Washington Small Estate Affidainty form emerges as a beneficial tool. This form is specifically designed to simplify the legal process for estates that fall below a certain value threshold, allowing for a more expedited transfer of assets to rightful heirs without the need for a formal probate process. It crucially serves those who find themselves navigating the intricacies of estate management by offering a clear, less burdensome path forward. The utilization of this form is subject to specific qualifications regarding the estate's total value and the type of assets involved, emphasizing the importance of understanding its applicability to an individual's specific circumstances. By adequately completing and filing the form according to the state's requirements, eligible parties can significantly reduce the time and expense associated with estate settlement, ultimately providing a measure of relief during a difficult time.

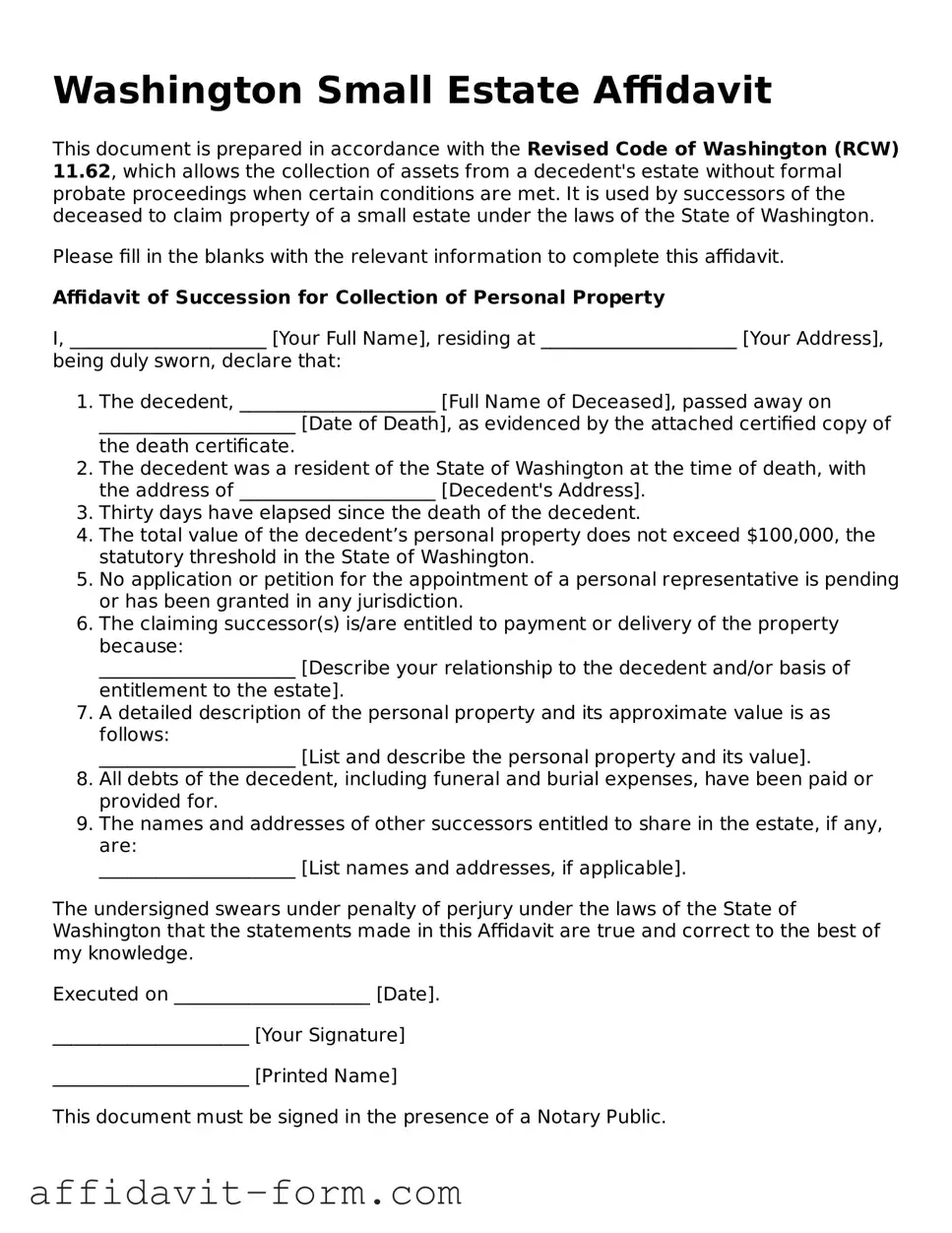

Form Example

Washington Small Estate Affidavit

This document is prepared in accordance with the Revised Code of Washington (RCW) 11.62, which allows the collection of assets from a decedent's estate without formal probate proceedings when certain conditions are met. It is used by successors of the deceased to claim property of a small estate under the laws of the State of Washington.

Please fill in the blanks with the relevant information to complete this affidavit.

Affidavit of Succession for Collection of Personal Property

I, _____________________ [Your Full Name], residing at _____________________ [Your Address], being duly sworn, declare that:

- The decedent, _____________________ [Full Name of Deceased], passed away on _____________________ [Date of Death], as evidenced by the attached certified copy of the death certificate.

- The decedent was a resident of the State of Washington at the time of death, with the address of _____________________ [Decedent's Address].

- Thirty days have elapsed since the death of the decedent.

- The total value of the decedent’s personal property does not exceed $100,000, the statutory threshold in the State of Washington.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The claiming successor(s) is/are entitled to payment or delivery of the property because:

_____________________ [Describe your relationship to the decedent and/or basis of entitlement to the estate]. - A detailed description of the personal property and its approximate value is as follows:

_____________________ [List and describe the personal property and its value]. - All debts of the decedent, including funeral and burial expenses, have been paid or provided for.

- The names and addresses of other successors entitled to share in the estate, if any, are:

_____________________ [List names and addresses, if applicable].

The undersigned swears under penalty of perjury under the laws of the State of Washington that the statements made in this Affidavit are true and correct to the best of my knowledge.

Executed on _____________________ [Date].

_____________________ [Your Signature]

_____________________ [Printed Name]

This document must be signed in the presence of a Notary Public.

State of Washington

County of _____________________

Subscribed and sworn to before me this ______ day of _______________, 20__.

_____________________ [Notary Signature]

_____________________ [Printed Name of Notary]

Notary Public in and for the State of Washington, residing at _____________________.

My commission expires _____________________.

Document Details

| Fact Name | Description |

|---|---|

| Purpose | Allows for the simplified transfer of assets from an estate without formal probate. |

| Eligibility | Estates with personal property valued at $100,000 or less. |

| Governing Law | RCW 11.62.010 - The Revised Code of Washington is the governing law for the Small Estate Affidavit. |

| Required Information | Includes the decedent's information, the claimant's attestation, a description of the property, and the value of the estate. |

| Limitations | Cannot be used for real estate transactions or if the estate exceeds the specified value limit. |

How to Use Washington Small Estate Affidavit

Filling out the Washington Small Estate Affidavit form is a straightforward process. This document is used when the value of the deceased's estate does not exceed the defined small estate limit in Washington state. Once completed and submitted, this affidavit allows for the distribution of the deceased's assets without the need for a formal probate process. It’s important for individuals who are entitled to these assets to complete the form accurately to ensure a smooth asset transfer.

- Gather all necessary documents related to the deceased's estate, including their death certificate and a list of assets.

- Confirm that the total value of the estate meets the small estate threshold in Washington state.

- Begin filling out the form by entering the full legal name of the deceased as well as the date of death in the designated sections.

- Provide the legal description and value of all assets within the estate. This information should include bank accounts, real estate, and personal property among others.

- List the names and addresses of all heirs or beneficiaries entitled to receive a portion of the estate.

- Calculate and note any debts owed by the estate, including funeral expenses, taxes, and other outstanding obligations.

- Sign the form in front of a notary public. Ensure that any other required parties also sign the document as necessary.

- Submit the completed form along with any required attachments to the appropriate county clerk's office in Washington state.

After submitting the Small Estate Affidit form, the next step involves the court reviewing the submitted documents. If everything is in order and the form has been properly completed, the court will issue an order allowing the distribution of the estate's assets according to the listed beneficiaries. It's essential to keep copies of all submitted documents for personal records and future reference. This process significantly simplifies estate resolution by negating the need for a lengthy probate process.

Listed Questions and Answers

What is a Small Estate Affidavit in Washington?

A Small Estate Affidavit is a legal document used in the state of Washington to manage and distribute a deceased person's estate without the need for a formal probate court process. This document can be used when the total value of the personal property in the estate does not exceed a certain amount, allowing for a simpler transfer of assets to beneficiaries or heirs.

Who is eligible to use the Small Estate Affidavit in Washington?

In Washington, the eligibility to use a Small Estate Affidavit is primarily determined by the total value of the estate's assets. The estate must be valued at $100,000 or less, and it only applies to personal property, excluding real estate. The person claiming the property, often a surviving spouse or other relative, must attest that all debts including taxes of the estate are paid or provided for before the affidavit is used.

What are the steps to file a Small Estate Affidavit in Washington?

- Ensure the estate qualifies by evaluating if the total value of the personal property is $100,000 or less and if 40 days have passed since the decedent's death.

- Gather required information such as a death certificate and an inventory of the estate's assets.

- Complete the Small Estate Affidavit form, available from the local court or online resources.

- Notify all heirs and anyone who may have a legal interest in the estate about the intent to use the affidavit.

- File the completed affidavit with relevant entities such as banks or the Department of Motor Vehicles to transfer property.

What information is needed to complete the affidavit?

To complete the Small Estate Affidavit, the following information is typically required:

- The full legal name and date of death of the deceased.

- A detailed list of all personal property included in the estate.

- The estimated value of each item of property.

- The names and addresses of all heirs or persons entitled to receive the property.

- An assurance that the estate's debts and taxes have been paid or will be paid.

Where can one find the Small Estate Affidavit form for Washington?

The form for the Small Estate Affidavit in Washington can typically be found at local court offices or online through the Washington State Courts' official website. It is advisable to ensure that the form is the current version and meets the latest requirements as outlined by state law.

Are there any filing fees for a Small Estate Affidavit in Washington?

While the Small Estate Affidavit process is designed to be simpler and less costly than formal probate, there may still be nominal filing fees associated with the process. These fees can vary depending on the county. It is recommended to consult with the local court clerk for the specific fees applicable in your area.

How long does the process take once the affidavit is filed?

After the Small Estate Affidavit is filed, the time it takes to transfer the assets can vary. Generally, the process can be completed quickly once all necessary paperwork is submitted and approved. However, the timeline can be affected by factors such as the responsiveness of financial institutions and the accuracy of the information provided in the affidavit.

Can real estate be transferred using the Small Estate Affidavit in Washington?

No, the Small Estate Affidavit in Washington is not applicable for the transfer of real estate. It is only intended for the distribution of personal property valued at $100,000 or less. The transfer of real estate often requires a more formal probate process or other legal mechanisms.

What happens if someone contests the use of a Small Estate Affidavit?

If the use of a Small Estate Affidavit is contested, the matter may need to be resolved in court. Contesting parties could include omitted heirs or creditors with claims against the estate. In such cases, it may be necessary to transition to a formal probate process to ensure that all legal concerns and claims are addressed appropriately.

Common mistakes

The Washington Small Estate Affidavit form is a crucial document for those seeking to settle an estate without formal probate in Washington State. However, mistakes in completing this form can lead to unnecessary delays, additional expenses, or even legal challenges. Here are four common errors individuals should avoid:

Incorrectly calculating the estate's value – Often, individuals misinterpret the criteria for a small estate in Washington. The total value of the estate's assets, excluding certain types of property like vehicles and personal property under a specific value, must not exceed $100,000. Accurate calculation is crucial, as overestimating or underestimating can result in the rejection of the affidavit.

Failing to properly identify and notify all heirs – The law requires that all heirs and legatees (people named in the will) are identified and notified. This step is often overlooked or improperly executed. Each must be given notice of the affidavit being filed, which ensures transparency and prevents potential disputes.

Omitting necessary documents – Along with the Small Estate Affidavit, certain supporting documents must be attached. These may include the death certificate, proof of the decedent's ownership of assets, and any existing will. Failure to attach these documents can result in processing delays or the affidavit being deemed incomplete.

Not understanding the affidavit's legal implications – Some individuals may not fully grasp the legal responsibilities and potential liabilities involved in signing the affidavit. For instance, an affiant (the person filling out the form) can be held liable to injured parties if the affidavit is inaccurately completed or if estate assets are improperly distributed. A thorough understanding of these implications is essential.

Ultimately, careful attention to detail and a comprehensive understanding of the legal requirements are vital when completing the Washington Small Estate Affidavit form. When in doubt, consulting with a legal expert specializing in estate planning or probate law in Washington State can help avoid these common mistakes and ensure the process goes smoothly.

Documents used along the form

When navigating the aftermath of a loved one's passing in Washington state, utilizing a Small Estate Affidavit form is a pragmatic approach for the expedited distribution of the decedent's assets. This document alone can suffice in certain cases, yet it often works in conjunction with an array of other forms and legal documents to ensure a comprehensive approach to estate management and asset transfer. Below is a list of documents typically used alongside the Small Estate Affidavit form, each serving a crucial role in the broader context of estate planning and administration.

- Death Certificate: This is an official document proving the death of the decedent. It is vital for validating the Small Estate Affidavit and is often required by financial institutions and other entities before assets can be transferred.

- Last Will and Testament: If the decedent left a will, it outlines their wishes regarding the distribution of their assets and the executor of their estate. This document can guide the use of the Small Estate Affidavit.

- Letters Testamentary or Letters of Administration: Issued by the court, these documents authorize an individual to act on behalf of the decedent’s estate. They're necessary if the estate goes through a formal probate process.

- Certificate of Real Estate Value: If real estate is involved, this form is used for tax purposes to document the property's value at the time of the decedent’s death.

- Vehicle Title Transfer Forms: These are required to officially transfer ownership of vehicles owned by the decedent. The Department of Licensing needs this for the record update.

- Bank Account Closure Forms: These forms facilitate the process of closing the decedent’s bank accounts and transferring funds according to the Small Estate Affidavit or as per the decedent’s will.

- Stock Transfer Forms: If the decedent owned stocks, these forms are necessary to transfer ownership to the beneficiaries named in the Small Estate Affididavit or will.

- Life Insurance Claim Forms: Beneficiaries must submit these forms to claim life insurance payouts. The process may be simplified if the Small Estate Affidavit is accepted by the insurance company.

- Financial Institution Affidavit Form: Some banks and financial institutions have their own affidavit forms to facilitate the transfer of the decedent's assets. These are particularly useful when dealing with accounts in the decedent’s sole name.

The path to settling an estate is notably intricate, involving more than just filling out and filing a Small Estate Affidavit. Each document plays a unique role in affirming the rights of the beneficiaries and ensuring compliance with state laws and protocols. It is pragmatic to consult with a legal professional who can guide you through the process, ensuring that all paperwork is accurately completed and submitted. Properly managing these documents can significantly streamline the asset distribution process, making it as smooth and efficient as possible for all parties involved.

Similar forms

The Washington Small Estate Affidavit form is similar to various legal documents used in probate and estate planning processes. These documents, while distinct in their purposes, share common features with the Small Estate Affidavit in terms of simplifying the legal procedures associated with transferring the property of a deceased person. Below, three key documents similar in nature to the Small Estate Affidavit are outlined, detailing how each compares and contrasts in functionality and usage.

Simple Will

A Simple Will shares similarities with the Washington Small Estate Affidaid form in that it directs the disposition of an individual's assets upon death. Like the Small Estate Affidavit, a Simple Will aims to simplify the distribution of assets, albeit in a proactive manner, outlining the individual’s wishes before death. Both documents serve to expedite the legal process and ensure the decedent’s property is distributed according to their wishes or, in absence of a will, the state's laws. However, unlike the affidavit which is used posthumously to claim property without going through a lengthy probate process, a Simple Will typically requires probate, a process that involves validating the will, paying debts, and distributing the remaining property as instructed.

Transfer on Death (TOD) Deed

Like the Small Estate Affidavit, a Transfer on Death (TOD) Deed allows for the direct transfer of property to a beneficiary upon the owner’s death, bypassing the traditional probate process. Both documents share the goal of streamlining the transfer of assets and making the process as straightforward as possible. A TOD Deed, however, is executed by the property owner while alive and only takes effect upon their death, directly transferring real estate to the named beneficiary. Although similar in their purpose to avoid complicated legal processes, the Small Estate Affidavit applies more broadly to personal property, bank accounts, and other assets, not just real estate.

Joint Tenancy Agreement

A Joint Tenancy Agreement is another document with similar objectives to the Washington Small Estate Affidavit, particularly in easing the transfer of asset ownership upon death. In a Joint Tenancy, two or more people own property together with rights of survivorship, meaning upon the death of one joint tenant, the surviving tenant(s) automatically assume ownership of the decedent's share. This immediate transfer mirrors the expedited nature of the Small Estate Affidavit but is distinct in that it concerns only real estate and must be established while all parties are alive. Furthermore, a Joint Tenancy is a form of property title, whereas the Small Estate Affidavit is a post-death legal instrument used to collect the deceased's assets without probate.

Dos and Don'ts

When dealing with the completion of the Washington Small Estate Affidavit form, understanding what to do and what not to do can streamline the process and help avoid common pitfalls. Below are key guidelines to follow.

Do:

Double-check all the information you provide for accuracy. Ensure names, dates, and addresses are correct and reflect what is on official documents.

Review the eligibility criteria thoroughly before starting the form to make sure the estate qualifies as a 'small estate' under Washington State law.

Gather and attach necessary documents, such as the death certificate and proof of your relationship to the deceased, before submitting the affidavit.

Seek legal advice if you are unsure about any part of the process or the information required. A professional can provide valuable insight and help avoid errors.

Don't:

Do not rush through filling out the form. Take your time to understand each section and what is being asked to ensure the information provided is complete and accurate.

Avoid guessing on any part of the form. If you are unsure about an answer, it's better to seek clarification than to risk providing incorrect information.

Do not overlook the total value limit of the estate for it to qualify as a 'small estate' under Washington law, which may change over time. Make sure the estate falls within the current threshold.

Resist the temptation to submit the form without checking with all potential heirs and beneficiaries. Their rights and interests need to be considered and properly addressed.

Misconceptions

Only Family Members Can File the Small Estate Affidavit: A common misconception is that the Washington Small Estate Affidavit can only be filed by family members of the deceased. In reality, any person owed money by the estate or having a lawful interest in the estate can file this affidavit, given that they meet the state's requirements.

The Process Is Instantaneous: Many believe that using the Small Estate Affidavit leads to an immediate transfer of property. However, there is a mandatory waiting period of forty days after the death before the affidavit can be presented to the holder of the estate assets.

It’s Valid for All Asset Types: It's often misunderstood that the Small Estate Affidavit can be used for transferring all types of assets. This form is specifically for personal property like bank accounts and vehicles, and does not apply to real estate or other types of assets requiring different processes.

No Limit on the Estate’s Value: There is a misconception that there's no cap on the value of the estate for the Small Estate Affidavit to be applicable. In Washington, the estate must not exceed $100,000 in value for the affidavit to be used, not including liens and encumbrances.

It Overrides a Will: Another incorrect belief is that the affidavit overrides the deceased person's will. The affidavit process is intended to simplify the transfer of assets in agreement with the decedent’s will or, in the absence of a will, according to state intestacy laws.

Court Approval Is Not Needed: While it's true that filing a Small Estate Affidavit is more straightforward than going through probate, it's incorrect to assume court approval isn't required. Submission and acceptance of the document by the appropriate financial institutions and entities are needed, but this doesn't equate to formal court probate proceedings.

Unlimited Time Frame for Filing: People often believe there's no time limit in which to file the affidavit. Although Washington law is more flexible compared to other jurisdictions, there's an implied reasonable time frame within which the affidavit should be filed, generally suggested to be within the same year as the death.

Debts of the Deceased Are Ignored: A serious misconception is that filing a Small Estate Affidavit means debts of the deceased don't have to be paid. The truth is, the assets distributed through this affidavit are still subject to lawful claims by creditors, and certain debts may be prioritized over others.

It Can Transfer Title to Real Estate: Lastly, many mistakenly think that this form can facilitate the transfer of real estate titles. In Washington, the Small Estate Affidavit applies to personal property only. Real estate transactions require a different legal process and cannot be handled through this affidavit.

Key takeaways

When handling the affairs of someone who has passed away in Washington State, a Small Estate Affidavit can be a straightforward way to manage their estate if it qualifies as "small" under state law. Understanding how to correctly fill out and use this document can simplify the process. Here are six key takeaways to help guide you:

- Qualifying Estates: The estate must meet specific criteria to be considered small. As of the last update, the total value of the estate's assets must not exceed a certain threshold, which Washington State sets. It's crucial to verify the most current threshold to determine eligibility.

- Listing Assets Correctly: Accurately listing all assets that belong to the estate is essential. This includes bank accounts, vehicles, and personal property. However, certain assets, such as life insurance and retirement accounts that have designated beneficiaries, should not be included in this calculation.

- Wait Period: There is a mandatory waiting period before you can file the affidavit, starting from the date of death. This period allows for all creditors to be notified and gives them time to make claims on the estate.

- Legal Declarations: The affidavit requires you to make several legal declarations. These include affirming the estate qualifies as small, that you are rightfully entitled to the property, and that there are no disputes over the estate among heirs.

- Notarization: The form must be notarized to be legally valid. This step involves signing the document in front of a notary public, who verifies your identity and acknowledges that you signed the document willingly.

- Filing with Appropriate Entities: Once completed and notarized, the affidavit may need to be filed with certain entities or presented to others to collect the assets. This could include banks, the Department of Licensing for vehicle titles, or other organizations holding the estate's assets.

Correctly filling out and using the Washington Small Estate Affidavit form can streamline the process of managing a small estate, making it easier for heirs to distribute the assets of their loved one. Always ensure you have the most current information and consider consulting with a legal expert to navigate the process effectively.

Fill out Popular Small Estate Affidavit Forms for Different States

Affidavit of Heirship Alabama - Its usage is a testament to the legal system's adaptability, offering solutions tailored to the needs of less complex estates.

Small Estate Affidavit Montana - The affidavit requires detailed information about the deceased’s assets and debts to ensure a fair distribution among heirs.

Connecticut Probate Fees - When completed correctly, it provides a legally binding testament to the rightful distribution of the deceased's tangible personal property.