Printable Small Estate Affidavit Form for Wyoming

In the picturesque state of Wyoming, settling a deceased person's affairs can be both an emotionally and administratively challenging process. Fortunately, for those estates that qualify as "small" under specific criteria, Wyoming provides a streamlined option known as the Small Estate Affidavit form. This legal document serves as a simplified route for transferring property from the deceased to their rightful heirs without the need for a lengthy probate process. To be eligible, the total value of the estate must meet the threshold defined by Wyoming law, which takes into account the value of assets after debts have been settled. For individuals navigating the aftermath of a loved one's passing, understanding the requirements, limitations, and procedural steps to correctly utilize this form is crucial. It not only facilitates a smoother transition of assets but also significantly reduces the time and financial burden often associated with traditional estate settlements. The form itself requires detailed information about the deceased, the assets in question, and the heirs, all of which must be accurately presented to ensure the process moves forward without complications.

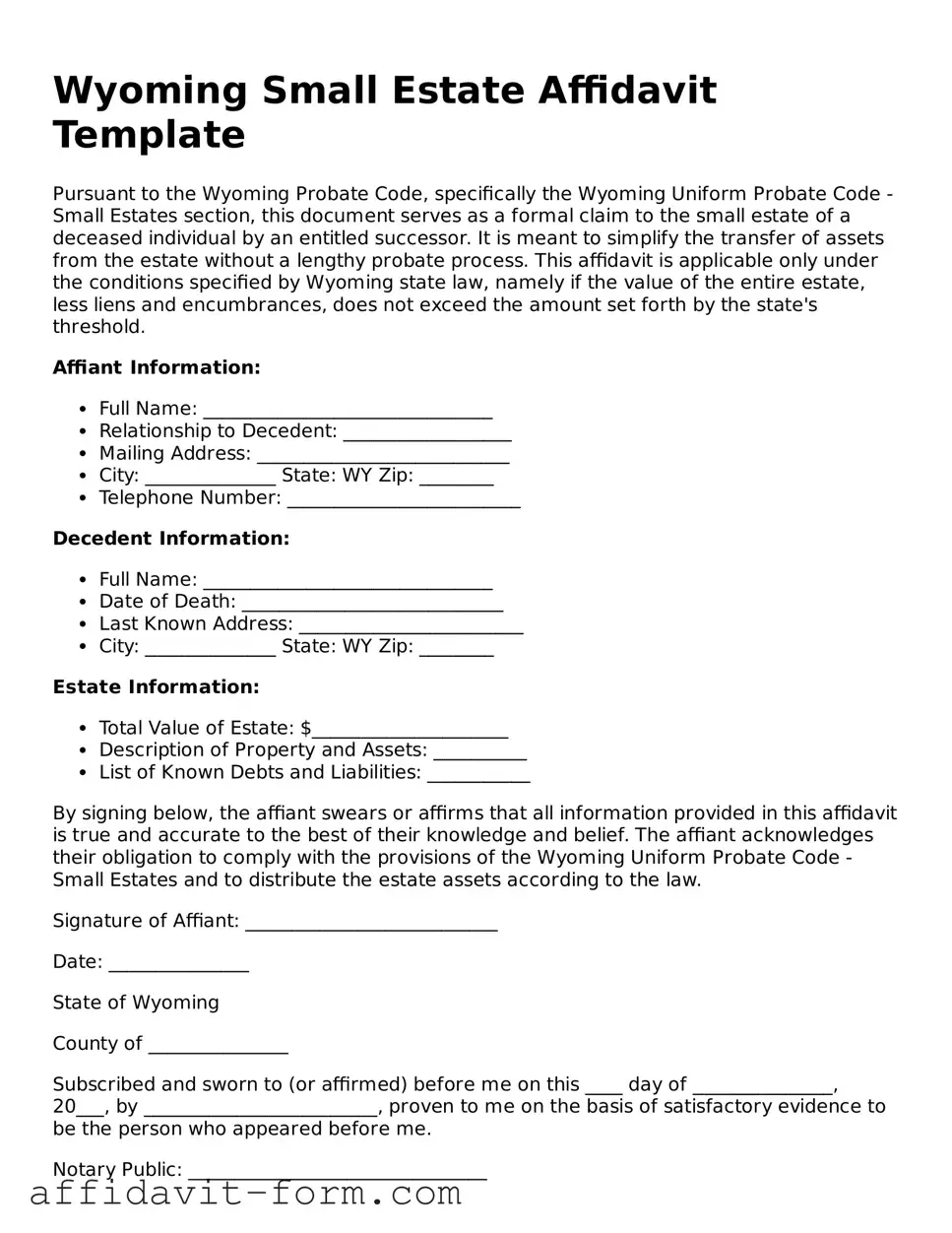

Form Example

Wyoming Small Estate Affidavit Template

Pursuant to the Wyoming Probate Code, specifically the Wyoming Uniform Probate Code - Small Estates section, this document serves as a formal claim to the small estate of a deceased individual by an entitled successor. It is meant to simplify the transfer of assets from the estate without a lengthy probate process. This affidavit is applicable only under the conditions specified by Wyoming state law, namely if the value of the entire estate, less liens and encumbrances, does not exceed the amount set forth by the state's threshold.

Affiant Information:

- Full Name: _______________________________

- Relationship to Decedent: __________________

- Mailing Address: ___________________________

- City: ______________ State: WY Zip: ________

- Telephone Number: _________________________

Decedent Information:

- Full Name: _______________________________

- Date of Death: ____________________________

- Last Known Address: ________________________

- City: ______________ State: WY Zip: ________

Estate Information:

- Total Value of Estate: $_____________________

- Description of Property and Assets: __________

- List of Known Debts and Liabilities: ___________

By signing below, the affiant swears or affirms that all information provided in this affidavit is true and accurate to the best of their knowledge and belief. The affiant acknowledges their obligation to comply with the provisions of the Wyoming Uniform Probate Code - Small Estates and to distribute the estate assets according to the law.

Signature of Affiant: ___________________________

Date: _______________

State of Wyoming

County of _______________

Subscribed and sworn to (or affirmed) before me on this ____ day of _______________, 20___, by _________________________, proven to me on the basis of satisfactory evidence to be the person who appeared before me.

Notary Public: ________________________________

My Commission Expires: ________________________

Document Details

| Fact Name | Detail |

|---|---|

| Eligibility Criteria | The estate's value must not exceed $200,000 to qualify for using a Wyoming Small Estate Affidavit. |

| Waiting Period | There is a 30-day waiting period after the deceased's passing before the affidavit can be filed. |

| Applicable Law | The form is governed by Title 2 (Wills, Decedents' Estates and Probate Code) of the Wyoming Statutes. |

| Required Documentation | A certified copy of the death certificate and a detailed list of the estate's assets must accompany the affidavit. |

| Filing Procedure | The completed affidavit must be filed with the relevant local court in the county where the deceased lived or owned property. |

| Asset Distribution Limitations | Assets can only be distributed to rightful heirs or beneficiaries as per the affidavit statements and applicable law. |

How to Use Wyoming Small Estate Affidavit

Filling out a Small Estate Affidavit form in Wyoming is a process used to handle smaller estates without going through formal probate, potentially saving time and resources for those eligible. This document allows for the distribution of a deceased person's assets by their rightful heirs or beneficiaries efficiently. While the form itself is straightforward, completing it attentively is important to ensure it meets legal requirements and accurately reflects the decedent's estate details.

- Begin by entering the full legal name of the deceased (the decedent) at the top of the form where indicated. Make sure this matches the name as it appears on the death certificate.

- Fill in the date of the decedent's death. Double-check this against the death certificate to avoid discrepancies.

- Provide your full legal name and address as the affidavit, indicating your relationship to the decedent and why you are eligible to act in this capacity.

- List the names, addresses, and relationships of all heirs or beneficiaries to the estate, ensuring no one entitled to a part of the estate is omitted.

- Detail all of the assets within the estate, including but not limited to bank accounts, vehicles, real property, and personal property. Be as specific as possible, including account numbers, descriptions, and values when applicable.

- Attach a certified copy of the death certificate to the affidavit as proof of the decedent's passing. This is a required attachment for the form to be processed.

- If real estate is involved, ensure that a complete legal description of the property is provided. This may require consulting a deed or other property records.

- Carefully read the declaration or oath section at the end of the form. By signing, you are affirming under penalty of perjury that all information provided is true and accurate to the best of your knowledge.

- Sign and date the form in front of a notary public. The notary will also need to sign, date, and affix their official seal, making the affidavit a notarized document.

- Finally, file the completed and notarized affidavit with the appropriate local or state court, along with any filing fees that may be required. The exact filing location may vary depending on the county or jurisdiction.

After submitting the Small Estate Affidavit, the legal process for distributing the deceased's assets to the rightful heirs or beneficiaries begins. Depending on local regulations and the specific assets involved, additional steps may be required to transfer ownership or access funds. However, properly completing and filing the Small Estate Affidavit is a critical first step in this process, allowing for a smoother and more expedient distribution of the estate under Wyoming law.

Listed Questions and Answers

What is a Wyoming Small Estate Affidavit?

A Wyoming Small Estate Affidavit is a legal document that allows the assets of a deceased person, known as the decedent, to be distributed without a formal probate process. This affidavit can be used when the total value of the decedent's assets meets the criteria defined by Wyoming law, making estate settlement faster and less complicated for small estates.

Who can file a Wyoming Small Estate Affidavit?

In Wyoming, the following individuals may file a Small Estate Affidavit:

- Surviving spouses who are entitled to the decedent's property under the law or by the terms of a will.

- Heirs, as recognized under Wyoming law, in cases where there is no surviving spouse or if the spouse is not claiming all of the property.

- Other persons legally entitled to the property, if no other qualified claimants exist.

What are the requirements for using a Wyoming Small Estate Affidavit?

The requirements for using a Wyoming Small Estate Affidavit include:

- The total value of the decedent’s estate must not exceed the amount specified by Wyoming law at the time of the filing. This amount is subject to change, so it’s important to verify the current threshold.

- At least 30 days have passed since the death of the decedent.

- There are no pending applications or grants for administering the estate in Wyoming or elsewhere.

- All debts, including funeral expenses, taxes, and healthcare bills, owed by the decedent have been paid, or there is a plan in place for their payment.

What assets can be transferred using a Wyoming Small Estate Affidavit?

The types of assets that can typically be transferred include:

-

Personal property, such as vehicles, jewelry, and household items.

- Bank accounts and other financial assets not exceeding the value limit set by Wyoming law.

- Certain types of securities, under specific conditions.

- Other non-real estate assets meeting the state’s criteria for small estates.

How do I file a Wyoming Small Estate Affidavit?

Filing a Small Estate Affidavit in Wyoming involves several key steps:

- Ensure the estate qualifies by meeting the necessary requirements in terms of value and the type of assets.

- Complete the Small Estate Affidavit form with accurate information regarding the decedent, the assets, and the rightful heirs or beneficiaries.

- Attach any required supporting documents, which may include a certified copy of the death certificate and proof of the decedent’s ownership of the assets listed.

- File the completed affidavit with the appropriate local court or entity responsible for handling such matters, depending on the type of asset being claimed.

Are there any fees associated with filing a Wyoming Small Estate Affidark Affidavit?

Yes, there may be filing fees associated with the Wyoming Small Estate Affidavit. These fees vary depending on the county and the type of assets being transferred. Generally, the fees are relatively nominal compared to those for a full probate process. However, it’s important to contact the local court or entity where the affidavit will be filed to inquire about the exact fee structure and any acceptable forms of payment.

Common mistakes

Filling out the Wyoming Small Estate Affidavit form can seem straightforward, but it's all too easy to make mistakes that can lead to delays or complications. Below are nine common missteps people often make when completing this document.

Not waiting the required period after the decedent's passing. Wyoming law mandates a specific waiting period before an affidavit can be filed. Jumping the gun could invalidate your efforts.

Overlooking the asset threshold. The state of Wyoming has a maximum value for what qualifies as a small estate. If the estate's value exceeds this amount, the small estate process is not applicable, which is a detail often missed.

Providing inaccurate descriptions of assets. Every asset needs to be listed with a clear and precise description. Vague or incorrect descriptions can create confusion and potential disputes down the line.

Failing to notify potential heirs. Wyoming law requires that all potential heirs or beneficiaries be notified about the affidavit. Not doing so can lead to future legal challenges.

Omitting important documents. Sometimes, people forget to attach required documents, such as a certified death certificate, which is essential for the affidavit to be processed.

Misunderstanding signer requirements. All heirs or beneficiaries must sign the affidavit. Mistakenly thinking only one signature is needed is a common error.

Incorrectly calculating debts and taxes. Debts and taxes that the estate owes must be accurately reported and deducted from the estate's total value. Misestimations can cause significant issues.

Using an outdated form. States periodically update their legal forms. Using an outdated version can mean an automatic rejection.

Not seeking legal advice when necessary. Some small estate situations can be complex. Failure to seek professional advice can lead to mistakes in the form's preparation and submission.

When filling out a Wyoming Small Estate Affidavit form, paying attention to these common pitfalls can save you time and avoid unnecessary complications. Always double-check your information, follow the correct procedures, and consider consulting with a legal professional to navigate the process successfully.

Documents used along the form

When dealing with the distribution of an estate in Wyoming, especially through a Small Estate Affidavit, several additional documents often play a crucial role throughout the process. These documents assist in ensuring that the process is smooth, legally compliant, and as efficient as possible. They support the affidavit by providing necessary information or acting as supplementary proof to expedite the transfer of the deceased's assets to their rightful inheritors.

- Certified Copy of the Death Certificate: This document is essential for every aspect of managing a deceased's estate. It is the official record of death and is often required to access bank accounts, transfer titles, and for many other transactions related to the estate.

- Copy of the Will: If the deceased left a will, a copy of it should accompany the Small Estate Affidavit. The will provides details about the decedent's wishes regarding the distribution of their assets, helping to guide the process in accordance with their wishes.

- Letters Testamentary or Letters of Administration: These are issued by a probate court and authorize an individual to act as the executor or administrator of the deceased's estate. While not always required in the case of a small estate affidavit, they are necessary if the estate includes certain types of assets or if legal disputes arise.

- Notice to Creditors: In some cases, it might be necessary to notify potential creditors of the estate's administration. This notice invites them to file any claims against the estate within a specified period.

- Property Appraisal Documents: If the estate includes real estate or valuable personal property, appraisals might be necessary to establish the value of these assets for tax purposes or for equitable distribution.

Together, these documents support the assertions made in a Wyoming Small Estate Affidavit and ensure the administration of the estate adheres to state laws and respects the decedent's wishes. For anyone navigating this process, understanding and gathering these documents early can help make the procedure as straightforward as possible. It's also advisable to consult with a legal expert to ensure all requirements are met and to address any complications that may arise.

Similar forms

The Wyoming Small Estate Affidavit form is similar to other streamlined legal documents designed to simplify the process of asset distribution without a formal probate procedure. These documents are often used in situations where the estate in question is below a certain value threshold, making them invaluable tools for expedient property transfer. Each has its specific use case but shares the common goal of facilitating easier management of an estate's legal requirements.

Affidavit for Collection of Personal Property is closely related to the Small Estate Affidavit. It allows the transfer of personal property to the rightful heirs without going through probate court. Both require detailed lists of the decedent's assets and assurance that debts and taxes have been paid. The Affidavit for Collection of Personal Property, much like the Small Estate Affidate, relies on honesty and full disclosure from the person completing the form.

Transfer on Death Deed (TODD) shares similarities with the Small Estate Affidavit in its purpose of avoiding the probate process for certain assets. A Transfer on Death Deed allows property owners to name a beneficiary to whom the property will pass upon their death, without requiring the property to go through probate. While the TODD is specifically for real estate, the Small Estate Affidavit applies to personal property, bank accounts, and other assets. Both facilitate a smoother transition of assets upon death.

Joint Tenancy with Right of Survivorship (JTWROS) agreements can also be compared to Small Estate Affidavits. JTWROS is a method of co-owning property that allows the surviving owner(s) to automatically inherit the deceased owner's share of the property, bypassing probate. Though this arrangement pertains to how property is held and not to a post-death legal document, its objective aligns with that of the Small Estate Affidavit by avoiding probate court for the transfer of assets.

Dos and Don'ts

Filling out the Wyoming Small Estate Affidavit form is a crucial process that helps to transfer property of a deceased person to their rightful heirs without the need for a formal probate process. This document is typically used when the total value of the estate falls below a certain threshold, making it a simpler way to distribute assets to beneficiaries. Here are some key do's and don'ts that individuals should keep in mind when completing this form:

- Do thoroughly read the instructions provided with the form before filling it out. It's essential to understand every part to ensure it's completed correctly.

- Do verify that the total value of the estate qualifies for the small estate process in Wyoming. This condition is crucial for the form’s validity.

- Do gather all necessary documents that verify the assets and debts of the estate. Accurate information is key to a smooth process.

- Do list all the deceased person’s assets and their values as accurately as possible. The precision will help in avoiding disputes or questions down the line.

- Do provide complete information for all beneficiaries, including their full names, addresses, and their relationship to the deceased. This clarifies who is entitled to what.

- Don’t rush through the form. Take your time to fill out each section with the necessary details and double-check your information.

- Don’t leave any sections blank. If a section does not apply, it’s best to mark it as “N/A” or “not applicable.” This demonstrates that no information was overlooked.

- Don’t guess on values or information. If you’re unsure about certain details, it’s better to consult with a professional or check official documents for the correct information.

- Don’t forget to sign the affidavit in front of a notary. This step is required for the document to be legally binding.

- Don’t hesitate to seek legal advice if you have questions or concerns about the process. An experienced attorney can provide guidance specific to Wyoming laws and help ensure that the affidavit is filled out correctly.

By following these guidelines, individuals can navigate the process of completing the Wyoming Small Estate Affidavit form more confidently and effectively, helping to ensure that the estate is settled smoothly and according to the law.

Misconceptions

When handling the affairs of a loved one who has passed away in Wyoming, the Small Estate Affidavit procedure is often misunderstood. Here are five common misconceptions that need clarification:

Anyone Can File: It's often thought that any individual can file a Small Estate Affidavit in Wyoming. In reality, this process is primarily for the successors of the deceased—this could be family members or other heirs. The law specifies who qualifies to manage the deceased's estate under this simplified procedure.

It's Instantaneous: Some believe that the Small Estate Affidavit process in Wyoming is immediate. However, there is a waiting period of 30 days after the death before the affidavit can be filed. This waiting period is a legal requirement and serves as a buffer to ensure all affairs of the deceased are in order before the distribution of assets.

No Limit on Asset Value: Another common misconception is that the Small Estate Affidavit can be used regardless of the asset value of the deceased's estate. The truth is, Wyoming law imposes a limit on the total value of the deceased's assets for their estate to qualify for this process. Specifically, the assets must not exceed a certain threshold, which is subject to change; therefore, it's crucial to verify the current limit before filing.

Avoids Probate Court Entirely: Many believe that using a Small Estate Affidavit will avoid probate court entirely. While it is true that this process simplifies the handling of the estate, thereby minimizing the involvement of the court, there are instances where court intervention could still be necessary. For example, if there are disputes among heirs or creditors' claims against the estate, court proceedings may be needed.

Applicable for Real Estate: A vital misconception is that the Small Estate Affidavit in Wyoming can be used to transfer real estate. The truth, however, is that this procedure is primarily for personal property, such as bank accounts, stocks, and other non-real estate assets. Real estate transfer upon death often requires a different process, which may include formal probate, depending on the circumstances.

Key takeaways

When dealing with the passing of a loved one, managing their estate in Wyoming can be streamlined through the use of a Small Estate Affidavit form. This document allows for a simpler process in certain circumstances. Below are key takeaways to understand when filling out and using the Wyoming Small Estate Affidavit form:

- Eligibility Requirements: The total estate value must not exceed Wyoming's specified limit for small estates. This threshold is subject to change, so it’s important to verify the current limit.

- Asset Types: Not all assets can be transferred using a Small Estate Affidavit. Typically, this form is suited for personal property, bank accounts, and other assets not requiring a formal probate process.

- Waiting Period: Wyoming law mandates a waiting period after the death of the estate owner before the Small Estate Affidavit can be filed. Checking the most recent laws will provide the current required waiting time.

- Documentation: Accurate and complete documentation of the deceased’s assets, along with any debts, is crucial. These details must be included in the affidavit.

- Signatory Requirements: The affidavit must be signed by the rightful heirs or the designated representative, affirming their claim to the estate under penalty of perjury.

- Legal Review: While not always mandatory, having the affidavit reviewed by a legal expert can help avoid errors and ensure the process goes smoothly.

- Filing the Affidavit: Once completed, the affidavit must be filed appropriately, often with the local probate court or directly with the entity holding the asset, like a bank.

- Potential for Objections: Be aware that other parties may object to the transfer of assets via a Small Estate Affidavit. Such objections could lead to a more formal probate process.

- No Substitute for a Will: It’s important to note that a Small Estate Affidavit is not a substitute for a will. It is simply a tool for estate settlement that may be used when the conditions allow.

Utilizing the Small Estate Affiditary Form in Wyoming can offer a less complicated path to settling an estate, but it's essential to understand and follow the rules carefully. When in doubt, consulting with a legal professional can provide guidance tailored to the specific situation.

Fill out Popular Small Estate Affidavit Forms for Different States

South Dakota Small Estate Affidavit - State-specific laws dictate the maximum value an estate can have to qualify for handling through a Small Estate Affidavit.

Vermont Will Requirements - The document ideally provides peace of mind to families during difficult times by ensuring that the decedent's assets are distributed as intended with minimal legal hurdles.

How Long Does an Executor Have to Settle an Estate in Maryland - It serves as a declaration by the heirs to rightfully collect the deceased's assets, under oath, to the accuracy of the information provided.