Printable Small Estate Affidavit Form for Wisconsin

When a loved one passes away, the process of settling their affairs can seem daunting, especially during a period of grief. Yet, in Wisconsin, for estates that meet certain criteria, there is a streamlined option that can alleviate much of the burden. The Wisconsin Small Estate Affiffidavit form serves as a tool to help individuals manage the assets of a deceased person's estate without the need for a lengthy probate court process. This form is particularly useful for estates that are relatively modest in value, allowing for the transfer of property to rightful heirs or legatees in a more efficient and cost-effective manner. It's important to understand the eligibility requirements, such as the maximum value of the estate, the types of property that can be transferred, and the necessary documentation, to ensure a smooth and successful transfer of assets. By familiarizing themselves with the process, individuals can navigate this challenging time with greater ease and confidence.

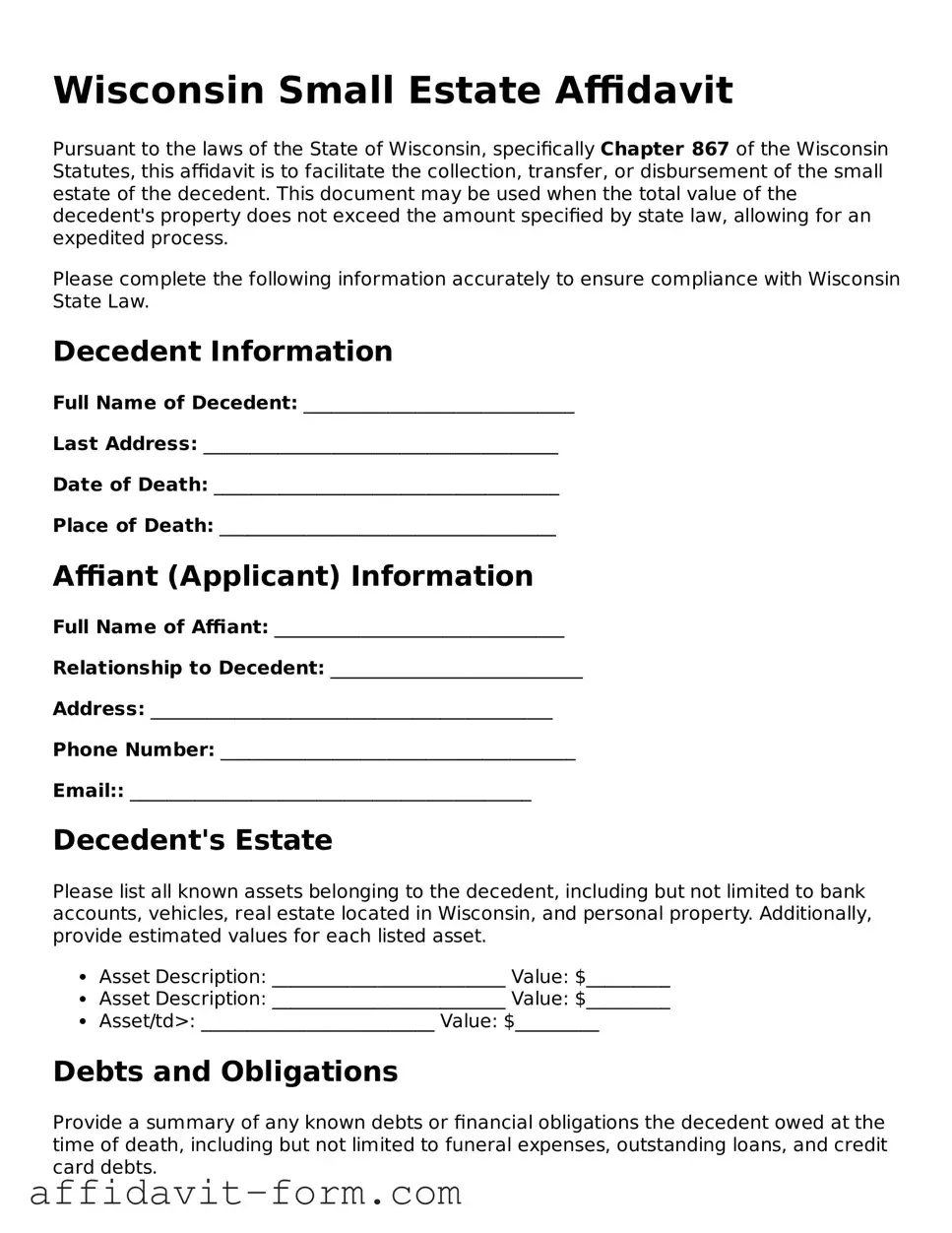

Form Example

Wisconsin Small Estate Affidavit

Pursuant to the laws of the State of Wisconsin, specifically Chapter 867 of the Wisconsin Statutes, this affidavit is to facilitate the collection, transfer, or disbursement of the small estate of the decedent. This document may be used when the total value of the decedent's property does not exceed the amount specified by state law, allowing for an expedited process.

Please complete the following information accurately to ensure compliance with Wisconsin State Law.

Decedent Information

Full Name of Decedent: _____________________________

Last Address: ______________________________________

Date of Death: _____________________________________

Place of Death: ____________________________________

Affiant (Applicant) Information

Full Name of Affiant: _______________________________

Relationship to Decedent: ___________________________

Address: ___________________________________________

Phone Number: ______________________________________

Email:: ___________________________________________

Decedent's Estate

Please list all known assets belonging to the decedent, including but not limited to bank accounts, vehicles, real estate located in Wisconsin, and personal property. Additionally, provide estimated values for each listed asset.

- Asset Description: _________________________ Value: $_________

- Asset Description: _________________________ Value: $_________

- Asset/td>: _________________________ Value: $_________

Debts and Obligations

Provide a summary of any known debts or financial obligations the decedent owed at the time of death, including but not limited to funeral expenses, outstanding loans, and credit card debts.

- Debtor: _________________________ Amount Owed: $__________

- Debtor: _________________________ Amount Owed: $__________

Declaration

The undersigned affirms that the information provided in this affidavit is true and correct to the best of their knowledge, understanding, and belief. The affiant acknowledges their obligation to distribute the assets of the decedent's estate to rightful claimants in accordance with Wisconsin Statutes and understands the penalties for misrepresenting facts or unlawfully withholding assets.

Signature of Affiant: _______________________________

Date: _____________________________________________

Notary

This document was acknowledged before me on ______________________ by _________________________________________ (name of affiant), who is personally known to me or who has produced ______________________________ (type of identification) as identification.

Signature of Notary Public: ________________________

Printed Name: ___________________________________

Date: ___________________________________________

Commission Expires: ____________________________

Document Details

| Fact | Detail |

|---|---|

| Eligibility Criteria | The decedent's total estate value must not exceed $50,000 to qualify for the Small Estate Affidavit procedure in Wisconsin. |

| Governing Law | Wisconsin Statutes, Section 867.03 outlines the laws governing the use of the Small Estate Affidavit in Wisconsin. |

| Waiting Period | An affidavit cannot be filed until 30 days have passed since the death of the decedent, allowing time to accurately assess the estate's value. |

| Beneficiary Qualifications | Individuals entitled to the property of the decedent under a will or Wisconsin’s succession laws may use the affidavit to claim assets. |

| Required Information | The affidavit must include the decedent’s date of death, a description of the property, and the claiming successor’s relationship to the decedent. |

| Vehicle Titles | Vehicles can be transferred using the Small Estate Affidavit in Wisconsin if the estate qualifies under the specific value threshold. |

| Filing Process | No filing with the court is necessary; the completed affidavit is presented directly to the entity holding the decedent's asset. |

| Limitations | The affidavit does not apply to real estate and cannot be used to transfer real property, focusing instead on personal property. |

How to Use Wisconsin Small Estate Affidavit

When a person passes away, their assets must be handled in a manner consistent with the law. For estates that do not meet a certain threshold in value, the process is often streamlined through the use of a Small Estate Affidate. In Wisconsin, this document allows for a simpler transfer of property to heirs or beneficiaries without the need for a lengthy probate process. Ensuring accuracy while filling out this form is critical for its acceptance and effectiveness. Therefore, the following steps have been carefully curated to guide individuals through completing the Wisconsin Small Estate Affidavit form.

- Begin by carefully reading the entire form to understand the information required and instructions provided for each section.

- Enter the full legal name of the deceased, also referred to as the decedent, at the top of the form where indicated.

- Fill in the date of death of the decedent next to their name, ensuring it matches the date on the death certificate.

- Provide your name and address in the section designated for the affiant—the person filling out and submitting the affidavit.

- Include the legal description and value of the property subject to this affidavit. This may require consulting public records or professional valuations to ensure accuracy.

- Detail the names, addresses, and relationships of all heirs or beneficiaries entitled to receive property from the estate, ensuring that no one entitled is omitted.

- Declare, under oath, your understanding that you are assuming responsibility to use the estate's assets to pay outstanding debts, claims, and taxes before distributing the remaining property to the rightful heirs or beneficiaries.

- If applicable, attach a certified copy of the death certificate to the affidavit. Some jurisdictions may require this document for the affidavit to be considered valid.

- Review the completed affidavit thoroughly for accuracy and completeness. Inaccuracies or missing information can cause delays or rejection of the document.

- Sign the affidavit in front of a notary public. The presence of a notary is essential as it validates the authenticity of the signatures on the document.

- Submit the completed and notarized affidavit to the appropriate entity, usually a financial institution or agency holding the assets, to transfer the ownership as described in the affidavit.

Following these steps carefully can aid in the hassle-free transfer of assets, allowing heirs or beneficiaries to bypass the more time-consuming and often costly probate process. It's important to remember that while this form simplifies the process, it should be handled with care and attention to detail to ensure that the transfer of assets complies with Wisconsin laws and regulations. Should questions or concerns arise, consulting with a legal professional who specializes in estate planning or probate law may offer further guidance and peace of mind during this process.

Listed Questions and Answers

What is a Wisconsin Small Estate Affidavit, and who can use it?

A Wisconsin Small Estate Affidavit is a legal document used to simplify the process of distributing a deceased person's assets when those assets are below a certain value. It allows eligible individuals, typically successors or heirs, to claim property of the deceased without going through a lengthy and complex probate court process. To use this form, the total value of the deceased's estate must not exceed the threshold specified by Wisconsin law, and a certain period must have passed since the death of the property owner.

What are the requirements for filing a Wisconsin Small Estate Affidavit?

Several key requirements must be met to file a Wisconsin Small Estate Affidavit:

- The total value of the estate must fall below the Wisconsin threshold, which can change, so it's critical to check the current limit.

- A certain time period must have elapsed since the death of the decedent, as stipulated by state law.

- The person filing the affidavit must be an entitled successor, such as a spouse, child, or other relative, or a person designated in the deceased's will.

- There should be no ongoing probate proceedings concerning the decedent's estate.

How do you file a Wisconsin Small Estate Affidavit?

To file a Wisconsin Small Estate Affidavit, follow these steps:

- Ensure all requirements mentioned above are met.

- Complete the affidavit form accurately, providing details about the deceased's assets, debts, and heirs.

- Sign the form in front of a notary public to formally notarize the document.

- Present the notarized affidavit to the holder of the property (such as a bank) or a court, if necessary, to claim the assets.

What types of property can be transferred using a Wisconsin Small Estate Affidavit?

The types of property that can typically be transferred include:

- Bank accounts with small balances

- Stocks and bonds

- Small personal property items such as jewelry or vehicles

- Certain real estate interests, depending on the total value of the estate and applicable Wisconsin laws

Common mistakes

When dealing with the aftermath of a loved one's passing, individuals in Wisconsin may find themselves filling out a Small Estate Affidate form. This form, while intended to simplify the process of settling an estate that falls below a certain value threshold, can prove tricky for those unfamiliar with its requirements. To ensure the process is as smooth as possible, avoiding common mistakes is crucial. Here are eight missteps often made:

Not verifying eligibility: Before proceeding, it's important to ensure that the estate qualifies as a "small estate" under Wisconsin law. This involves meeting specific criteria related to the value of the estate.

Incorrectly listing assets: A frequent error is the failure to accurately list all assets belonging to the deceased. This includes both tangible and intangible assets.

Overlooking debts and liabilities: Just as with assets, all debts and liabilities of the deceased must be accurately reported. This ensures a fair and lawful distribution of the estate.

Failing to obtain necessary signatures: The form requires signatures from all heirs or beneficiaries. Missing any can invalidate the document or cause delays.

Not providing adequate documentation: The affidavit must be accompanied by documents that prove the value of the estate's assets and the decedent's death, among others. Skipping or providing incomplete documentation is a common error.

Forgetting to update the account: Assets that are jointly owned or already designated to a beneficiary (like life insurance policies or retirement accounts) should be updated separately and are not typically included in the small estate process.

Misunderstanding the timeline: There are specific time frames within which the small estate affidavit process must be initiated and completed. Not adhering to these can complicate the settlement.

Omitting the affirmation statement: At the end of the affidavit, there's a statement that must be affirmed in front of a notary. Neglecting this step can render the affidavit legally ineffective.

Aside from these specific mistakes, here are some general recommendations to avoid complications:

Seek professional advice: Consulting with a legal professional can provide clarity and guidance, ensuring that the process is handled correctly.

Review the form thoroughly: Before submitting, double-check all information provided for accuracy and completeness.

Be mindful of the details: Pay close attention to the instructions on the form to avoid overlooking minor but crucial details.

In conclusion, while the Small Estate Affidavit form in Wisconsin is designed to streamline the estate settlement process for smaller estates, navigating it does require attention to detail and a clear understanding of the requirements. By avoiding these common errors, individuals can ensure a smoother and more efficient process during what is undoubtedly a difficult time.

Documents used along the form

When dealing with a small estate in Wisconsin, several other documents may be necessary along with the Small Estate Affidavit. These documents help ensure that the decedent's assets are distributed correctly and that all legal requirements are met. Understanding these forms can simplify the probate process or even avoid it altogether, making the administration of the estate more straightforward for the representatives involved.

- Death Certificate: This serves as an official record of death and is required for most legal and financial proceedings following someone's death. It validates the need for the Small Estate Affidavit.

- Last Will and Testament: If the deceased left a will, it dictates how their assets should be distributed. It may also nominate an executor for the estate.

- Letters of Administration or Letters Testamentary: These documents are issued by a court, giving an individual the authority to act on behalf of the deceased's estate.

- Notice to Creditors: This document notifies all potential creditors of the estate's probate process, inviting them to claim any debts owed by the deceased.

- Inventory of Assets: This list includes all assets and property owned by the deceased at the time of death, including real estate, bank accounts, and personal property.

- Transfer on Death (TOD) Deed: If applicable, this document transfers real estate to the beneficiary named in the deed upon the death of the owner, circumventing the probate process.

- Beneficiary Designations: Documents like life insurance policies or retirement accounts that have named beneficiaries proceed directly to those individuals, outside the scope of the Small Estate Affidavit.

- Final Tax Returns: The decedent's final state and federal tax returns must be filed, resolving any outstanding tax liabilities.

- Deed of Distribution: This applies to situations where real property is involved. It officially transfers ownership of property from the estate to the new owner as dictated by the will or state law.

Accompanying the Small Estate Affidavit with the correct documents is crucial to a smooth process in settling an estate. Each document plays a unique role in ensuring that the estate is managed and distributed according to legal standards and the decedent's wishes. Proper preparation and understanding of these documents can provide clarity and ease during what is often a challenging time.

Similar forms

The Wisconsin Small Estate Affidavit form is similar to other legal documents that are utilized to manage and distribute a deceased person's assets in a simplified manner. These forms are especially useful in cases where the deceased did not leave a large estate, making it unnecessary to go through a full probate process. Comparable documents include Transfer on Death Deed (TOD), Affidavit for Collection of Personal Property, and the Summary Settlement of Estates. Each of these documents serves a similar purpose but is applied under specific circumstances.

Transfer on Death Deed (TOD): This document is akin to the Wisconsin Small Estate Affidavit in its function of transferring property. The key difference lies in the specific asset it addresses: real estate. A TOD deed allows property owners to name beneficiaries who will inherit their property upon the owner's death, bypassing the need for the property to go through probate court. Similar to the Small Estate Affidavit, this document simplifies the transfer of assets, yet it is uniquely focused on real estate and requires the property owner to plan ahead by recording the deed prior to their passing.

Affidavit for Collection of Personal Property: This document closely resembles the Small Estate Affidavit by providing a streamlined process for transferring assets without probate. It allows heirs or designated individuals to collect personal property of the deceased, such as bank accounts, stocks, or other non-real estate assets, provided these assets fall below a certain threshold value. The Affidavit for Collection of Personal Property and the Small Estate Affidavit function similarly in hastening the asset transfer process, making them beneficial for small estates.

Summary Settlement of Estates: Another document related to the Small Estate Affidifice, the Summary Settlement of Estates is applicable in cases where the estate’s total value does not warrant a full probate procedure. This legal process is designed for relatively small estates, often with clear directives and few complications. It includes summarizing the estate’s assets, paying off any debts, and distributing the remaining assets to the rightful heirs or beneficiaries. While it is a more formal procedure than the Small Estate Affidavit, it shares the goal of expediting the distribution of assets from an estate that does not meet the conventional threshold for probate.

Dos and Don'ts

Navigating the completion of the Wisconsin Small Estate Affidavit form might initially seem daunting. However, understanding what to do, and what not to do, can simplify the process significantly. Here’s a guide to help individuals steer through it with greater accuracy and compliance.

Things You Should Do

- Verify eligibility: Before filling out the form, ensure the estate qualifies under Wisconsin law as a "small estate." This typically means the total value of the estate does not exceed the threshold set by state law, considering the type of assets involved.

- Provide accurate information: It’s crucial to fill out the form with accurate and complete information about the deceased person’s assets, debts, and beneficiaries. Mistakes or omissions can lead to delays or legal complications.

- Gather required documents: Alongside the affidavit, you might need to attach certain documents, such as a death certificate, proof of your relationship to the deceased, and documentation related to the estate’s assets.

- Review the form carefully: Before submitting, review every section of the affidavit to ensure all information is correct and no sections have been accidentally overlooked.

- Seek legal advice if necessary: If there’s any confusion or complexity concerning the estate or the affidavit, consulting with a legal professional specializing in estate law can provide clarity and guidance.

Things You Shouldn’t Do

- Do not guess on values or information: If unsure about an asset’s value or any other information requested on the form, make the effort to obtain accurate details rather than guessing.

- Avoid using the form for large or complicated estates: The Small Estate Affafidavit is intended for simpler estate procedures. For larger or more complex estates, other legal processes should be considered.

- Do not omit known creditors: If the estate has outstanding debts, ensure all known creditors are listed. Failing to acknowledge debts can complicate the settlement of the estate.

- Do not sign without ensuring the document’s accuracy: Take your time to verify all information on the affidavit is correct and in order. A hastily signed document with errors can lead to legal issues.

- Avoid handling the process entirely on your own if overwhelmed: Estate affairs can be complex and emotionally taxing. Seek support, whether from family members or professionals, if the process becomes overwhelming.

Misconceptions

When it comes to handling the estate of a deceased person in Wisconsin, the Small Estate Affidavit form is a tool designed to simplify the process for estates that meet specific criteria. However, there are common misconceptions about this form that can lead to confusion. Here's a look at some of these misconceptions:

- Any estate qualifies for a Small Estate Affidavit. In Wisconsin, only estates valued at $50,000 or less qualify for the use of a Small Estate Affidavit. This threshold is based on the total value of the estate's assets, not including certain deductions and allowances.

- The form grants immediate access to estate assets. Even though the Small Estate Affidavit is designed to be a simpler process, the person claiming the assets (the affiant) must properly complete the form and may need to wait for a certain period. Additionally, they must assure that the deceased person’s debts and any claims against the estate have been satisfied.

- The form negates the need for a will. The Small Estate Affidavit does not replace a will. If the deceased left a will, the distribution of assets must still follow the will's directives, within the confines of the law. The affidavit simply offers a streamlined process for asset distribution.

- Real estate can be transferred using a Small Estate Affidavit. In Wisconsin, the Small Estate Affidavit cannot be used to transfer real estate directly. Separate legal processes are necessary to handle real estate, even in small estates. However, there are other mechanisms, such as Transfer on Death (TOD) deeds, that can be planned in advance to handle real estate without going through probate.

- Filing the form with the court is always required. While it is true that the Small Estate Affidavit needs to be executed accurately, not all circumstances require it to be filed with a court. In many cases, the completed form is presented directly to the entity holding the estate assets (for example, a bank) to release them to the rightful heir or beneficiary.

Understanding these misconceptions can help individuals navigate the process of managing a small estate more effectively. It is also advisable to consult with a legal professional to ensure that the process is handled correctly and in accordance with Wisconsin laws.

Key takeaways

Filling out and using the Wisconsin Small Estate Affidavit form is a process that allows individuals to manage the estate of a deceased person in a straightforward manner, particularly when the estate does not meet the threshold requiring formal probate. Here are nine key takeaways to understand when dealing with this form:

- The Wisconsin Small Estate Affidavit form is specifically designed for estates valued at $50,000 or less. This threshold ensures that smaller estates can be settled more expediently.

- To use this form, the applicant must be an heir or an individual legally entitled to the estate. This includes spouses, domestic partners, children, or other relatives as defined by state law.

- Submission of the affidavit does not require court involvement, which simplifies the process and reduces the time and costs associated with settling an estate.

- It's important to accurately assess the value of the estate's assets to ensure it qualifies for the Small Estate process. This valuation excludes certain types of assets, such as those with named beneficiaries.

- Before filing the affidavit, Wisconsin law mandates a 30-day waiting period after the deceased person’s death. This waiting period allows for a more accurate assessment of the estate's value and outstanding debts.

- Debts of the estate must be carefully considered when completing the affidavit. In some cases, the estate may need to settle outstanding debts before distributing assets to heirs.

- Completion and submission of the form require detailed information about the deceased's assets, including account numbers, descriptions of property, and the value of each asset.

- The form must be signed in the presence of a notary public to ensure its validity. The notarization acts as a protective measure for all parties involved.

- Once filed, the Small Estate Affidavit allows the person completing the form to act on behalf of the estate, such as closing accounts or transferring property, in accordance with Wisconsin law.

Understanding and following these key points ensures that the Small Estate process in Wisconsin is carried out properly, providing a streamlined approach to settling an estate that is both time and cost-efficient.

Fill out Popular Small Estate Affidavit Forms for Different States

Virginia Small Estate Affidavit Pdf - Directs financial institutions to release the deceased's assets to the designated heirs.

Michigan Probate - Appropriate for laypersons without legal training, the form is designed to be straightforward and user-friendly, alleviating additional stress.