Printable Small Estate Affidavit Form for West Virginia

When a loved one passes away in West Virginia, managing their estate can seem like a daunting process. Fortunately, for smaller estates, the State provides a simplified procedure through the use of a Small Estate Affidavit form. This legal document allows for the expedited transfer of the deceased's assets to their rightful heirs without the need for a prolonged probate process. Designed to ease the burden during a time of grief, it applies to estates that fall below a specific value threshold, making it an optimal choice for many families. The form must be accurately completed and filed with the appropriate county office, a step that requires attention to detail to ensure that all information provided is correct and complies with West Virginia law. It stands as a testament to the state's commitment to streamlining legal proceedings for its residents, significantly reducing the time and costs associated with distributing a loved one's estate. Understanding the major aspects of the Small Estate Affidavit form is crucial for those navigating this process, as it sets forth the foundational steps towards a smoother transition during a period of loss.

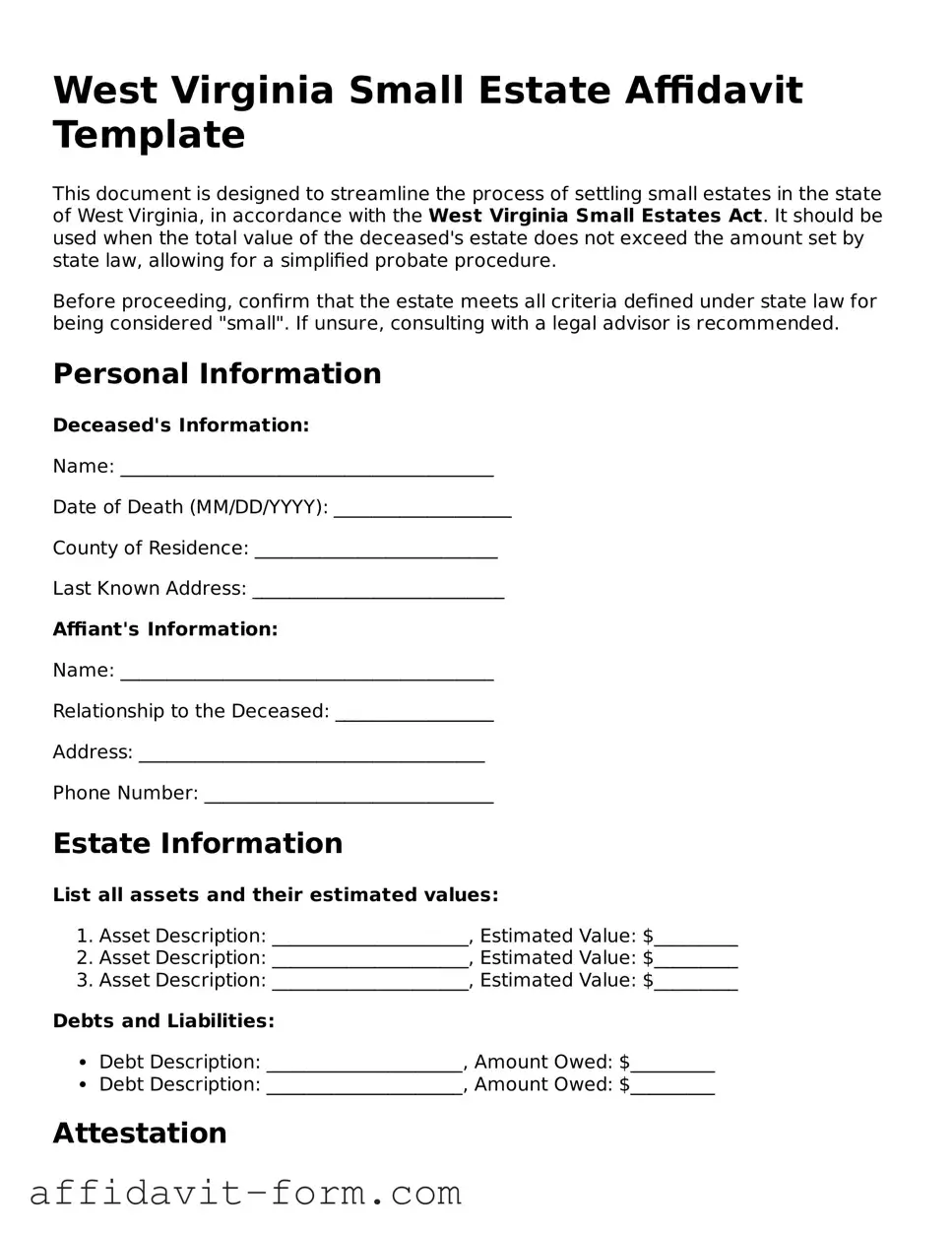

Form Example

West Virginia Small Estate Affidavit Template

This document is designed to streamline the process of settling small estates in the state of West Virginia, in accordance with the West Virginia Small Estates Act. It should be used when the total value of the deceased's estate does not exceed the amount set by state law, allowing for a simplified probate procedure.

Before proceeding, confirm that the estate meets all criteria defined under state law for being considered "small". If unsure, consulting with a legal advisor is recommended.

Personal Information

Deceased's Information:

Name: ________________________________________

Date of Death (MM/DD/YYYY): ___________________

County of Residence: __________________________

Last Known Address: ___________________________

Affiant's Information:

Name: ________________________________________

Relationship to the Deceased: _________________

Address: _____________________________________

Phone Number: _______________________________

Estate Information

List all assets and their estimated values:

- Asset Description: _____________________, Estimated Value: $_________

- Asset Description: _____________________, Estimated Value: $_________

- Asset Description: _____________________, Estimated Value: $_________

Debts and Liabilities:

- Debt Description: _____________________, Amount Owed: $_________

- Debt Description: _____________________, Amount Owed: $_________

Attestation

I, _______________________(Affiant's Name), declare under penalty of perjury that the information provided herein is true and accurate to the best of my knowledge and belief. I understand that this affidavit is being made for the purpose of collecting the small estate of the deceased, in accordance with the laws of the State of West Virginia, and for no other purpose.

Date: ___________________

Affiant's Signature: ___________________________

State of West Virginia

County of ___________________

Subscribed and sworn to before me this ____ day of _______________, 20__.

Notary Public: _______________________________

Commission Expires: __________________________

Document Details

| Fact | Description |

|---|---|

| Eligibility | Only estates valued at $50,000 or less qualify for the West Virginia Small Estate Affidavit process. |

| Required Waiting Period | There is a 30-day waiting period from the date of death before an affidavit can be filed. |

| Governing Law | The process is governed by §44-3A-11a of the West Virginia Code. |

| Main Purpose | It allows for the transfer of a deceased's assets without formal probate. |

How to Use West Virginia Small Estate Affidavit

Navigating the aftermath of a loved one's passing is a complex process, laden with legal paperwork and procedures. Among these, the West Virginia Small Estate Affidavit form offers a pathway to simplify the settlement of an estate that falls under a certain value threshold. It's a tool designed to expedite the legal hoops, allowing for the quick distribution of the deceased's assets to their rightful heirs without the need for a lengthy probate process. Understanding and filling out this form correctly is a crucial step for those eligible to use it, ensuring the smooth execution of their loved one's final affairs.

Here's a step-by-step guide to complete the West Virginia Small Estate Affidavit form:

- Gather the necessary documents: Before filling out the form, collect all relevant documents, including the death certificate and an inventory list of the deceased's assets and liabilities. These will help in accurately completing the form.

- Identify the heir(s) or legatee(s): Determine who the rightful heirs or legatees (if a will is present) of the estate are. This will include immediate family members, named beneficiaries, or others as dictated by West Virginia law.

- Calculate the estate's total value: Add up the total value of the deceased's assets. Remember, the estate must fall below the state-specific threshold to qualify for small estate processing.

- Complete the affidavit information: Fill out the form with the deceased's details, including their full name, date of death, and other required identifying information.

- Detail the assets and debts: List all assets within the estate, alongside any outstanding debts. Accuracy here is vital, as this information dictates the distribution of the estate.

- Sign and notarize the form: The affidavit must be signed in the presence of a notary public. This formalizes the document and adheres to state legal requirements.

- File the form with the local county clerk: Once completed and notarized, submit the affidavit to the county clerk's office in the county where the deceased person lived. There might be a filing fee, so it's wise to verify this beforehand.

- Notify financial institutions and other entities: With the completed affidavit, you’ll need to inform banks, credit unions, and other entities holding the deceased's assets. This is the final step in transferring assets to the legal heirs.

Completing the West Virginia Small Estate Affidavit form is a significant task that requires attention to detail and a thorough understanding of the estate in question. By following these steps carefully, individuals can navigate this process with confidence, ensuring that their loved one’s estate is settled fairly and expeditiously. Remember, this form is a legal document, and accuracy matters at every step of the way. When in doubt, seeking legal advice to guide you through the process can be incredibly valuable.

Listed Questions and Answers

What is a West Virginia Small Estate Affidavit?

A West Virginia Small Estate Affidavit is a legal document used to streamline the process of estate settlement for small estates in West Virginia. This form is specifically designed for situations where the deceased person's estate does not exceed a certain financial threshold, making it eligible for a more expedited and less complicated probate process. It allows the transfer of assets to the rightful heirs without requiring a formal probate court procedure.

Who is eligible to use the Small Estate Affidavit in West Virginia?

The eligibility to use a Small Estate Affidavit in West Virginia hinges on several criteria:

- The total value of the estate must not exceed $100,000.

- The deceased must have been a resident of West Virginia at the time of death.

- There must be no pending applications for the appointment of a personal representative in any jurisdiction.

What information is required to fill out the Small Estate Affidavit form?

To properly complete the Small Estate Affidavit form in WestVideoDoc, the following information is necessary:

- The full legal name and address of the decedent

- The date of death of the decedent

- A detailed list of the estate’s assets, including descriptions and values

- The names and addresses of the heirs entitled to the estate assets

- Documentation proving the affiant's right to the estate, such as a will (if applicable) or proof of kinship

Can real estate be transferred using the Small Estate Affidavit in West Virginia?

In West Virginia, real estate cannot be directly transferred using a Small Estate Affidavit. The affidavit only applies to personal property like bank accounts, vehicles, and household goods. If the decedent owned real estate, whether solely or as a tenant in common, other legal procedures are necessary to transfer ownership. This might involve a simplified probate process or, in some cases, a standard probate proceeding, depending on the circumstances surrounding the estate. For transferring real estate, seeking legal advice to understand the available options is advisable.

Common mistakes

When dealing with the sensitive task of filling out the West Virginia Small Estate Affidavit form, people often rush through the process or overlook crucial details. This form is instrumental in the administration of a deceased person's estate under a simplified procedure if the total value meets certain criteria. Mistakes made during this process can lead to delays, legal complications, or the outright dismissal of the affidavit. Here are four common errors to avoid:

Not Verifying Eligibility: One of the initial mistakes is not thoroughly checking whether the estate qualifies as a "small estate" under West Virginia law. The value threshold and criteria can change, leading some to assume eligibility without confirming the current standards.

Incomplete Information: Filling out the form in haste often results in leaving important sections incomplete. Every question on the form serves a purpose, whether it’s confirming the absence of a will or detailing the estate's assets and debts. Incomplete information can cause significant delays.

Incorrect Asset Valuation: Accurately valuing the assets of the estate is crucial. Mistakes in valuation, whether by overestimating or underestimating asset values, can affect the affidavit's validity. This error could also lead to disputes among heirs or beneficiaries.

Failing to Provide Necessary Documentation: The affidavit must be supported by relevant documents, such as death certificates and proof of the decedent's ownership of property. Neglecting to attach these documents or providing incomplete or incorrect documentation can result in the rejection of the affidavit.

Avoiding these mistakes requires taking the time to carefully read instructions, double-checking all entered information, accurately assessing the estate's value, and ensuring that all required documentation is complete and accurate. This attention to detail not only respects the decedent's legacy but also facilitates a smoother legal process for all parties involved.

Documents used along the form

When someone passes away in West Virginia, handling their estate often requires more than just a Small Estate Affidavit. This document is important for transferring property of a deceased person without a formal probate process, but it's usually just the beginning. Other forms and documents often come into play, each serving a unique role in the process of settling an estate. Let's explore some of these key documents which complement the Small Estate Affidavit,

- Death Certificate: A certified copy of the death certificate is crucial. It serves as official proof of death and is required by financial institutions, government agencies, and courts before they will transfer the deceased's assets.

- Last Will and Testament: If available, the deceased person’s will provides instructions on distributing their assets. It should be reviewed to determine if the Small Estate Affidavit procedure is appropriate.

- Letter of Administration: Required when there's no will. This document, issued by the court, authorizes someone to act as the administrator of the estate.

- Vehicle Title Transfer Forms: To transfer ownership of vehicles owned by the deceased, you'll need specific DMV forms that vary depending on the vehicle type.

- Real Estate Deed: If the estate includes real property, a new deed may be needed to transfer property to the beneficiaries or heirs.

- Bank Forms: Banks often have their own forms to fill out before they will release the deceased's assets, even when you have a Small Estate Affidavit.

- Stock and Bond Transfer Forms: Similar to banks, brokerage firms and transfer agents have specific forms for the transfer of securities without going through probate.

- Notice to Creditors: Although not always mandatory, publishing a notice to creditors in a local newspaper, allows unknown creditors to make claims against the estate.

This list is not exhaustive, but it covers some of the significant documents that are often needed alongside the Small Estate Affidavit in West Virginia. Each estate is unique, so the required documents might vary. Professional advice can be invaluable in navigating the complexities of estate settlement and ensuring that all legal obligations are met efficiently.

Similar forms

The West Virginia Small Estate Affidavit form is similar to several other documents used in the legal and estate planning fields, each serving a unique but somewhat related purpose. These documents include the General Affidavit, the Transfer on Death Deed, and the Durable Power of Attorney. Though they share commonalities with the Small Estate Affidavit in terms of legal functions relating to assets, property, or personal wishes, each differs in its specific application and requirements.

General Affidavit: The General Affidavit, much like the Small Estate Affidavit, is a sworn statement made in writing. However, it is used in a broader range of situations, not limited to estate matters. Both forms require the signer to state facts under oath, but the General Affidavit is adaptable, serving different legal needs that could range from personal declarations to financial disputes. Its versatility in function contrasts with the Small Estate Affidavit’s specialized use in expediting the transfer of a deceased person's assets.

Transfer on Death Deed (TODD): The Transfer on Death Deed, another document similar to the Small Estate Affidavit, directly concerns the passing of real estate upon the owner's death. While a Small Estate Affidavit facilitates the transfer of assets without a formal probate, the TODD designates a beneficiary to real property, effectively transferring the deed upon death. Both aim to simplify the process of transferring assets, but the TODD is exclusively for real estate and operates under specific registration and notarization requirements.

Durable Power of Attorney (DPOA): The Durable Power of Attorney shares the Small Estate Affidavit's concern with managing an individual's affairs, especially in preparation for future incapacity. Whereas the Small Estate Affidavit deals with the distribution of assets after death, a DPOA appoints a trusted person to handle the principal's affairs while they are still alive. This could include decisions regarding finances, health care, and other personal matters. The key difference is timing and applicability: the DPOA is effective during the principal’s lifetime, particularly when they are unable to make decisions themselves.

Dos and Don'ts

In managing the affairs of a deceased loved one in West Virginia, the Small Estate Affidavit form can simplify the probate process for estates that qualify under state law. It is essential, however, to approach this document with care and precision to avoid unnecessary delays or legal complications. Here are vital do's and don'ts to consider when filling out the form:

Do:

- Verify the estate's eligibility: Ensure the total value of the estate meets West Virginia's threshold for 'small estates', considering all assets that would typically pass through probate.

- Accurately identify and list all assets: Include all assets eligible for transfer under the affidavit, detailing their nature and value with accuracy.

- Confirm the waiting period has passed: West Virginia may require a specific period to elapse after the decedent's death before the affidavit can be filed. Ensure you comply with this timeframe.

- Obtain necessary documents: Gather all required documents, such as the death certificate and proof of rights to the assets, to support the statements in the affidavit.

- Clearly identify heirs or beneficiaries: Specify the rightful heirs or designated beneficiaries, providing clearrelationships to the decedent.

- Complete the affidavit in full: Do not leave any sections incomplete unless the form specifically indicates that it's optional.

- Sign the affidavit in the presence of a notary: Ensure the affidavit is notarized to affirm the authenticity of the signatures and the truthfulness of the information provided.

- File the affidavit with the correct county office: Submit the completed affidavit to the proper county court or relevant office where the decedent owned property or resided.

- Keep copies for your records: Retain a copy of the filed affidavit and all accompanying documentation for personal records and future reference.

- Seek legal advice if unsure: If any part of the process is unclear or if the estate's situation is complex, consulting with a legal professional is advised.

Don't:

- Fill out the form in haste: Rushing can lead to errors or omissions that may complicate the estate settlement process.

- Guess values or details: Estimating values of assets or providing unclear descriptions can result in discrepancies and potential challenges.

- Omit any eligible assets: Failure to include all assets that the affidavit covers can lead to incomplete or improper distribution.

- Forge or alter documents: All supporting documents must be original or certified copies to ensure legality and avoid fraud allegations.

- Misrepresent your relationship to the decedent: Falsely claiming to be an heir or misstating your relationship can have legal repercussions.

- Fail to notify co-heirs: All heirs or beneficiaries should be informed about the affidavit and the distribution of assets.

- Ignore filing deadlines: Adhere to any deadlines for submitting the affidavit to avoid delays in the estate's distribution.

- Disregard tax obligations: Be aware that certain assets may be subject to taxes. Properly addressing these obligations is crucial.

- Use the form for non-qualifying estates: If the estate exceeds the small estate threshold or has complicated legal issues, this form might not be appropriate.

- Attempt to resolve disputes with this form: If there are disagreements among heirs or questions about the will, seek legal assistance rather than trying to resolve these through the affidavit.

Misconceptions

When navigating the process of handling a loved one’s estate in West Virginia, you may come across the Small Estate Affidavit form. This can be a helpful tool in certain circumstances, but there are several misconceptions surrounding its use and significance. Understanding these common misunderstandings can help settlers and executors manage their expectations and obligations more effectively.

- Misconception #1: The form is suitable for all estates, regardless of size or complexity.

In reality, the Small Estate Affidavit form is specifically designed for estates that fall under a certain value threshold, which excludes real estate. It's intended to simplify the process for smaller, less complicated estates, not to serve as a one-size-fits-all solution.

- Misconception #2: Using the form avoids the probate process entirely.

Although the form can streamline some of the legal steps required, it doesn't eliminate the need for probate in all cases. Depending on the specific assets and their titles, some items may still require formal probate proceedings.

- Misconception #3: The form grants immediate access to the decedent’s assets.

While it can expedite the transfer of certain assets, it's important to understand that there may still be a waiting period. Financial institutions and other entities may have additional requirements or paperwork before releasing the assets to the rightful heirs.

- Misconception #4: There’s no need for a lawyer when using this form.

Even for smaller estates, legal advice can be invaluable. A lawyer familiar with West Virginia estate law can help ensure that the form is completed correctly and advise on any potential complications or additional steps that might be required.

- Misconception #5: The form covers all types of assets.

Actually, certain types of property, including real estate and some types of personal property, may not be transferable using the Small Estate Affidavit. It's important to verify which assets can legally be included.

- Misconception #6: Completion of the form is all that's required to settle an estate.

Completing the form is a step in the process, but other actions such as settling debts, filing final tax returns, and distributing remaining assets according to the affidavit must also be taken. Handling an estate, even a small one, involves a comprehensive approach to ensure all legal, financial, and tax-related responsibilities are met.

Understanding these misconceptions can greatly assist in navigating the complexities of estate management. It ensures that the Small Estate Affidavit is used appropriately and effectively, respecting legal guidelines and the wishes of the deceased. It's always advisable to consult with legal professionals when dealing with estate matters to ensure compliance and peace of mind.

Key takeaways

When individuals find themselves needing to manage a small estate in West Virginia, the Small Estate Affidavit form is a crucial document to understand. This form simplifies the process of estate settlement for estates that fall beneath a certain value threshold, making it a valuable tool for those who qualify. Here are key takeaways regarding its use and filling-out process.

- Eligibility Criteria: The Small Estate Affidavit in West Virginia is specifically designed for estates where the total value does not exceed $50,000, a threshold aimed at streamlining the process for smaller estates.

- Assets Count: Only personal property is considered when determining the estate's value for the purposes of this affidavit. Real estate is excluded from the calculation, focusing the scope of the document on belongings such as bank accounts, vehicles, and other movable assets.

- Required Documentation: To properly complete the Small Estate Affidavit, you need to gather pertinent documentation that includes the death certificate of the deceased, an inventory list of the estate’s assets, and any outstanding debts owed by the estate.

- Heirs and Beneficiaries: The affidavit necessitates the identification of all legal heirs and/or beneficiaries, ensuring that the distribution of the estate is executed according to the will (if one exists) or state laws governing inheritance.

- Filing Location: The completed Small Estate Affidavit must be filed with the county clerk in the county where the deceased resided at the time of their passing. This step initiates the official handling of the small estate.

- No Probate Necessary: By using the Small Estate Affidavit, eligible estates can avoid the often lengthy and complex probate process. This expedited path saves time and legal expenses for the heirs or beneficiaries.

- Legal Authority: Upon approval of the affidavit by the county clerk, the person filing the document is granted the authority to collect and distribute the assets of the estate. This power is subject to the limitations outlined within the affidavit and applicable state laws.

- Responsibility for Debts: The person who files the affidavit and manages the estate assets must ensure that any debts owed by the estate are satisfied from the estate's assets before distribution to the heirs or beneficiaries.

- Timeframe: There is a waiting period of at least 60 days after the death of the decedent before the Small Estate Affidavit can be filed. This period allows time for all potential creditors to be notified.

- Legal Guidance: Given the legal implications of handling an estate, even a small one, consulting with a legal professional knowledgeable in West Virginia estate law can provide valuable insight and help avoid potential pitfalls in the process.

Filling out and using the Small Estate Affidavit form in West Virginia requires careful consideration of the estate's value, the rightful heirs or beneficiaries, and the existing debts of the estate. By following the proper procedures and legal requirements, individuals can settle small estates in a more straightforward and cost-effective manner.

Fill out Popular Small Estate Affidavit Forms for Different States

How to File Probate Without a Lawyer - It’s an efficient method for distributing specific assets like paycheck proceeds, small bank accounts, and personal effects directly to beneficiaries.

Small Estate Affidavit Massachusetts - A Small Estate Affidavit form is a legal document that provides a streamlined way for beneficiaries to claim assets from an estate without a formal probate process when the total value falls below a state-specified limit.

South Dakota Small Estate Affidavit - Used when the total value of the estate doesn't exceed state-specified limits, making asset distribution simpler and faster.

Small Estate Affidavit Georgia - Completion and submission of the form are generally straightforward, requiring attention to detail and accuracy in reporting.